The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Nov. 10:

San Francisco

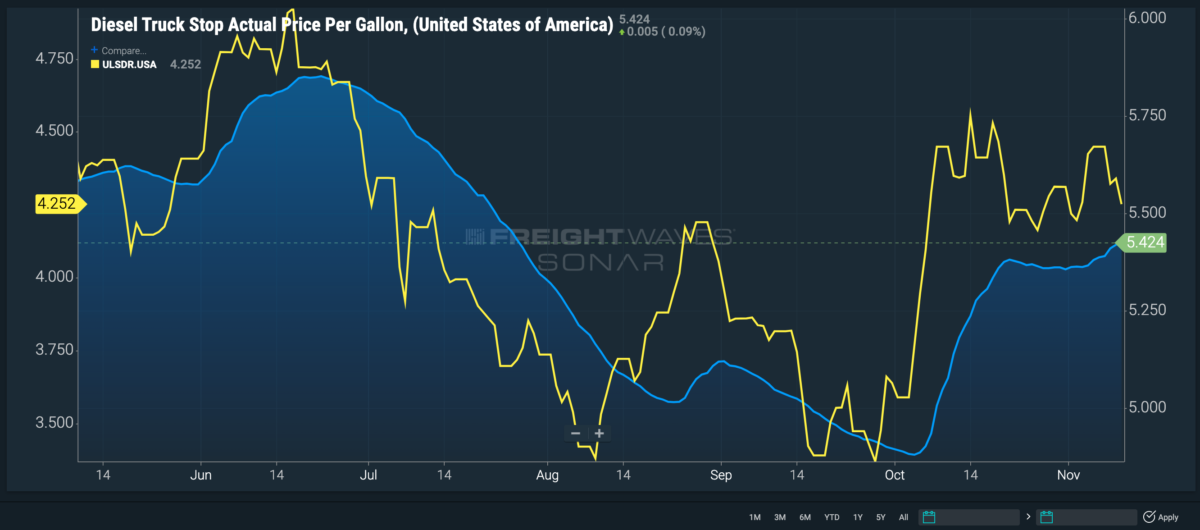

Reefer volumes in Northern California are beginning to level out after rising to a three-month high.

The months of September and October proved to be slow for reefer volumes in the San Francisco market. But now that produce such as broccoli, cauliflower and cabbage are back in season, things are starting to pick back up.

The Reefer Outbound Tender Volume Index saw immediate growth at the start of the month, rising more than five points, or 20%, since Nov. 1. This just goes to show that even though demand for consumer goods transported on dry vans is trending down, people still need their vegetables.

Neighboring market Stockton, California, saw a drop in reefer tenders at the start of the month, but this week they are trending right back up along with San Francisco. The Reefer Outbound Tender Volume index edged up more than two points, or 6.5%, since Friday.

Tender rejections are climbing steadily in both markets. Since Nov. 1, the Reefer Outbound Tender Reject Index in San Francisco is up 108 basis points to 1.7%, and Stockton’s is up 156 bps to 2.4%.

Columbus, Ohio

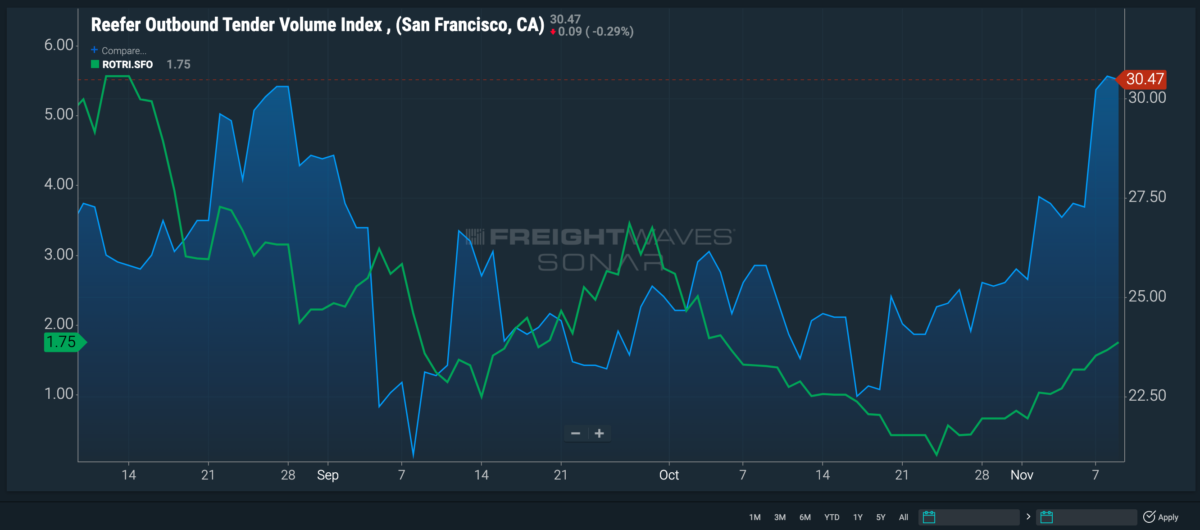

Major markets across the nation are experiencing declines in volume heading into the holidays. However, Columbus, Ohio, is one of the only markets in the top 10 by outbound tender market share that is seeing a rise this month.

Like other markets, Columbus saw a decrease in outbound demand leading into November, falling 7.4% from Oct. 30 to Nov. 2. Things then began to take a turn in the opposite direction. The Outbound Tender Volume Index rose almost eight points by Nov. 4 and gained another 12 points between then and Wednesday to 232.77. Inbound capacity is trending upward as well this month, rising 6% since Nov. 1.

Outbound demand and inbound capacity may be increasing, but rejection rates are still trending downward this month. The Outbound Tender Reject Index for Columbus is down 63 bps since Nov. 1 — and 206 bps overall in the last 30 days — to 2.9%, indicating that carriers are settling into their contracted tenders likely for better rates.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

Diesel prices

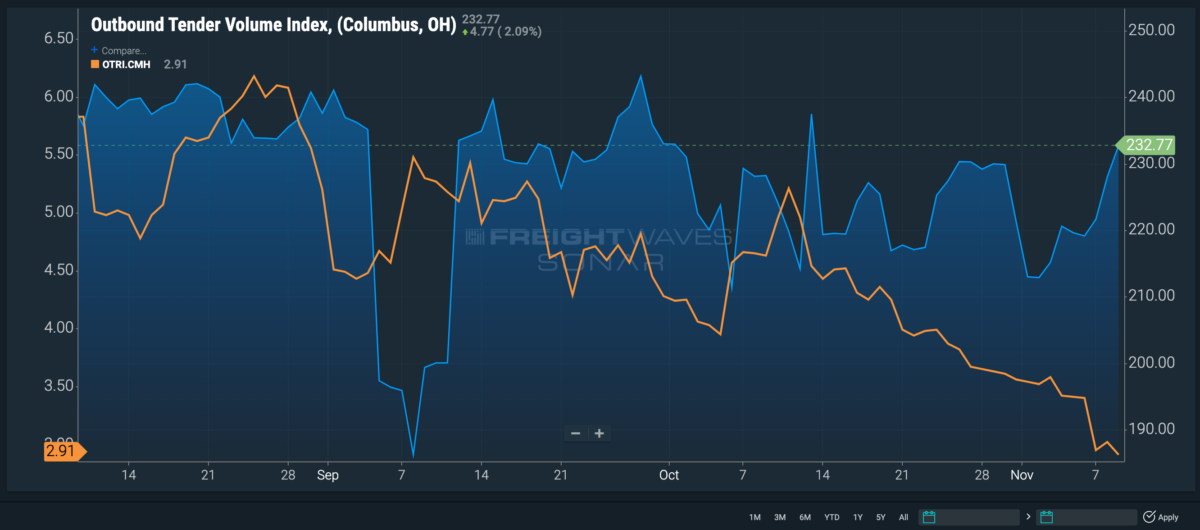

Diesel fuel prices per gallon have slowed the rate at which they are rising but still continue to increase steadily.

The actual price per gallon started to level out in late October at around $5.30 and since has risen to $5.42 currently. A rise nonetheless but not near the rate of increase that was seen over the summer.

On the other hand, the rack price dropped significantly this week by nearly 20 cents.

Though it takes time for these wholesale prices to be reflected in the retail side of things, the spread between the two is up to more than $1, indicating that station owners have little wiggle room to drop prices at the pump and aren’t acting quickly to do so as demand remains high.