Oklahoma, where the drones come buzzing down the Plains

Atoke, a town of 3,000 people nestled in the Choctaw reservation in southeast Oklahoma, used to be home to herds of buffalo and bison (there is in fact a difference). Now this reservation, a hidden 11,000-square-mile parcel of land, has become one of the largest drone delivery testing sites in the world, according to FreightWaves’ Jack Daleo.

In addition to improving the economic opportunities for those living on the reservation, Daleo wrote that drone delivery could unlock a new level of safety and economic growth. James Grimsley, executive director of advanced technology initiatives for the Choctaw Nation, told Daleo an alarming statistic: 35% of the U.S. population lives in rural areas, yet 65% of traffic fatalities happen in those regions. Drone delivery could reduce the tribe’s reliance on those roads and highways.

Grimsley told Daleo, “In the 21st century United States of America, your ZIP code is still a strong predictor of your health outcomes, your access to opportunity and just your general quality of life. So your ZIP code basically gives us an indication of the type of infrastructure you’re going to have access to for transportation.”

Drone transportation also provides a potential boon for truckload transportation. For many trucking companies, delivering out of route or into distant rural areas can prove operationally challenging as the delivery location and the next load can be far apart. A fleshed-out drone delivery network can help consolidate major truckload nodes and create greater efficiencies for trucking and last-mile providers through fewer wasted empty miles and dwell times.

Help wanted: More diesel technicians required

Trucks are becoming more complicated, a challenge for those hiring and training the army of technicians who work these systems. The concern involves how technology and the role of maintenance technicians changed over decades. Gone are the days of heavy mechanical skills and pulling apart analog systems. The modern diesel technician must navigate various computer subsystems, sussing out the right error code or damaged sensor.

“Technicians represent one of our biggest hiring and retention needs as an organization,” Ron Schwartz, vice president of staffing for Penske Transportation Solutions, told Trucking Info. “There is a shortage of qualified new technicians entering the industry. There are not enough new techs available to replace those who are retiring.”

In a conversation I had back in February with Sandeep Kar, chief strategy officer at Noregon Systems, he said the “driver crisis [and] driver shortage is a huge crisis in the industry. But the fact is not many people know that the technician shortage is an even bigger crisis because these trucks are becoming more and more complicated. There’s more and more distributed electronics being added to these trucks, and there are not enough skilled technicians to service these trucks, especially in an era of just-in-time logistics when uptime is of prime importance.”

This shortage risks impacting trucking fleets that rely on in-house expertise, services provided by truck stops and smaller third-party shops. With electric and alternative fuel engines, expect additional attention from schools and trade groups as the maintenance follows the trucking technological revolution.

Market update: LMI September data, transportation capacity up, prices down

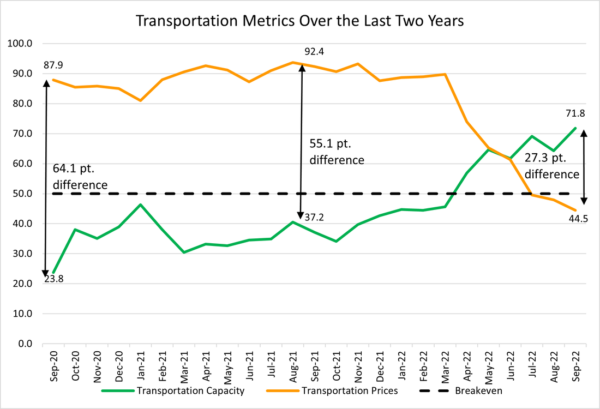

The Logistics Managers’ Index (LMI), a monthly survey measuring supply chain activity, showed an increase in transportation capacity for September. The reading jumped 7.5 percentage points to 78.8, the second-highest reading in the six-year history of the data set. While transportation capacity increased, the prices for transportation fell 3.5 points to 44.5, a two-year low for the index.

High levels of inventory continue to fuel movement in the primary LMI reading, with the September index reading at 64.5, up 1.7 index points from a 59.7 August reading. For those unaware, a reading over 50 indicates logistics is expanding, while anything below 50 indicates a shrinking logistics industry.

Regarding the inventory situation, the report said, “It is possible that inventories are merely in a holding pattern and will begin moving again when goods spending picks back up in Q4; we will not know for certain though for at least another 1-2 months. What we do know however is that right now inventory is moving at a much slower rate than what we have seen over the last two years. Transportation Capacity is up (+7.5) to 71.8, the second-highest rate in the six-year history of the LMI. Even if freight demand goes up in Q4, firms are pessimistic in regard to achieving a similar level of utilization to last year.”

FreightWaves SONAR spotlight: Diesel prices fall, but OPEC+ projected cuts lead to spooky oil markets

Summary: Halloween could start early for energy markets. While the DOE price reported on Monday fell 5.3 cents to $4.836 per gallon, there are growing concerns as OPEC+ plans on cutting oil production by 2 million barrels after a meeting this week.

FreightWaves’ John Kingston writes, “In an interview with CNBC on Monday, Jeffrey Currie, head of commodities research at Goldman Sachs, said OPEC is “incentivized to [cut production] as they are the only producer in the world with spare capacity.” OPEC is looking at a market where global benchmark Brent crude has dropped from June levels near $120 a barrel down to more recent numbers near $85 a barrel before Monday’s rebound.”

For major shippers eyeing additional contracted rate cuts, the pricing strategy of cutting linehaul rates and buffering the loss with a fuel surcharge could cause further pain for carriers later if diesel prices return to early 2022 levels.

The Routing Guide: Links from around the web

Werner acquires Baylor Trucking in latest deal (FreightWaves)

Southeastern spot rates increase in Hurricane Ian’s wake (Fleet Owner)

California Finds Truck Parking Shortage Complicated by EV Mandates (Transport Topics)

Class 8 truck orders set monthly record in September (FreightWaves)

Buttigieg announces nearly $40 million in grants to expand truck parking (Transport Dive)