UPS (NYSE: UPS) reported strong revenue supported by pricing and targeted growth initiatives during its second quarter earnings call Wednesday. Adjusted earnings per share climbed 23 percent to $1.94, and total revenue was up nearly 10 percent.

Like last quarter, International and Supply Chain and Freight segments generated double-digit growth in revenue and operating profit. The U.S. domestic segment rallied somewhat, reporting 6.3 percent revenue growth across all products.

Domestic revenue gains were driven by higher yields and good growth, with average daily shipments up 2.6 percent led by ground and next day air. Average revenue per piece increased 3.6 percent, the company’s best improvement in the last few years.

“As expected, higher pension expense and project related costs weighed on the segment’s results this quarter,” UPS Chief Financial Officer Richard Peretz said. “We’re bringing on substantial capacity this year which is driving additional expense. Looking forward, the efficiency gains from these projects as they come online, combined with the transformation initiative, will improve U.S. performance.”

Analysts on the call were interested in hearing more about the company’s plans to add capacity and the transformation initiative.

Additional capacity

UPS recently opened two new automated facilities in London and Paris to support continued growth across Europe. These new facilities provide more than 70,000 packages per hour of sorting capacity, according to UPS Chairman and CEO David Abney.

UPS is not just adding capacity across the pond, though. The company is gearing up to open its second largest domestic ground hub in Atlanta. It is slated to begin operations in the coming weeks and will sort over 100,000 pieces per hour. That is more than double the hub sorting capacity added all of last year.

“It incorporates the latest automated sortation and network control technologies,” Abney said. “It is a showplace of UPS’s network capabilities being deployed in several new regional hubs.”

One analyst asked about the cost of facilities and its impact on domestic margins.

“When you think about new buildings and we’ve been talking about almost 400,000 pieces an hour expansion going into the second half of the year in our network, it is about a 15- to 20-week process to get a building all the way up to a full run rate,” Peretz said. “So you’ve got these start-up costs, you’ve got training, you’ve got management costs and so that plays into the results. We know going into next year that it really is about improving yield. It’s about these new buildings and running at full capacity, once the initial start-up period is over.”

Transformation initiative

A strong point of interest for analysts on Wednesday’s call was UPS’s planned “transformation initiative.”

Abney talked about the success of the company’s voluntary retirement plan, noting that participation met expectations. The plan launched in April and closed in June, resulting in a pre-tax charge of $263 million.

Abney said the plan was the first step in a series of initiatives to be launched under the company’s transformation strategies.

One analyst asked when UPS expects to achieve the full run rate saving from the VRP initiative.

In response, Abney emphasized that the initiative involves a staggered departure, and future retirees will start to leave over the next 10 to 11 months.

“So what happens is the full run rate really occurs, call it, post June of 2019, but we’ll start seeing more people leave as we get further into the calendar, and as a result, of course, the savings will start building up,” Abney said “When we get to 2019 guidance, we’ll give you a little bit better picture. But suffice it to say that when we look at the NPV of a project like this, we did have a $263 million charge, but the annual run rate savings is $200 million, which is very positive.”

Analysts also asked about scope of the transformation plans outside the retirement initiative, but answers were somewhat vague. Both Abney and Peretz promised more details would be released at the company’s September conference.

UPS Chief Transformation Officer Scott Price did offer some insight into how UPS thinks about transformation, though.

“We think of transformation in two ways, both cost and growth. It’s a framework by which we are reexamining our way of operating, and so, of course, it would include operating methods, pricing and capacity,” Price said. “In September, when we have our New York conference, we’ll share a little bit more detail around how cost leverage, reducing our non-operating cost, procurement, working capital and those growth initiatives all come together to a pretty substantial multi-year program.”

Teamsters

While Abney did mention recent contract agreements struck between UPS and the Teamsters, the company was not apt to go into too much detail.

“Recently, UPS and Teamster leadership reached tentative master agreements covering employees in our U.S. small package and freight units,” Abney said. “In addition, we reached handshake agreements on local supplements, covering most U.S. employees. The parties are working hard to finalize the remaining locals. These contracts reward UPSers for their contributions to our success. They also enable the business to remain flexible to meet customer needs, increasing shareowner value.”

One analyst asked how the addition of part-time driving rules will affect business and how cost could grow moving forward if the contract that has been released to the public is ratified.

UPS Chief Operating Officer James Jay Barber declined to discuss the issue with analysts.

“Look, I think this isn’t really the forum to be doing forward forecasting, given the contract is not ratified yet. I think what I’d rather just update you on is where we are and when the time is right, we’ll walk you through all of that, obviously,” Barber said. “But we absolutely feel like we’re in a pretty good place right now, because, at this point, really, we have tentative agreements on the national masters in freight and package and we are just a handful away of the locals and the supplements, and we really believe that kind of the timeline, which I think we all do is important is in early August, we believe the Teamsters will get the communication and begin the process to a ratification and the voting process.”

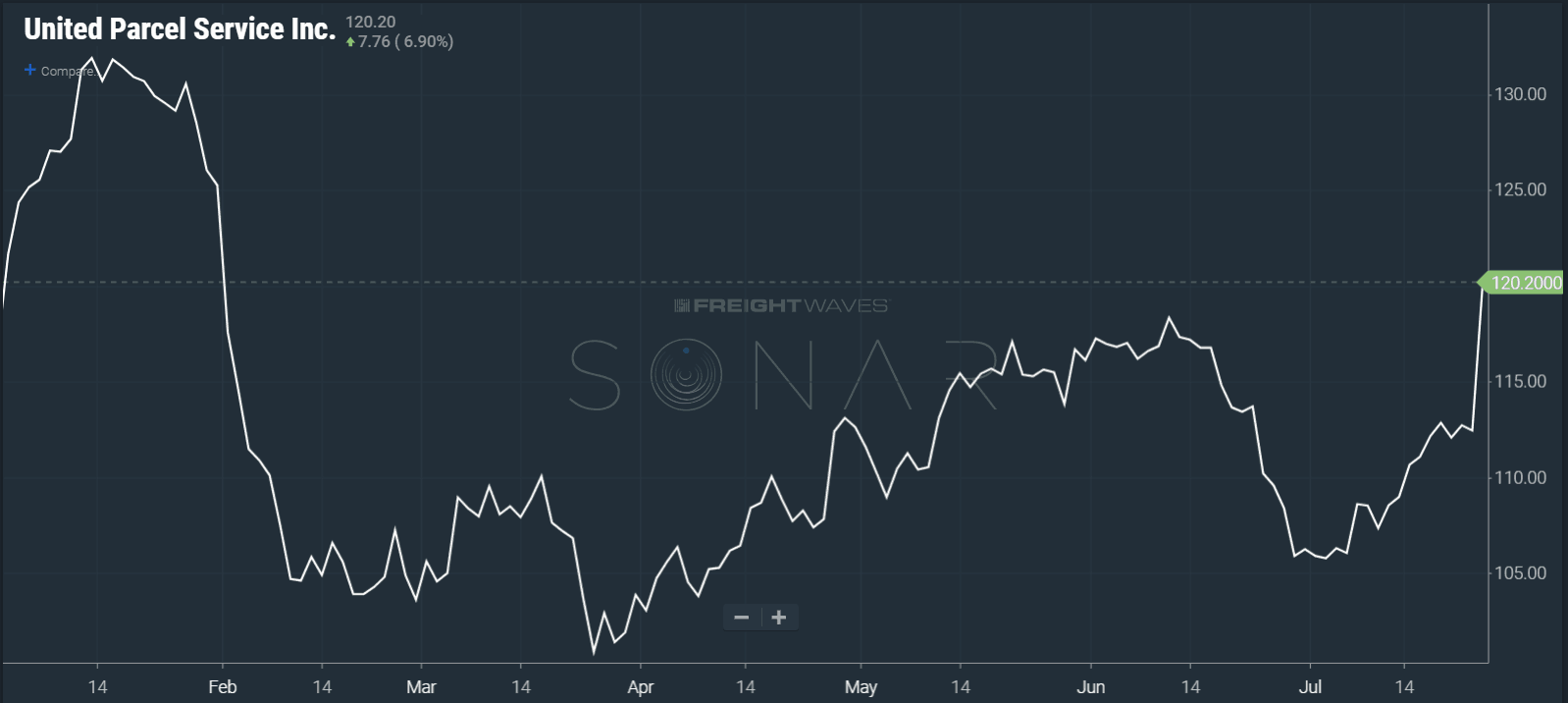

UPS’s stock is up 5.8 percent since the second quarter report was released, and Deutsche Bank has maintained the company’s hold status.

Financial stats

For the U.S. Domestic segment in 2Q 2018:

-

Revenue improved across all products, demonstrating robust market demand for UPS solutions.

-

Revenue per piece increased 3.6% as higher base-rates and fuel surcharges offset headwinds from customer and product mix.

-

Adjusted operating profit excludes transformation charges of $196 million, which lowered reported operating margin by 190 basis points.

For the International segment in 2Q 2018:

-

International revenue increased 14%, driven by double-digit growth in Export and Domestic.

-

Daily Export shipments increased 9.5%, led by strong growth in Europe and the U.S.

-

Operating profit was $618 million and adjusted operating profit rose 15% to $654 million.

-

Adjusted operating profit excludes transformation charges of $36 million.

For the Supply Chain and Freight segment in 2Q 2018:

-

Revenue increased 16% to $3.5 billion, the business units are focused on leveraging UPS solutions to better serve middle-market customers.

-

The Forwarding business led all units with 23% revenue growth, as revenue management initiatives drove top-line improvement.

-

UPS Freight revenue increased 13% on higher pricing and tonnage gains.

-

Operating profit was $216 million and adjusted operating profit was up 17% to $247 million.

-

Adjusted operating profit excludes transformation charges of $31 million.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.