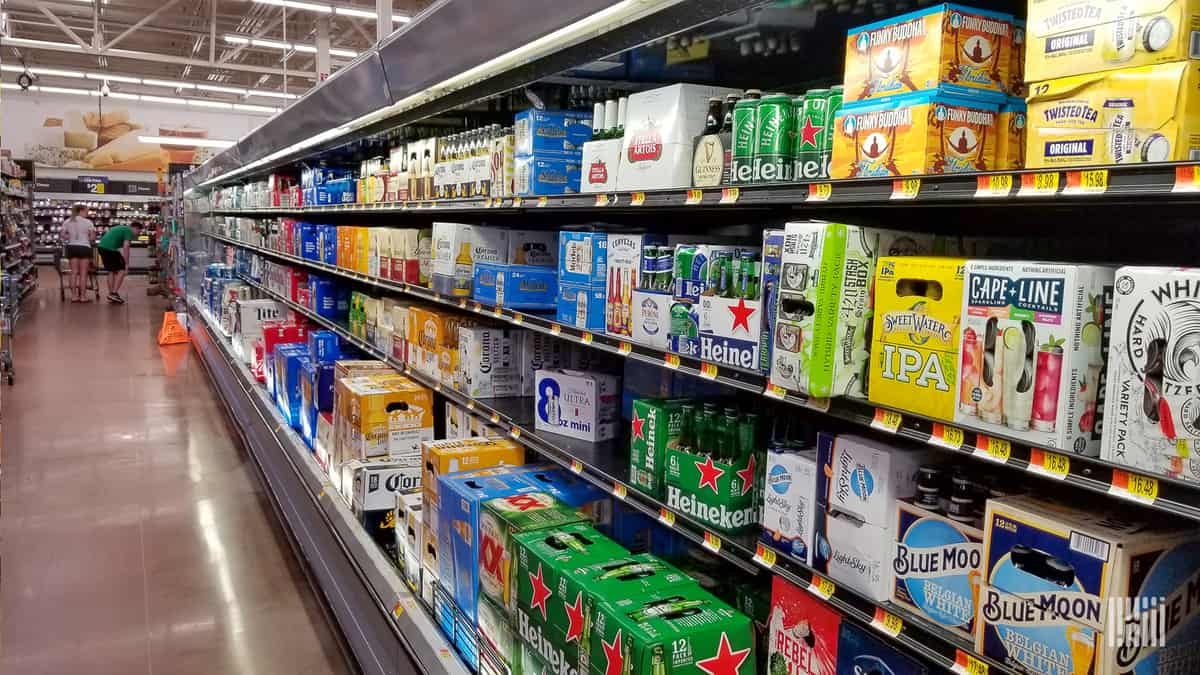

Every year around this time, shippers start seeing increased demand for all the quintessential summer fun foods as folks stock up on hot dogs, chips and beer for their July 4 barbecues. This year, American consumers are expected to spend $7.7 billion – a number that has climbed over $1 billion since 2019 – on food items leading up to the holiday, according to the National Retail Federation.

This year’s holiday spending estimate shakes out to roughly $84 per person across the country, and this total does not include spending on non-food items such as fireworks or special apparel.

“We expect to see increased volumes with our food/beverage, grocery chain, and food distribution customers,” Emerge SVP of Enterprise Sales Jake Papa said. “This includes increased volumes on contract volume, as well as the spot market. Spot rates for same day/next day transactions will increase in price, especially for last minute shipments over the 4th of July weekend.”

The markets are already reflecting the holiday surge, with outbound tender rejections, displayed in FreightWaves SONAR, beginning to tick upward in some key markets like Atlanta last week. The rest of the nation will likely follow suit as the long weekend approaches.

“This upward trend in rejections is the key indicator of capacity tightening ahead of the holiday,” FreightWaves Staff Writer Corey Smith wrote in a recent market update. “As the Empire City of the South continues to experience an increase, spot rates will react positively..”

Short holiday spikes, like those seen around July 4, provide a perfect use case for the shorter RFP cycles facilitated by Emerge’s next-gen freight procurement platform. These mini bids allow shippers to cover the temporary surges without risking their quality of service or breaking the bank.

“Shippers prepare for the holiday peak season by sending out more short-term RFPs. This includes 1-to-2-week contracts for shippers that are looking at increased volume on lanes that they can’t scale capacity easily,” Papa said. “This paired with utilizing a softening spot market allows shippers access to capacity without extremely high holiday surcharges.”

In addition to a spike in over-the-road, Papa said Emerge has seen an increase in intermodal RFP events run through its platform in order to prepare for increased volumes.

While the short spike offers can be somewhat stressful for shippers, especially those heavily – involved in the food and beverage world – it provides carriers with an opportunity to make some additional cash in the short term. The upset also isn’t expected to stick around long.

“Shippers and carriers should expect a quick recovery back to normal volumes the week after the holiday, and tender acceptance should return to levels similar to early summer,” Papa predicted.

When the holiday passes, markets are expected to resume their general softening. For shippers who have not reevaluated their contracts in recent months, this could be an ideal time to look into switching up their RFPs to take advantage of the shift.