Shipping stocks swooned when Chinese protesters took to the streets. But the civil unrest is turning out to be a positive: The Chinese government is loosening COVID restrictions faster than expected, which should support tanker and dry bulk demand and improve containerized cargo flows.

The abrupt policy shift coincides with more bad news on Chinese exports. On Wednesday, the Chinese government reported that total goods export value fell 8.7% year on year (y/y) in November. Economists polled by The Wall Street Journal had anticipated a 2% drop.

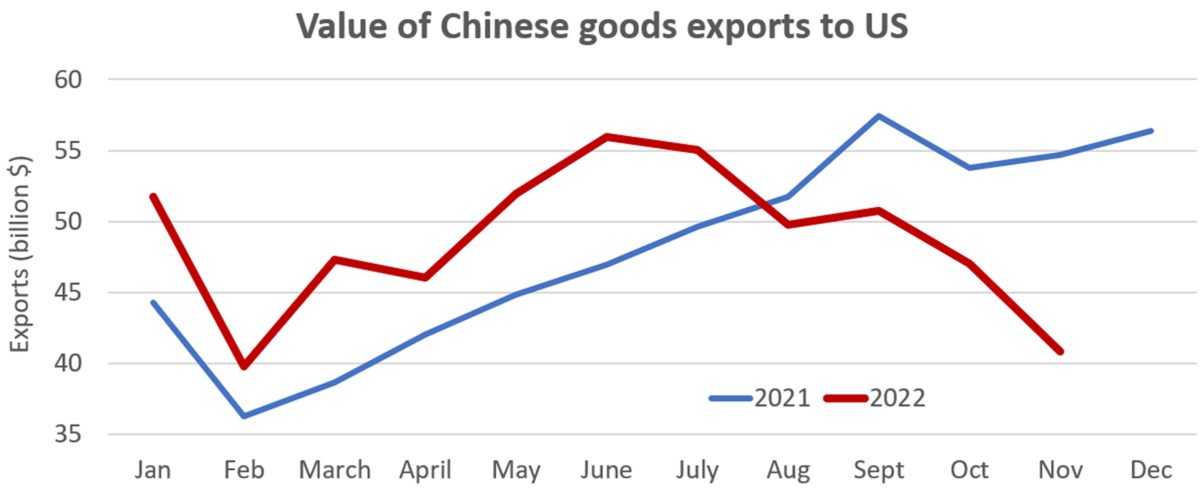

Chinese export value to the U.S. plunged 25% y/y, double the 12.6% y/y decline in October. Chinese exports to the U.S. have sunk 27% since June. The U.S. accounted for just 13.8% of China’s total export value last month, down from 17% in July.

U.S. Customs data shows an increasing y/y drop in inbound shipments from China, with declines continuing this month. Data from FreightWaves SONAR likewise shows a fall in Chinese bookings bound for the U.S.

Container trade could take time to recover

China’s November trade data was “dismal,” wrote Pantheon Economics. “We expect exports and imports to deteriorate in the coming months, before improving … over the course of 2023 as China recalibrates economic policy and weathers a likely COVID exit wave.”

Evercore ISI analyst Neo Wang noted that the government “pulled the trigger [on lockdowns] three months earlier than we expected.” Even so, he cautioned that “recovery takes time.”

Wang warned that the economic payoff from the policy change could be delayed by “stronger public fear due to lack of COVID experience,” labor shortages due to spreading infections and concerns over government “backpedaling.”

Another reason reopening may not immediately translate into higher containerized exports: Pantheon Economics pointed out that current weakness is more a result of falling overseas demand than lockdown disruptions to supply chains.

“China’s export product data shows a similar picture to that painted by Korean exports: falling shipments of electronics as consumers shift consumption patterns, while auto exports are strong as carmakers catch up on previous orders.”

Tanker demand boost could come swiftly

Weak Chinese demand for crude oil was one of the big headwinds for tanker rates in 2021 and earlier this year. Recovering volumes in recent months have supported higher rates for very large crude carriers (VLCCs; tankers that carry 2 million barrels of oil).

“Looking ahead, China’s reopening is likely to have a noticeably positive impact on the VLCC segment as China is the largest charterer of VLCCs,” said Omar Nokta, shipping analyst at Jefferies.

The higher the mobility of Chinese citizens as COVID restrictions ease, the higher the country’s fuel consumption and thus demand for tanker imports. Argus reported Wednesday that Chinese mobility is already rising, increasing gasoline margins.

Argus surveys showed that Chinese oil companies hiked purchases of crude in the first week of December. Purchases were at least 16.4 million barrels Dec. 1-7, it said, putting China “on course to exceed, by a considerable margin, the 26.4 million barrels that traded on the delivered spot market in November.”

Dry bulk upside, but not until 2023

Of all shipping sectors, dry bulk is the most exposed to China. Dry bulk shipping has suffered significant demand fallout this year due to China’s COVID lockdowns and property-market crisis.

According to Deutsche Bank analysts Amit Mehrotra and Chris Robertson, “A shift away from restrictive zero-COVID policy measures as well as measures to stabilize and support the domestic property market will be key for strengthening underlying dry bulk commodity demand.”

Mehrotra and Robertson expect a lag before the new COVID policy boosts dry bulk markets. “We don’t believe this will manifest significantly until the second quarter of 2023,” they wrote. They believe a spread of infections is more likely in the winter months, which could slow the practical effects of the policy change.

During an online forum hosted by Breakwave Advisors on Dec. 1, S&P Global analyst Liz Gao also predicted a lag. She pointed out that the Chinese Lunar New Year holiday in January will lead to a spike in travel by Chinese citizens, “so omicron spread will be faster.”

Jeffrey Landsberg, president of Commodore Research, emphasized the connection between the recent Chinese protests and a dry bulk rate recovery in 2023.

“For months, I’ve been saying the market has been too bullish and too optimistic [on a Chinese COVID reopening],” he said during the Breakwave forum. “But everything changed for me with the protests in China.

“The Chinese economy is doing so poorly that the government has no choice but to significantly ease [restrictions]. For dry bulk, the message is: China is going to surprise to the upside and this is actually a good time to go long.”

Click for more articles by Greg Miller

Related articles:

- US imports from China falling faster than from other countries

- China’s outbound container volumes take another step down

- Shipping stocks in the crosshairs as China fears mount

- Shipping’s China syndrome: Demand sinks across multiple cargo markets

- Global trade at the crossroads: Risks from geopolitics, inflation loom