A strong flow of Pacific moisture in an atmospheric river is clashing with an easterly flow in the upper levels of the atmosphere early this week. This is creating severe weather potential in the Red River Valley and will add to the ongoing flooding issues of the upper Mississippi River valley through mid-week. Shippers and carriers looking to move freight across this area should be mindful of the potential service delays heading into cities like Dallas and Oklahoma City early and St. Louis and Memphis mid-week.

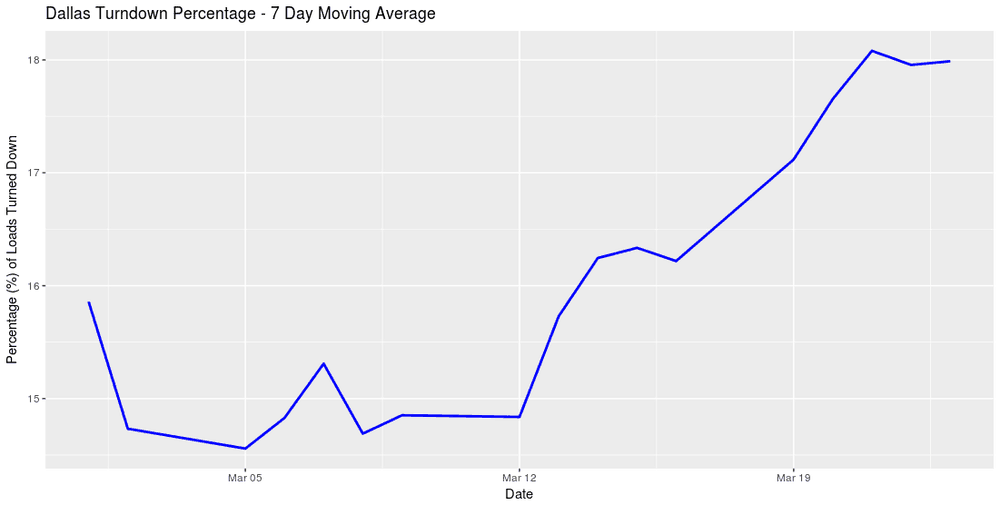

These storms are occurring at a time when freight is starting to pick up out of the southern regions. In the last several days FreightWaves’ TRI, Tender Rejection Index, is showing the Dallas outbound market is starting to pick up volume. The TRI measures the number of loads rejected by carriers that have been tendered by suppliers. An increase in loads rejected tends to signify carriers’ unwillingness to honor their contracted rates versus looking to the spot market for higher paying loads. It is also a measure of truck availability.

What carriers and shippers can infer from the increase in rejections is that they can expect to see spot market rates climb as demand outpaces supply. Re-positioning trucks into a heated outbound market is a tactic that most carriers do not recognize until the market has already incorporated the tightened capacity into the rates. The TRI is a leading indicator to spot rates. FreightWaves readers will have a leg up on the competition. Year over year, the spot market rate has increased from $1.09 to $1.43 as of the end of February in the Dallas to Chicago lane, according to DAT.

Rails will be affected by this weather as well. The Canadian National Railway (CNI), one of the largest providers of rail transport in 2017, has its main American thoroughfare along the Mississippi River from Chicago to New Orleans. According to Cowen, a financial services firm, CNI has responded to criticism over its poor service in 2018, citing unexpected flooding along the Mississippi River along with its rapid growth.

This week’s weather pattern will not help the railroad improve upon its service, but it will provide it with another excuse.

The current system will not be as cold as its immediate predecessors. It will be more of a rain-driven system with little to no major snow accumulation on the front end. Snow will be a factor in the Great Lakes region into the weekend. The main concern with this system is the slow-moving nature. The rain will accumulate over the same areas as it slowly moves its main core of precipitation from the Dallas, Oklahoma City corridor on Monday to Houston, Memphis, and Nashville by late Wednesday. The heaviest of rains will remain to the south with the threat of severe weather. The system will not be exiting the east coast until the weekend so be prepared for some sloppy transits.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.