China’s imports record strong third quarter with October data also suggesting more goods on the way.

China’s imports into the U.S. hit a monthly record in September, with the fourth quarter setting up for more potential records.

Along with container import and trucking demand data from U.S. import gateways, the trade figures show the first round of tariffs on $250 billion in Chinese goods have done little to dissuade U.S. customers.

Instead, they sparked a “pull forward” effect by shippers to beat deadlines for tariffs on Chinese goods. The effect has not been uniform across all imports, with only some segments showing unusual growth. But the effect could pick up speed though the rest of the year as higher tariffs start in 2019.

“The commentary during the third-quarter earnings season from a lot of companies has been that duties of 10% are something we can certainly pass through to our customers,” says Chris Rogers, research analyst for trade data researcher Panjiva, a unit of S&P Global (NYSE: SPGI).

“The challenge will be when those are increased to 25% in the new year.”

The total dollar value of Chinese goods imported into the U.S. hit $50 billion in September, according to Department of Commerce figures released last week, up 10% year-on-year. Year-to-date, the dollar value of Chinese goods coming to the U.S. are up 8% to $394.7 billion.

Overall, the third quarter was strong with August and July being the fourth and fifth highest months on record for dollar value of Chinese imports.

The third quarter is already a seasonal high for imports due to holiday stocking, so the pull forward from shippers is difficult to distinguish from regular seasonality

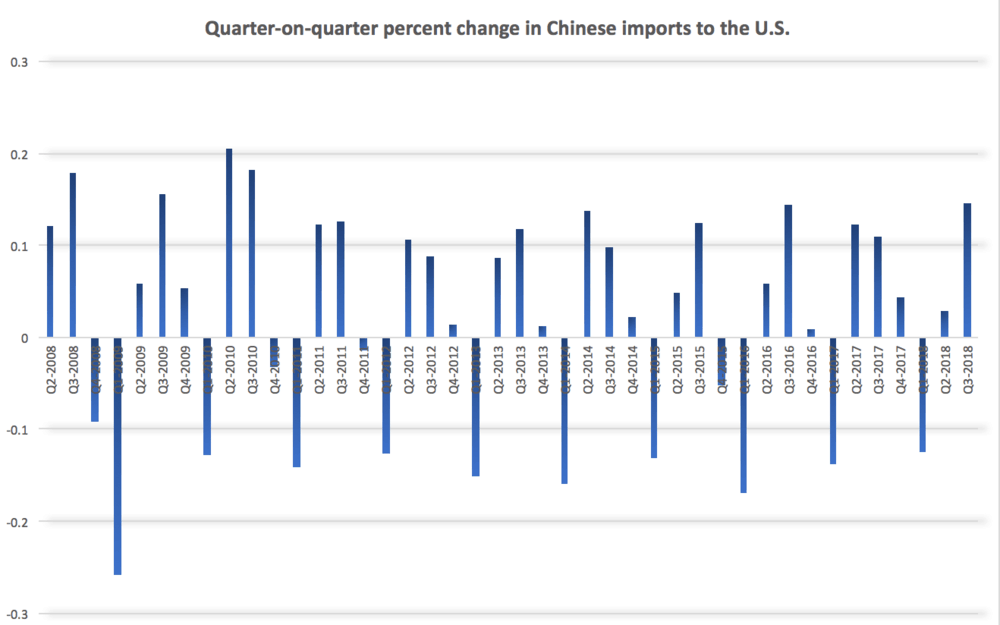

Total third-quarter imports from China rose 14.5% quarter-on-quarter. The level is high, but not the highest seen over the last ten years. Indeed, some transportation company executives say the season has not been out of the ordinary.

Brian Sondey, chief executive of container lessor Triton International (NYSE: TRTN), says the company has seen strong trans-Pacific volumes as shippers bring freight in ahead of tariffs, but “it doesn’t feel like an unusual seasonal pattern generally speaking for us.”

But other intermodal executives see a pull forward effect more clearly in their business. Matt Cox, chief executive of U.S. shipping line Matson (NYSE: MATX), said there is a “beating of the clock factor going on in the broader market in general, and so we will see some pull-forward volumes.”

Likewise, Jean-Jacques Ruest, chief executive of Canadian National Railway (NYSE: CNI), said “definitely there has been pull forward. We got the sense that we have an earlier peak this year, that the so-called fall peak came in earlier.”

The staggered implementation of tariffs, which duties coming into effect in June, August and September, also make it difficult to discern whether there has been a significant pull forward effect, says Panjiva’s Rogers.

“One of the challenges in determining whether there’s a pull forward or not is not only are we in the middle of peak shipping season, but we also have a situation where the tariffs are applied in three different stages,” Rogers said. “It’s difficult to disinter what is pull forward and what is not.”

Nonetheless, some products subject to tariffs have shown much stronger growth during the third quarter. Microwaves and refrigerators showed import volume growth of 9.8% and 15.3%, respectively, in September, Panjiva data show.

In addition, pumping and valve systems showed import growth of 23.6% and 17.4%, respectively during September.

The peak may not be over. Panjiva’s data show that Chinese exports to the U.S. accelerated in October, growing 13.2% year-on-year compared to 12.9% growth in September.

“If there has been a pull forward, we haven’t necessarily seen it reverse in October,” Rogers said. “That might speak to a strong economy, strong consumer demand. It certainly doesn’t suggest these tariffs have massively discouraged Americans from buying products in China.”