Dry bulk has tanker envy in 2020.

Dry bulk was where day traders placed their bets back in the day, in the mid-2000s, but this year, traders on Robinhood and other retail platforms have instead put their chips on floating storage and stocks like Nordic American Tankers (NYSE: NAT).

Here’s the emerging dry bulk shipping pitch: Dry bulk stocks trade in relatively high correlation with spot rates and unlike tanker stocks, they don’t face a painful floating-storage destocking phase. Dry bulk rates have just dramatically spiked off extremely low levels and could go much higher if Chinese import demand remains strong, Brazil clears its export logjams, and global COVID-19 economic fallout is not as severe as first feared.

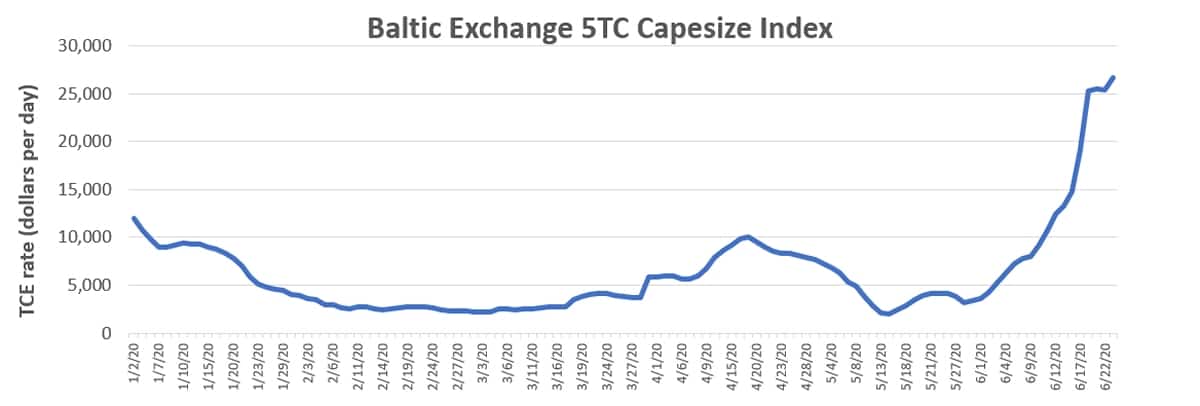

Rates for Capesizes — bulkers with capacity of around 180,000 deadweight tons (DWT) that carry iron ore and coal — have jumped 631% this month, from an abysmally low $3,648 per day on June 1 to $26,672 per day on Tuesday, according to assessments of the Baltic Exchange’s 5TC Capesize Index (breakeven for a Capesize is around $13,000-$14,000 per day).

“Last week was one of the most exciting weeks in many years for the Capesize market, as spot rates more than doubled in a relentless rally that caught even seasoned freight traders and brokers by surprise and validated, once again, the incredibly volatile nature of shipping,” said Breakwave Advisors, the creator of the Breakwave Dry Bulk Shipping ETF (NYSE: BDRY), in a new report.

Fool me twice …

FreightWaves asked J Mintzmyer, a retail-investor-centric analyst at Seeking Alpha’s Value Investor’s Edge, why retail investors have been less enthusiastic about dry bulk than tankers, and whether their enthusiasm in dry bulk could be kindled.

“In terms of the lack of retail interest in bulk compared to tankers, dry bulk has had a much longer bear market run than tankers, with no real sustainable rate run since about 2011,” he responded. “Tankers had a strong 2015-2016 run and 2019 was also very strong, plus we just had a nice run for a few months in 2020.

“I think dry bulk makes sense for a summer trade based on rates coming off near-record lows and the high likelihood of Chinese stimulus driving increased iron-ore imports from Brazil. It’s a great trade to combine both the broad global recovery theme as well as a seasonal run in dry bulk rates.

“But in the medium and long term, I’m much more skeptical on bulkers than tankers.”

Minztmyer also believes retail investor disappointment with tanker bets may weigh against shifting their chips to bulkers. “There’s probably a bit of ‘fool me once, shame on you; fool me twice, shame on me’ going on as lots of people got super enthusiastic on tankers only to get disappointed by the markets. If the trade didn’t work that well in tankers, I can’t fault anyone for being skeptical on bulkers.”

Making the bull case

The bear case for dry bulk is that demand is highly dependent on China and industrial production globally, which would fall as a result of COVID-19, lowering demand for iron ore and coal for steel production, while the outbreak in Brazil could curtail the iron-ore exports that support Capesize rates.

Environmental constraints would curb coal use for power generation and the trade war would restrict grain cargoes. Rates could collapse as quickly as they rose. Meanwhile, dry bulk stocks have too much insider ownership, limiting the public float and trading liquidity.

Executives of listed shipping companies presented the bull case during a Marine Money virtual event on June 16. “Demand is picking up fairly rapidly,” asserted Hamish Norton, president of Star Bulk (NYSE: SBLK).

John Wobensmith, CEO of Genco Shipping & Trading (NYSE: GNK), assured that “logistical issues in Brazil have started to unwind over the last couple of weeks.” He also maintained that coal for power generation is far from dead; it has simply shifted to power plants in Asia from Europe.

With China accounting for around 70% of global iron-ore demand and 30% of overall dry bulk demand, Norton pointed out, “We’re lucky [to be in dry bulk] because China is probably the economy that is dealing with COVID-19 the best.”

Norton contrasted the very low rates seen earlier this year to the epic slump in 2016, explaining that “2016 was terrifying. Demand was suddenly dropping and supply was increasing and nobody knew when it was going to end. Now, we’ve got this identifiable shock and everybody knows when it will end. All we need is a vaccine. We’ve got a very specific problem with a very specific solution, which is psychologically much easier to deal with.”

The vessel supply outlook is also much better than in 2016, with orders for new bulkers extremely limited, not only because of COVID-19 but because of uncertainty over which designs can meet future greenhouse-gas regulations. “It used to be that if you ordered a ship and the law changed, the ship was grandfathered in,” said Norton. “With the political situation we face today, people are afraid — with good reason — that a new ship won’t be grandfathered in.

“I think it’s pretty clear that Greta Thunberg should be named the next Commodore of the Connecticut Maritime Association [CMA],” he joked, referring to the teenage activist and the CMA’s annual honoring of an individual who contributes to the maritime industry (unwittingly, in Thunberg’s case).

Stocks make big moves

On Tuesday, 624.4 million shares of Capesize owner Seanergy (NASDAQ: SHIP) traded hands, valued at around $150 million. Now infamous retail stock trader Dave Portney was a buyer, not because he knew anything about Capesize rate trends, but because he liked that the ticker was the word “ship.” “I got no clue what it actually is,” he acknowledged.

In general, dry bulk stocks have retaken a lot of ground over recent weeks, although they’re still well below where they started the year and they’re not rising as fast as spot rates.

At Tuesday’s close, the stock price of Eagle Bulk (NASDAQ: EGLE) was up 84% from lows hit in mid-May, with Star Bulk up 82%, Safe Bulkers (NYSE: SB) 55%, and Golden Ocean (NASDAQ: GOGL) and Genco 54%. Scorpio Bulkers (NYSE: SALT) was up 22% despite a highly dilutive follow-on offering on June 9.

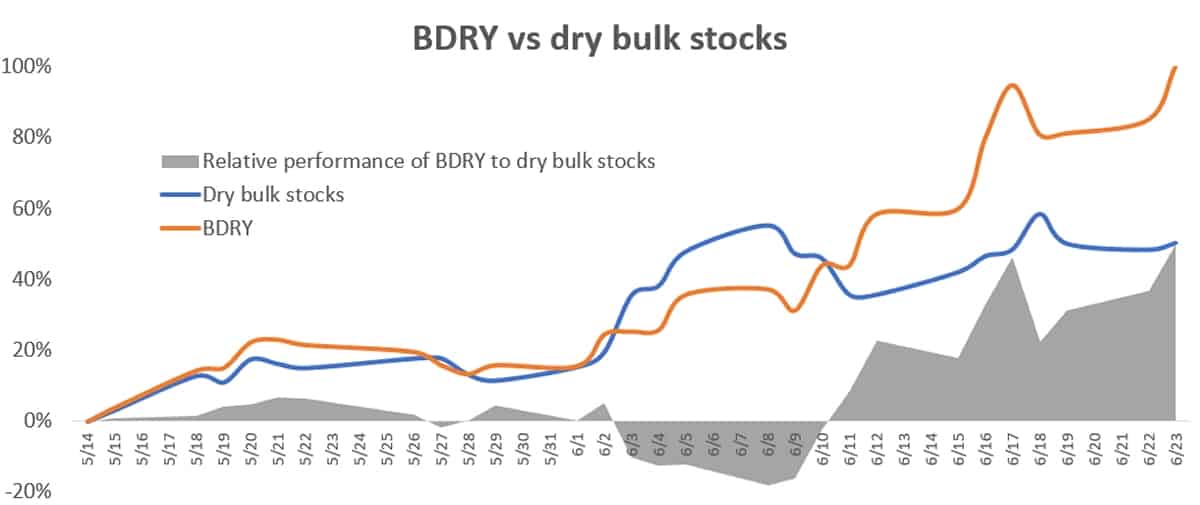

Breakwave’s BDRY exchange-traded fund (ETF) is another way to play the market. The ETF purchases dry bulk freight futures to emulate the curve of the Baltic Dry Index (BDI). Unlike shipowner equities, it is not swayed by broader stock market sentiment. BDRY rose 10% on Tuesday.

Breakwave Advisors founder John Kartsonas provided FreightWaves with a chart showing the ETF’s outperformance versus a basket of dry bulk stocks since May 14.

Deconstructing the Capesize spike

Three important variables for the Capesize markets are rates from Brazil to China, rates from Australia to China, and the effect of exhaust gas “scrubbers.”

As a result of the IMO 2020 rule effective Jan. 1, ships with scrubbers can burn 0.5% sulfur heavy fuel oil (HFO) while those without scrubbers must burn 0.1% sulfur fuel known as very low sulfur fuel oil (VLSFO). Spot rates measured on a time charter equivalent (TCE) basis are calculated in dollars per day net of fuel, thus a scrubber ship burning cheaper HFO would post a higher TCE rate than a nonscrubber ship doing the exact same spot contract but burning VLSFO.

In 2019, Platts introduced a Capesize index, the CapeT4, that featured rate assessments for both scrubber ships and nonscrubber ships. The Baltic Exchange 5TC is based on nonscrubber ships.

What the CapeT4 index shows is that base rates were bouncing along the bottom throughout the first quarter, at or under $5,000 per day, but early in the year, HFO was much cheaper than VLSFO, so scrubber Capes were outperforming nonscrubber Capes.

Initially, that outperformance was over $10,000 per day but that advantage faded fast. As the coronavirus slashed the price of crude oil, the spread between HFO and VLSFO narrowed, and scrubber ships saw their TCE decline throughout the first quarter not because of underlying cargo demand, but because the advantage they obtained from their scrubbers deteriorated.

The Platts index data shows that rate moves in June have nothing to do with the fuel differential. Rather, they are being driven by the supply-demand balances in the two main Cape loading markets: Australia and Brazil.

The Platts indices show that rates to China out of Australia are higher than out of Brazil, reaching $28,596 per day (for nonscrubber ships) on Tuesday.

The Platts index assessed nonscrubber Capes on the Brazil-China run at $24,055 per day on Tuesday.

What happens next in Brazil will be critical to Capesize spot rates, and by extension, equities of Capesize owners.

Will Brazilian miner Vale (NYSE: VALE) resolve ongoing mining safety issues related to the 2019 tailings-dam disaster and simultaneously avoid being shut down by COVID-19 outbreaks? How confident owners are in Vale will determine how many Capes ballast empty from the Pacific to the Atlantic Basin.

Future Capesize rates will be determined by how well or poorly owners match basin deployments with basin cargoes — a judgment that will be made all the more a roll of a dice by COVID-19. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON DRY BULK: Rates just jumped, but things change fast; just a month ago, rates were collapsing: see story here. For a primer on how the BDRY ETF offers a different way of investing versus shipowner stocks, see story here. And for a look at the ‘Greta Thunberg effect,’ how environmentalism is curtailing newbuildings to the benefit of spot rates, see story here.