Long-distance truckload rates continue to slide in the second quarter

Data on producer prices shows that wholesale inflation pressure rose mildly in May but remains generally subdued in the economy. Industry detail showed rates in trucking increased modestly, though long-distance truckload rates continued to decline.

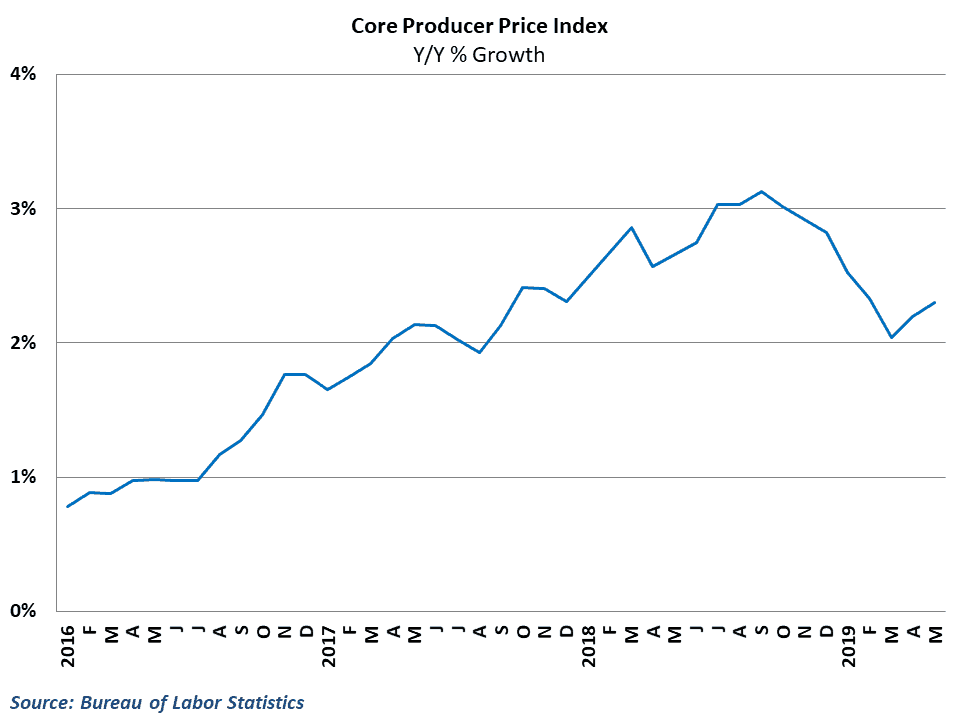

The Bureau of Labor Statistics reported that the producer price index (PPI) rose 0.1 percent in May from April’s levels. This falls short of consensus estimates of a 0.2 percent gain and follows a 0.2 percent gain in the previous month. Overall results during the month were weighed down by declines in food, trade services and energy prices, which are some of the more volatile components of producer prices. The core PPI, which excludes these categories, notched a second consecutive 0.4 percent gain in May as year-over-year growth rose to 2.3 percent

Market watchers and policymakers typically use the PPI to gain some insight into what the underlying pressures of inflation are in the economy. The lack of inflation pressure over the last couple of months has caught the eye of Federal Reserve officials as they mull a cut in interest rates to combat an expected slowdown in the economy. However, this morning’s core PPI results would suggest that inflation pressures may be stabilizing after softening considerably since the end of 2018.

Long-distance truckload rates keep falling

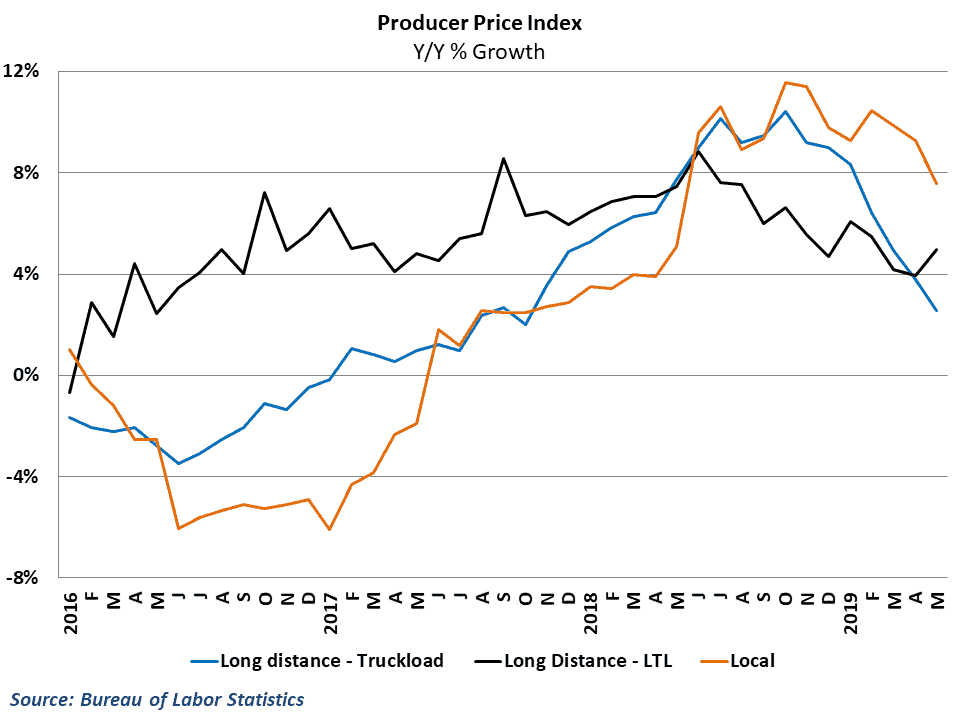

Industry detail in the May PPI data showed that rates in the trucking industry posted a solid gain during the month. Producer prices for General Freight Trucking rose 0.4 percent in May, ending a streak of three consecutive monthly declines from February through April. Despite the monthly gain, year-over-year growth in overall trucking rates slipped to 4.1 percent, driven by tough comparisons to last year.

Details in the trucking industry show that the gain in overall trucking rates in May was overwhelmingly driven by a jump in long-distance less-than-truckload (LTL) rates, which jumped 2.0 percent from April’s levels. Long-distance truckload rates continued their slide in May, falling by 0.2 percent from April’s levels. Rates for long-distance trucking have now declined for four consecutive months, pushing yearly growth down to a 19-month low of 2.5 percent. Rates for local trucking services managed to eke out a slight gain in May, rising by a modest 0.1 percent while year-over-year growth slipped to 7.9 percent.

Behind the Numbers

April’s headline results were roughly in line with expectations, though the increase in core wholesale prices was stronger than expected for the second straight month. Fed officials have increasingly signaled the possibility of a rate cut this year in the wake of the renewed trade conflict with China and concerns over slowing growth in the U.S. economy. The headline numbers would definitely suggest some softening inflation pressure, but for the time being, core data gives little reason to add additional monetary stimulus into the mix. It is also worth noting that there was no significant impact of tariffs on wholesale inflation in May’s results. Any evidence of tariffs on producer prices is not likely to be seen until June at the earliest, and may be offset by the general softening in the global economy, which would put downward pressure on prices.

On the trucking side, the surge in LTL rates helped mask some continuing problems in the industry. LTL gets partially insulated from some of the issues that are affecting the truckload side of the market. For one, when activity on the goods side of the economy slows down, shippers may no longer have full truckloads to ship and will increasingly utilize LTL services. In addition, LTL demand gets a bigger boost from last-mile services related to e-commerce. E-commerce has been one of the steadiest areas of growth over the last decade, performing well even when the broader retail sector is struggling.

Long-distance truckload carriers continue to be plagued with the same issues they’ve faced all year; 2018 saw carriers add significant capacity, which was then met with slowing freight demand. As a result, rates in the industry have fallen steadily since January. It is worth noting that historically, PPI data for trucking grows approximately 2.0-2.5 percent each year, so the current pace of growth is roughly in line with norms. However, there are still concerns that demand will remain weak in upcoming months and capacity is still quite loose in the industry, so rates may have further to fall before they stabilize.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.