The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 13:

Detroit

Outbound demand in Detroit peaked at record highs in August and September, but after a couple of stagnant weeks in October, it is taking a steep drop.

The Outbound Tender Volume Index in Detroit reached a record high in late September of 266.2, but from Oct. 1 through Tuesday there was a slight decrease of 1.3%. On Wednesday the index took a sharp decline of almost 50 points, or 15.4%, to 223.4 — its lowest value since April.

Inbound volume levels took a dive on Wednesday as well. The Inbound Tender Volume Index dropped more than 35 points, or 12.4%, to 251.7. Inbound capacity levels still exceed outbound volume by 12.7%, pushing the Headhaul Index down 50% in the past two days to -28.3.

The softening in the Detroit market has carriers accepting more contracted freight, as the Outbound Tender Reject Index fell 32 basis points since Monday to 3.6%.

Nashville, Tennessee

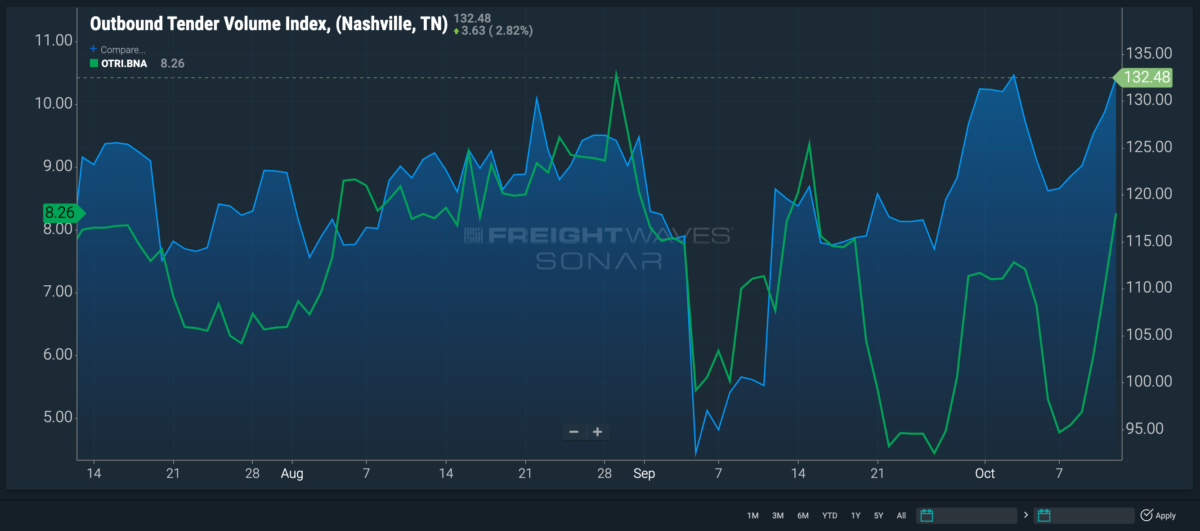

Outbound volumes in Nashville are skyrocketing to reach a five-month high.

Tendered freight volumes leaving Music City were consistent the past couple of months, seeing minor increases and dips every week or so, but in the final days of September leading into October, they began to roar upward. Starting on Sept. 26 the Outbound Tender Volume Index gained almost 19 points by Oct. 3, only to lose 12 points in the days that followed. However, the index gained back the lost points by increasing 10 bps, or 10%, since Oct. 6 to 132.4 — its highest value since May.

While outbound volumes are trending up, inbound capacity is trending down. Inbound freight volumes are down 5.8% this week, placing the variance between inbound and outbound volumes at less than 0.5%. This extremely slim disparity is moving the Headhaul Index up 97% to -0.26.

The significant drop in inbound capacity allows carriers to relish the excess outbound freight to choose from. The Outbound Tender Reject Index is up 348 bps since last Friday as carriers search the spot market for better rates.

Philadelphia

Outbound volumes in Philadelphia were off to a good start at the beginning of Q4 but in the past week took a sudden tumble to a six-month low.

Freight volume levels leaving the Philadelphia market were on a steady incline leading into October, but on Oct. 5 they dropped just over 5%, then an additional 4% in the week that followed to their lowest levels since May.

Philadelphia is a major consumer center and backhaul market in the Northeast, but outbound volumes have exceeded inbound volumes throughout the year so far. The Inbound Tender Volume Index is down in October as well, dropping more than 11 points, or 6.8%, since Oct. 5.

Since the Philadelphia market has been showing headhaul activity all year, the Headhaul Index remained — with minor exceptions usually around the holiday — mostly in the positive. This recent sharp decrease in both directional flows of volume is pushing the Headhaul index down, falling 25% since Oct. 3.

Capacity is reacting to the drop in volume by settling into contracted freight. Rejection rates were up to more than 7% at the start of the month, but the Outbound Tender Reject Index has since dropped 162 bps to 5.6%.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

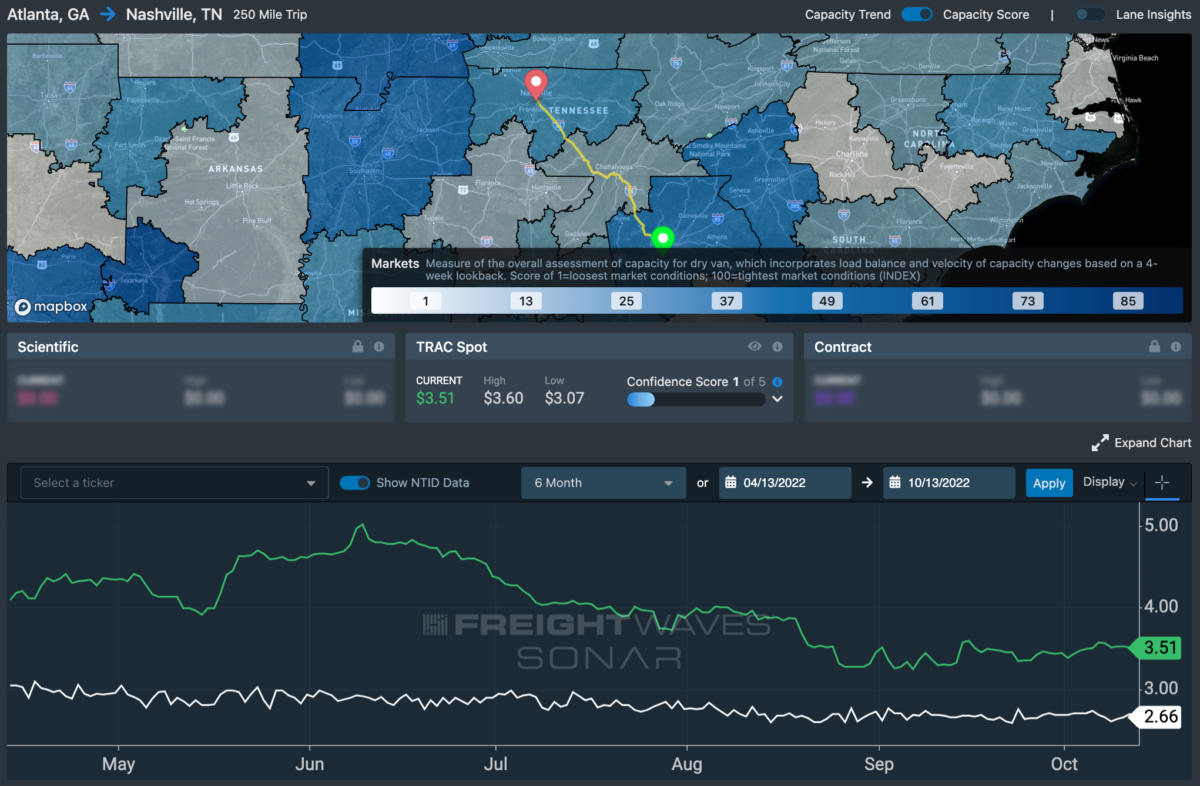

Lane to watch: Atlanta to Nashville

A lane like this from a headhaul market into a backhaul market usually has an elevated rate to make up for the likelihood of not being able to book a load at the end of the road. But with outbound volume and rejection rates both on the rise in Nashville, this could be an ideal situation for carriers in the Southeast.

Spot market rates from Atlanta to Nashville are up 12 cents since the start of the month to $3.51 a mile — 85 cents above the national average. This lane is recorded in SONAR Market Dashboard at an even 250 miles, and a return trip to Atlanta is currently paying $3.47 a mile to make up for that low mileage. In addition, with rejection rates rising out of Nashville, the return rates are likely to start experiencing upward pressure.