When a company like Ford warns about the supply chain, analysts are shocked. Why? Because they’re looking at the wrong indicators. You hear comments on TV like, “Supply chain is getting better: Look at the Port of Los Angeles!” It’s insane. You cannot look at one port as an indicator of the supply chain.

Ford’s supply chain problem for auto parts has been telegraphed for months if you follow trade. Back on June 10, Ford’s exposure to the German labor strife was highlighted.

Now, Ford and hundreds of other companies are facing additional supply chain disruptions as a result of dockworker strikes at the British ports of Liverpool and Felixstowe. The union Unite wants a fair wage that matches inflation.

“We will strike again and again and again until our wages match inflation,” said Bobby Morton, national officer for Unite. “The message we are trying to get out to employers is that we couldn’t walk away during COVID. There was no respite. We are working in all kinds of weather. There has been no reward whatsoever for the efforts that our people made over these two and a half to three years. Now the inflation rate is rocketing. We need to be recognized and we need to be thanked for the efforts that we have made.”

Until these wage demands are met, expect more labor discontent.

Since the first eight-day strike at Felixstowe in August, the port’s owner, Hutchison Port Holdings, increased the dockworkers’ salaries by 7% and issued back pay. But Morton says the workers are still not satisfied.

“We asked our members, ‘Are you prepared to accept the 7% that’s been imposed upon you? Or do you want to carry on striking to get what you deserve?’” Morton said. “And we got a return of 82% of our members said that they want to carry on regardless.”

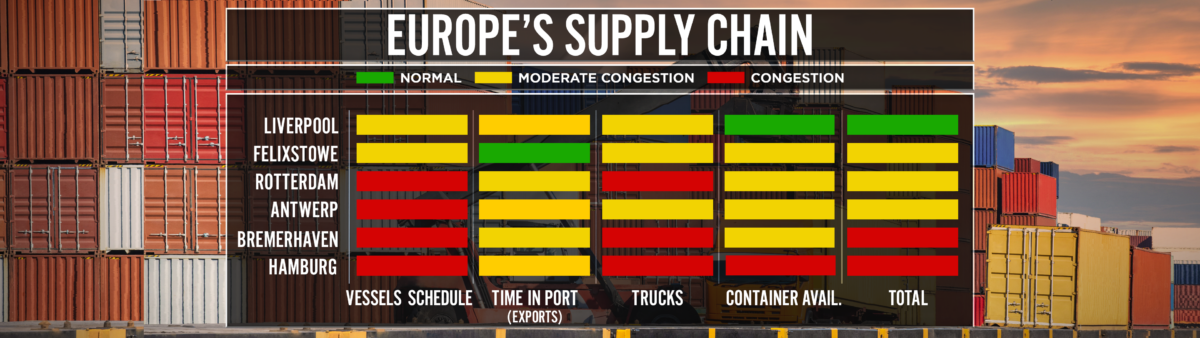

These dual strikes overlap and will not only impact the productivity of the U.K. ports but also the ports of Germany, the Netherlands and Belgium. Containers are being redirected to those ports, which will only add to the congestion.

“The Felixstowe labor strike led to a monumental increase in berth times, with the U.K. recording an 86.1% increase month over month July to August 2022, resulting in carrier lines redirecting their vessels to other major European and smaller U.K. ports,” said Josh Brazil, vice president of supply chain insights at project44.

A decrease in shipment arrivals as a result of congestion delays is also a byproduct of this labor strife.

“If there are production part availability issues, staffing issues, truck delays and now port delays, we are seeing cases where an end-to-end transit time may go from 15 or 30 days to now 20-45,” said Glenn Koepke, general manager of network collaboration at FourKites. “This makes planning and forecasting extremely difficult for all parties.”

This is why investors and the “smart money” on Wall Street need to understand trade and how it feeds the supply chain.

This latest round of labor strikes will only compound the delays of product leaving the ports.

Andreas Braun, Europe, Middle East and Africa ocean product director for Crane Worldwide Logistics, has been sounding the horn on the congestion for months, warning the pileup of containers will not be cleared in Germany until the first quarter of 2023.

The supply chain depends on the fluidity of trade on a global basis. Thinking otherwise is just nonsense.

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company project44; maritime transport data company MDS Transmodal UK; ocean and air freight rate benchmarking and market analytics platform Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; DHL Global Forwarding; freight logistics provider Seko Logistics; and Planet, provider of global, daily satellite imagery and geospatial solutions.

Freight Zippy

When will we learn that offshoring does nothing for workers except make a few union leader more powerful and corporation wealthier

Time to tax these companies and the consultants that send jobs overseas…

Then ‘offshore’ their jobs…