Hot Takes

Last Sunday through Tuesday, Amazon had Deal Days on top of its three-week Holiday Beauty Haul event wrapping up next Monday. In an effort to kick-start the holiday shopping and sales early, Amazon has amped up its efforts to get people buying. It has select days throughout October and November when certain big-ticket brands have deep discounts.

We all know Amazon is king in the retail market, and at the rate it’s going, could it be the king of the freight world as well?

Let’s start at the beginning. It’s 2017 and there’s a sweet new app, Relay, that helps drivers get checked into Amazon facilities quicker and special relay lanes to encourage drivers to use the app. The Amazon Relay app paved the way for creating the first Amazon load-matching platform, the foundation for its digital brokerage effort.

As time went on, Amazon created carrier portals and partnered with brokerages like U.S. Xpress to build the foundation of the Amazon brokerage. It increased its dedicated truck operations by recruiting fleets to join. Then it began the pay-per-day plan, in which assets are paid per day to run loads tendered to them.

Then Amazon launched its own digital freight brokerage, Amazon Freight. It built out its own brokerage straight from what it had in place on top of what it had seen other brokerages successfully accomplish. It’s turning cost into revenue, securing its own capacity while allowing outside freight into the network to mitigate the expense of backhaul lanes.

Because of what Amazon is as a company, it knows exactly what lanes are straight backhaul and can fit the external freight into those backhaul lanes. Marc Wulfraat, president of supply chain consultancy MWPVL International, has said, “What took UPS 120 years to build out, Amazon is attempting to do in less than a decade.”

That further proves Amazon can and will sell anything and everything.

Amazon Freight without question will follow suit with Amazon Web Services. In 15 years AWS is powering one-third of the online market. Amazon’s brokerage was started in 2019 and in 15 years will it have quietly bought up one-third of the trucking capacity? We don’t know, but if I was a gambler I wouldn’t doubt it.

What’s on the horizon for the Amazon Freight world? Let’s find out next week.

Quick Hits

Look! It’s a unicorn! — Flock Freight, a digital logistics provider, has raised $215 million in Series D financing led by SoftBank. It is valued at $1.3 billion, making it a rare but beautiful unicorn. Flock Freight uses proprietary technology to pool LTL and partial truckload shipments together to create shared truckloads.

With Flock Freight pooling its shipments, on a daily basis it upholds its mission to “move freight in a way that treats the environment and drivers with care.” Since the company started, it has eliminated 15,000 tons of carbon dioxide emissions with a goal to reach 20,000 tons by the end of this year.

More companies are taking into account their carbon footprints and their supply chain emissions. Flock Freight has combined lower transportation costs, high-quality customer service and reduced carbon emissions. Is it a unicorn in other aspects or just slightly ahead of the curve?

Everything is fine — Congestion at the ports of LA and Long Beach is nothing new. But it’s all anyone can talk about since “Game of Thrones” ended. There was a shot that we had made progress. The amount of ships waiting had decreased from a record-setting 73 to the high 60s and Biden announced there would be 24/7 port operations.

Well, we aren’t out of the woods yet. Currently there is $22 billion (with a B) worth of cargo chilling in the ocean off the coast of Los Angeles. Waiting time to get unloaded is averaging about 13 days. Some container ships are sitting longer than that with no real end in sight.

People who are talking to the dockworkers are saying that they have no room to place containers and they can only operate two cranes at a time due to capacity at the dock and equipment limitations. A lot of the crane parts are out of stock and back-ordered, so if they had the space for all six cranes to function, they could be facing larger issues with broken parts.

There is no doubt we’ll all continue to watch and see what happens. I’m hoping it ends better than “Game of Thrones.”

Market Check

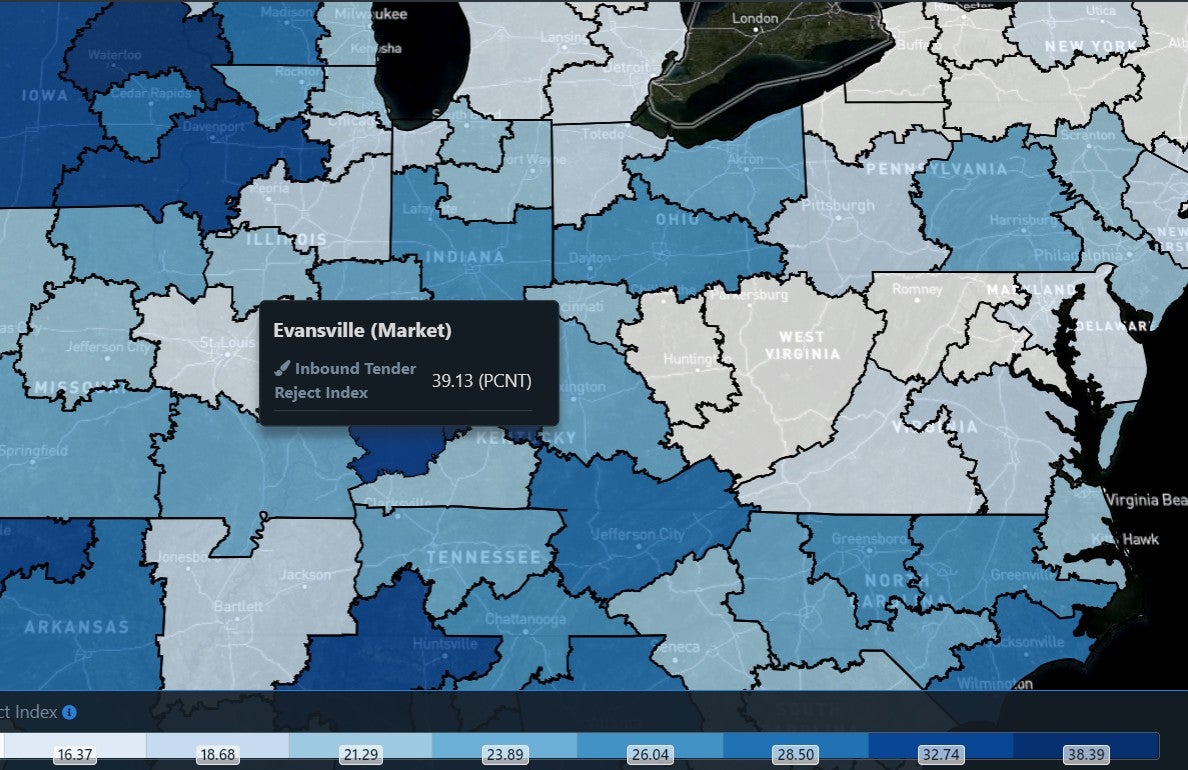

The Inbound Tender Reject Index measures how willing carriers are to deliver loads into a market under contracted terms. Currently Evansville, Indiana, has the second-highest rejection rates of inbound tendered shipment at 39.13%. It’s pretty clear no one wants to go to the Pocket City.

That being said, if you find yourself with a lane headed to E’ville, you’re going to want a slightly higher rate to get in there. In the ITRI map above, lighter colors are your friends. Those are the inbound lanes you can price a little lower knowing carriers are willing to go into those markets. Evansville is as blue as Tobias trying to become a member of the Blue Man Group.

If you have a shipper that wants inbound freight into Evansville, you’re going to want to extend some lead times to open up more options to ensure you don’t have to pay a bunch of money to ensure your product arrives.

Who’s with Whom

We’re back with some fresh takes on a familiar question. This time we have Arnes Arnes Crnolic, a carrier relationship manager with Sunset Transportation in St. Louis, who takes on wild rate quoting.

How many loads per day do you not quote (or put a “go away” rate on), just because you don’t have time to quote everything and/or you aren’t sure about the pricing on certain lanes? (That obviously excludes opportunities that are insane, mult-pick, three to four drops, overweight, etc.)

CRNOLIC: “Sunset, as a company guideline, does not provide obscenely high rates without having an actual truck in hand. We typically request delivery deadlines to properly gauge options — and to get the most options — for the best rates, even on more difficult lanes. Our teams follow a ‘no option is a bad option’ when it comes to tougher lanes and customer service requests, and we do work to negotiate the best option for all parties. We cultivate relationships with our core carriers to work in collaboration to accomplish what others might consider a tough task. This shines through in mutual trust and helping one another when situations arise. These relationships are extremely important for Sunset and we work hard at keeping integrity part of the equation.”

The more you know

CVSA conducted hazmat inspections without forewarning

Colorado trucking company takes ‘huge hit’ from I-70 closures