Freight markets are returning to normal after the Thanksgiving break. National tender rejection levels have declined each day for the past three days and settled in at the lowest value in over two weeks of 13.36%. Decreased capacity prior to Thanksgiving is typically a short-lived event as drivers are attempting to get closer to home and become less available. The week following the holiday they return to the road. National capacity continues to remain relatively high as OTRI.USA is only 108 bps higher than the annual low that was reached in late October. Higher tender rejection levels indicate lower capacity.

Prior to the holiday, spot rates were running up mirroring the national tender rejection rates. The DAT national van freight rate index climbed from $1.61 to $1.75 per mile from October 30th to November 19th. Tender rejection rates increased from 12.73% to 14.76% during the same time. Both are an indication that capacity was lower or at least not in the areas it needed to be.

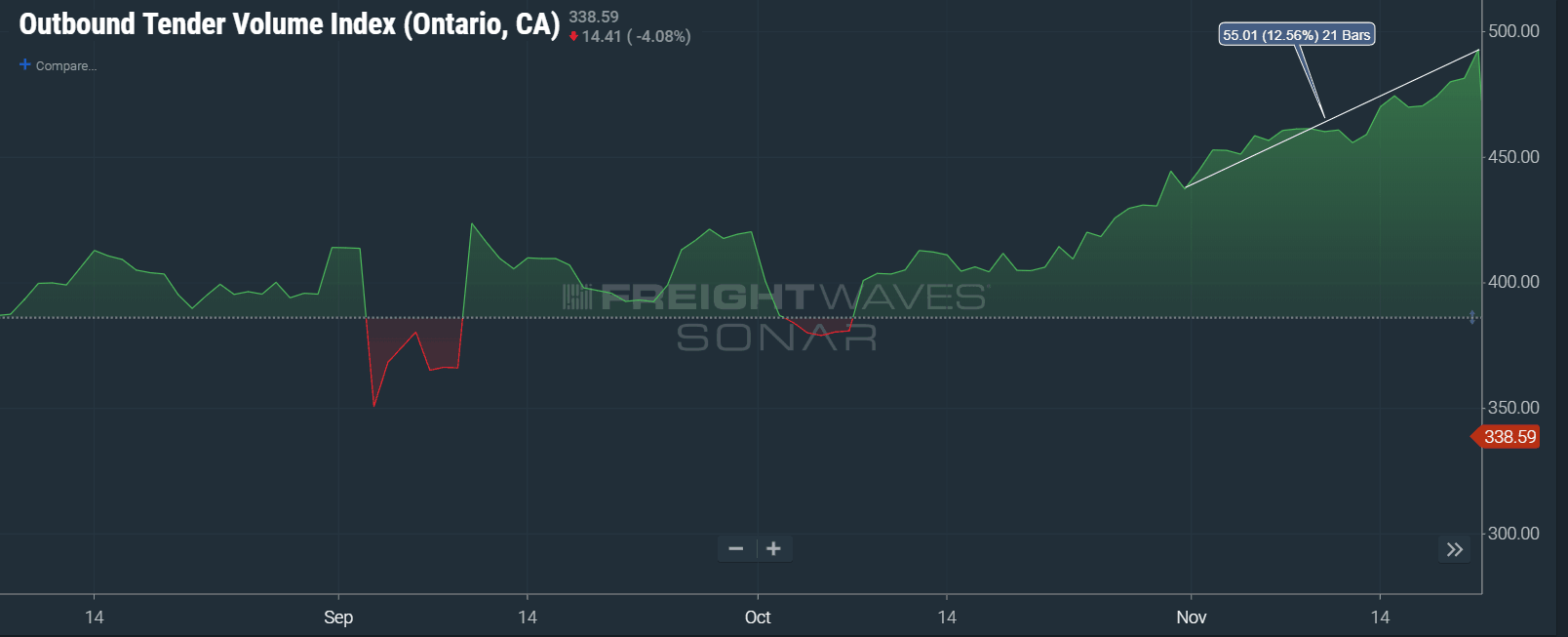

Southern California has been the most active region in the country over the past month. Volume has been increasing out of the Ontario, CA market over the past month. The outbound tender volume index for Ontario (OTVI.ONT) has increased 12.56% since the beginning of November.

Record port volume is a big factor along with the holiday retail inventories coming from overseas. It took carriers a little while to figure out they needed to move capacity to the west coast. Tender rejection rates out of Los Angeles (OTRI.LAX) climbed from 9.87% on November 2nd to 14.67% by November 23rd, but they have since recovered to 11.16% where it stands today.

Los Angeles often leads the country for national capacity shortages. The vast area between the population centers makes it difficult to source trucks to the region when volume surges as it takes a lot of time to position trucks in the market. It takes solo drivers two to three days to get from Dallas to L.A. Once trucks are there, it can expose other areas of the country to inadequate coverage. The decreasing tender rejection index (OTRI.ONT) and Headhaul Index (HAUL.ONT) indicate this. A declining HAUL value indicates there are an increasing number of inbound loads in relation to outbound loads, meaning the supply of trucks is not decreasing as fast.

In other areas of the country there have been short lived disruptions. The Twin Falls, Idaho market along with Pendleton, Oregon have had increasing tender rejection levels this past week. It is Christmas tree season, and Oregon is the largest supplier of Christmas trees in the country. The high paying tree loads attract drivers away from normal routes for a short time.

The Dallas market which can be impacted by west coast activity has settled back down after a few weeks of lowered capacity. Outbound tender rejections for Dallas (OTRI.DAL) climbed from under 7% to 10.3% in the two weeks leading up to Thanksgiving. Now the value is 7.59%.

Experts are still expecting a big consumer spending driven retail season, but for now the freight market is still showing signs of stabilizing. This is not unusual for the week after Thanksgiving, but historically things start to heat back up as Christmas gets closer.