Businesses are reopening, coastal vacation rentals are selling out. Container volumes into West Coast ports are rising. The S&P 500 briefly erased its losses. Stock fervor is so intense that investors are trading ultimately worthless shares of bankrupt companies.

You might almost think that the coronavirus crisis was over. It isn’t.

Global infections are at or near all-time highs. A sobering new assessment from the Paris-based Organization for Economic Co-operation and Development (OECD) predicts that outcomes will range from bad to worse and that heavy damage to trade and global economies is inescapable.

“By the end of 2021, the loss of income will exceed that of any previous recession over the last 100 years outside of wartime, with dire and long-lasting consequences to people, firms and governments,” warned OECD Chief Economist Laurence Boone in a statement published on Wednesday.

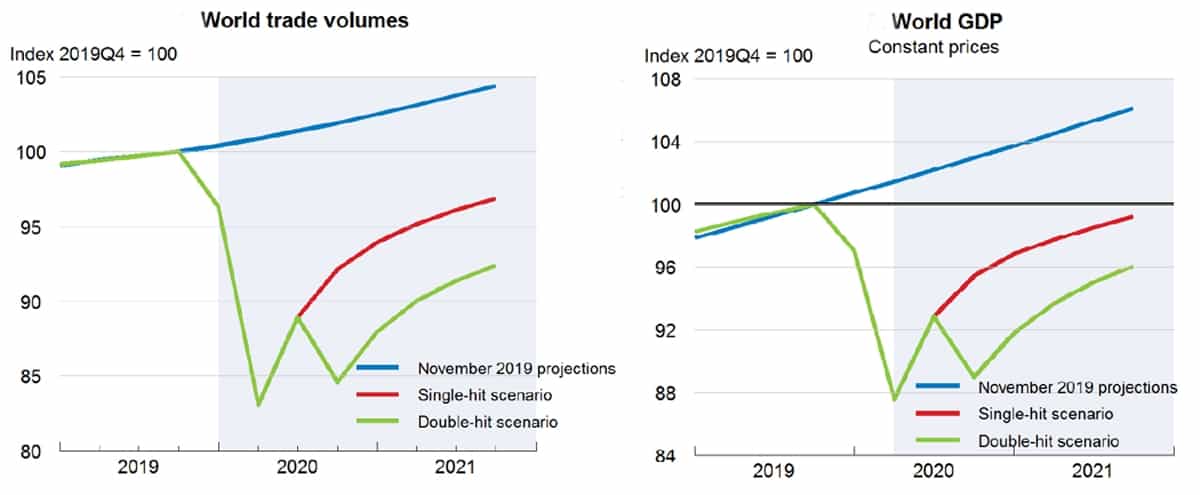

The OECD outlined two scenarios: “Single Hit,” in which the virus continues to recede and remains under control, and “Double Hit,” in which a second wave of infections erupts by year-end.

Both forecasts are ugly. In Single Hit, global GDP falls 6% this year and U.S. GDP drops 7.3%. In Double Hit, 2020 global GDP plunges 7.6% and U.S. GDP 8.5%, while 2021 recoveries are much slower.

Global trade fallout

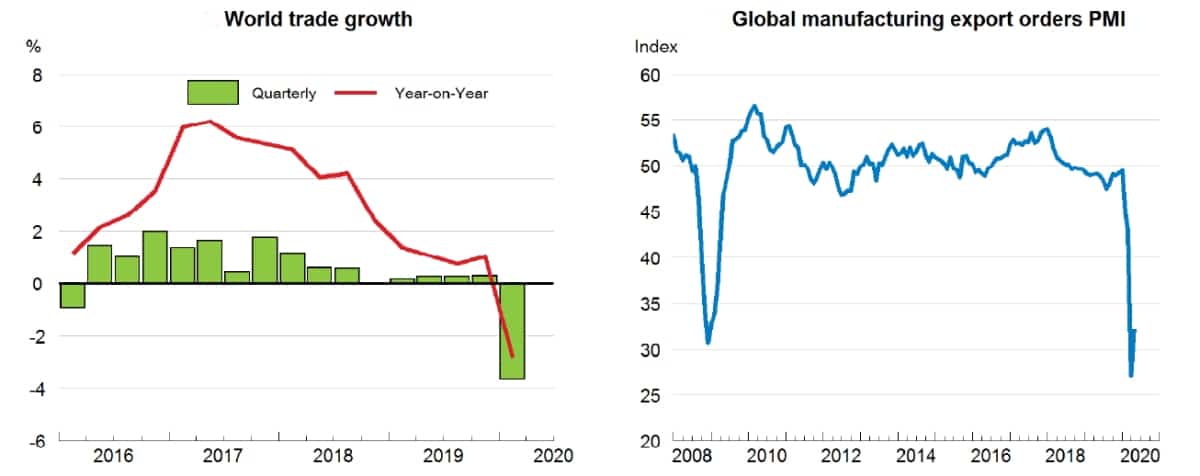

“World trade is now contracting sharply,” said the OECD, which estimated a decline of 3.75% in the first quarter and said that “an even larger global output decline [is expected] in the second quarter.”

The full-year hit to global real trade growth is expected to be significantly more severe than the hit to GDP: -9.5% under Single Hit, -11.4% under Double Hit. The Double Hit scenario posits a dramatically slower trade recovery in 2021, with growth of 2.5% compared to 6% under Single Hit.

Threat to supply chains

The more systemic threat to trade — particularly for container shipping — is that the pandemic could convince companies to bring sourcing back home. “The crisis has demonstrated the vulnerability of domestic production to sourcing inputs from distant locations through complex global value chains (GVCs),” said the OECD.

“The latest data shows that foreign value added in production exceeded 50% in most economies and areas,” it continued.

The risk is that GVCs will “be shortened to reduce input sourcing risk and enhance resilience,” said the OECD. It noted that this threat “comes on top of other threats to international trade” from rising tariffs.

The U.S.-China trade dispute could be worsened by COVID-19. “The fulfillment of the U.S.-China Phase One trade deal may be undermined by weaker demand due to the pandemic,” said the OECD.

As Boone summed up the trade threat: “Economies are diverging. The pandemic has accelerated the shift from ‘great integration to ‘great fragmentation.’”