Executives at North America’s major railroads are making the case that intermodal service will be more reliable and consistent after a year of major service changes. This comes as weakness in the industrial economy makes consumer-driven freight more important than ever to the railroads.

Collectively known as precision scheduled railroading, the efficiency drives have made intermodal more “operationally friendly, but not necessarily . . . more customer friendly,” Larry Gross, principal of Gross Transportation Consulting, said at the Intermodal Association of North America’s annual trade show this week.

Data from the Intermodal Association of North America (IANA) show domestic intermodal container volumes are down 6.3% year-to-date.

Comparables to last year are difficult given the artificial boost from tariff front-loading. Even so, domestic containers are up only 0.7% versus 2017 levels, essentially flat over the last two years. Over the last four quarters, intermodal’s share of freight movements versus over-the-road trucking has dropped, Gross said.

Speaking about the 2019 volume drop, “we did not see a decline in domestic container in the last recession so this is a very unusual event,” Gross said.

Yet there is confidence also with major truck carriers that intermodal will regain its mojo with shippers. Schneider NYSE: SNDR said it will be offering a new rail dray service at major intermodal ramps.

Despite customer grievances about service changes, railroad executives said service was actually worse previously. Precision scheduling was the only antidote for a railroad that had “periods of good service, but had challenges maintaining consistent reliable service,” said Maryclare Kenney, vice president of intermodal at CSX [NYSE: CSX].

“We were trying to be all things to all people. We didn’t think about the volume and density that were required to make you successful in railroading.”

The improvements, prompted by late CEO Hunter Harrison, have outweighed the implementation pains for customers, Kenney insisted.

At CSX, terminal dwell, a sign of how slow freight moves, was nine hours in the second quarter of 2019, down from a third quarter 2017 high of 12 hours. Network velocity is at a two-year high of 20 miles per hour, with intermodal unit cars traveling at 27 miles per hour.

For its own internal measure of trip-plan compliance, CSX said it has tightened its delivery window from four hours down to minutes with each deviation in that schedule subsequently examined. Kenney said 93% of deliveries were on time in the second quarter, with some routes hitting up to 99 percent for on-time delivery.

“We did eliminate some lanes of service, but we did that for the betterment of the business,” she added.

CSX made many improvements at its Northwest Ohio hub, where it was “doing a lot of car handling,” Kenney said. Now, CSX is looking to make the hub into an inland port by partnering with NorthPoint Development to develop warehousing and transload freight bound for Chicago and Northeast seaports.

It’s also looking to take a larger share of cross-border freight, especially refrigerated imports, by teaming with Canadian National Railway for a service linking Montreal and Toronto to the U.S. Northeast.

CSX has seen a lot of success with inland ports, in North and South Carolina, and Georgia, Kenney said.

On the driver side, CSX has improved terminal flow with the release of its appointment and pre-gate app, XGate, Kenney said. There has been 80% uptake in the app’s use at 22 terminals, and the railroad plans to rollout it out to other terminals. It has also implemented system-wide truck reservations, which could only be done with the tighter schedule from precision scheduling..

“It was hard to plan for our drays because you did not always see consistency in the volumes that came through the gate,” Kenney said. With an appointment, “now customers have a higher sense of reliability.”

With the cuts largely done, CSX wants to expand some terminals. Kenney said the Fairburn, Georgia, terminal has plenty of capacity for growth. CSX is also set to open its Raleigh, North Carolina, terminal next year as part of its Carolina Connector service. She added that CSX’s revamped network will be more stable for shippers.

“We’ve gone through the changes we need to implement,” Kenney said. “You will not see the changes you saw in 2017 and 2018.”

Railroad analyst Tony Hatch said the first mover on precision scheduling, Canadian National [NYSE: CNR], has emerged from scheduled railroading to now focus on growth.

CN’s implementation of precision scheduling meant “stripping away the terminals that were inefficient and weren’t making any money. It was painful to go through, but we are the better for it,” said CN intermodal chief Keith Reardon.

Intermodal service of goods from Asia out of western ports is slightly buoying CN’s intermodal volumes this year. CN is also tapping new growth opportunities with shipper-specific terminals for customers such as home improvement chain Menards and Ashley Furniture.

Reardon said such projects “would have been grounds for dismissal” under former CEO Harrison. “But we had to grow and that’s the next evolution in the business.”

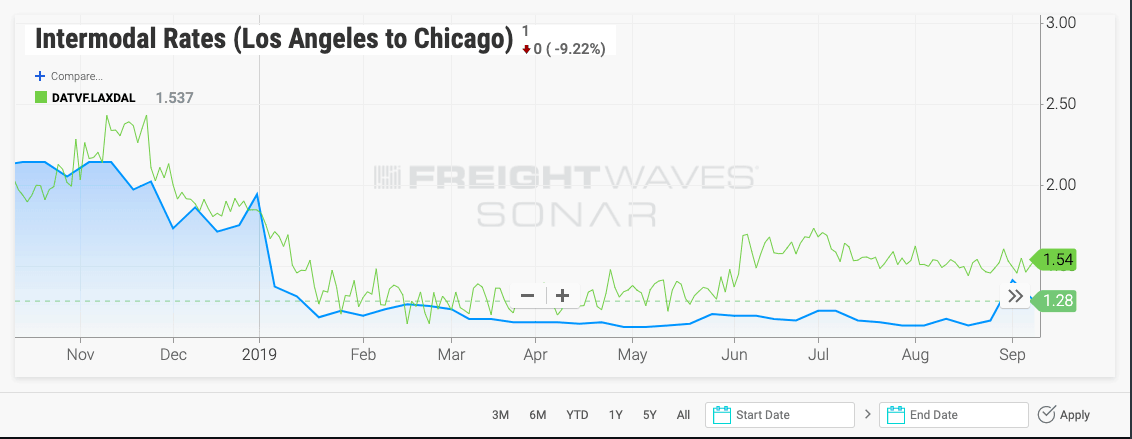

Jeff Heller, Norfolk Southern [NYSE: NSC] vice president of intermodal, said truck capacity has started to catch up with the railroads, likely diverting freight away from rail. Truck rates have become more competitive with intermodal rates in many lanes.

But he said the company is not eager to cut price and compete with trucking. He expected volumes to pick up in the fourth quarter and next year.

“We can either chase the business or wait for the growth to come back,” Heller said. “Let’s stick to the pricing power that we’ve got.”

As for the July 2019 rollout of its TOP21 plan, Heller said “it was a non-event” as the railroad saw no degradation in service. He said the company alerted customers 30 days in advance of service changes, “communicating to them in a transparent way, and we got a lot of credit for that.”