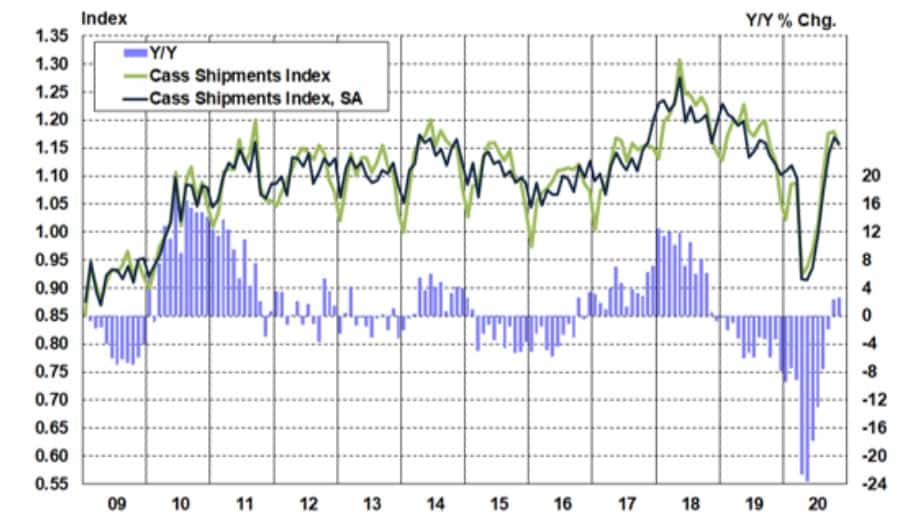

Cass announced Thursday that the November freight shipments index recorded a second consecutive month of year-over-year gains, up 2.7%, with the expenditures index remaining above prior-year levels for the third straight month, up 5.7%.

However, the shipments dataset dipped 2.2% from October, down 1% on a seasonally adjusted basis. The sequential decline was the first since April, “likely due to the worsening pandemic numbers impacting the trajectory of the recovery,” according to the author, ACT Research’s Tim Denoyer. An “easier prior year comparison” was noted as the reason for the year-over-year improvement.

The shipments index turned positive on a year-over-year comparison for the first time in nearly two years last month.

While shipments backed up from the prior month, Denoyer credited the recent recovery in the index to improving less-than-truckload tonnage, which has increased by mid-single-digits year-over-year in the past two months. “After declining in 20 of the 22 months through August, recovery is under way in LTL with three straight months of accelerating growth.”

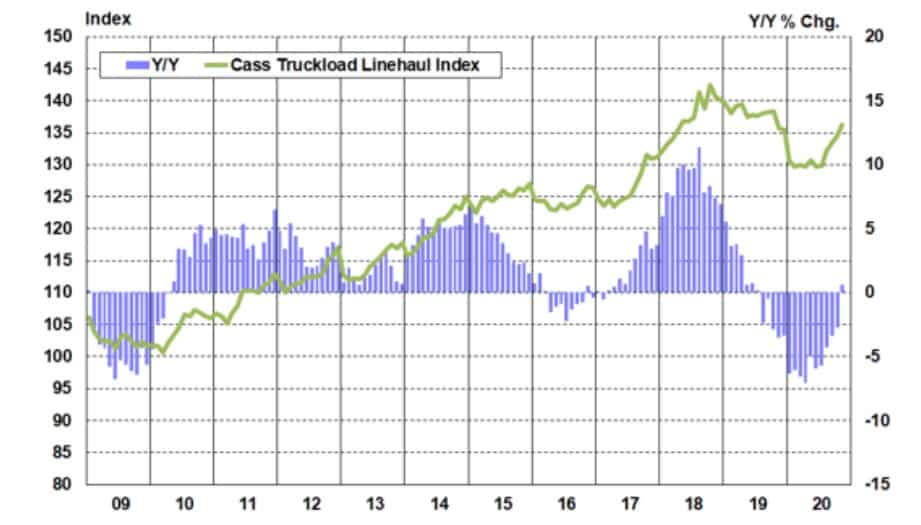

The expenditures index advanced sequentially, up 2.9% (+5.1% after seasonal adjustments), after a flat October. The report noted that high TL spot rates are starting to bleed into contract rates, allowing the dataset to bump up against late-2018 and early-2019 highs.

Denoyer said “implied freight rates” — expenditures divided by shipments — were up 3% year-over-year in the month, following a 0.6% increase in October. “Based in part on spot trends, implied freight rates are likely to accelerate in 2021,” he added. The data includes all modes with TL representative of more than half of the freight spend.

The TL linehaul index was up 0.6% year-over-year in November, up 1.4% sequentially. This was the index’s first year-over-year increase since July 2019. He believes “contract rates are accelerating” and expects “the Cass Truckload Linehaul Index to continue to improve in the coming months.”

“Although the recovery in shipments stalled a bit in November, we feel that, based on low inventory levels at U.S. retailers and the continuing strength in intermodal volumes on the North American railroad network, freight trends look set to continue to move higher in the near term,” Denoyer added. “While near-term risks from the pandemic remain elevated, recently begun vaccinations will reduce these risks in the coming months.”

Data used in the Cass indexes is derived from freight bills paid by Cass Information Systems (NASDAQ: CASS), a provider of payment management solutions. Cass processes $28 billion in freight payables on behalf of more than 8,000 subscribers annually.