Forward Air (NASDAQ: FWRD) will continue to pursue the less-than-truckload (LTL) market more heavily now that the worst of the pandemic-related freight declines appear to be in the rearview mirror. On its second-quarter earnings call with analysts on Friday, Chairman, President and CEO Tom Schmitt said he sees “more Savannahs to come,” referring to the company’s recent expansion outside of its normal airport-to-airport transportation network.

On July 13, the Greeneville, Tennessee-based trucking company announced it would offer its first traditional LTL service. Forward has historically specialized in the movement of airfreight by ground through scheduled and expedited LTL service for airlines and cargo carriers as well as freight forwarders. The company runs linehaul service from its terminals that are located in or around major airports.

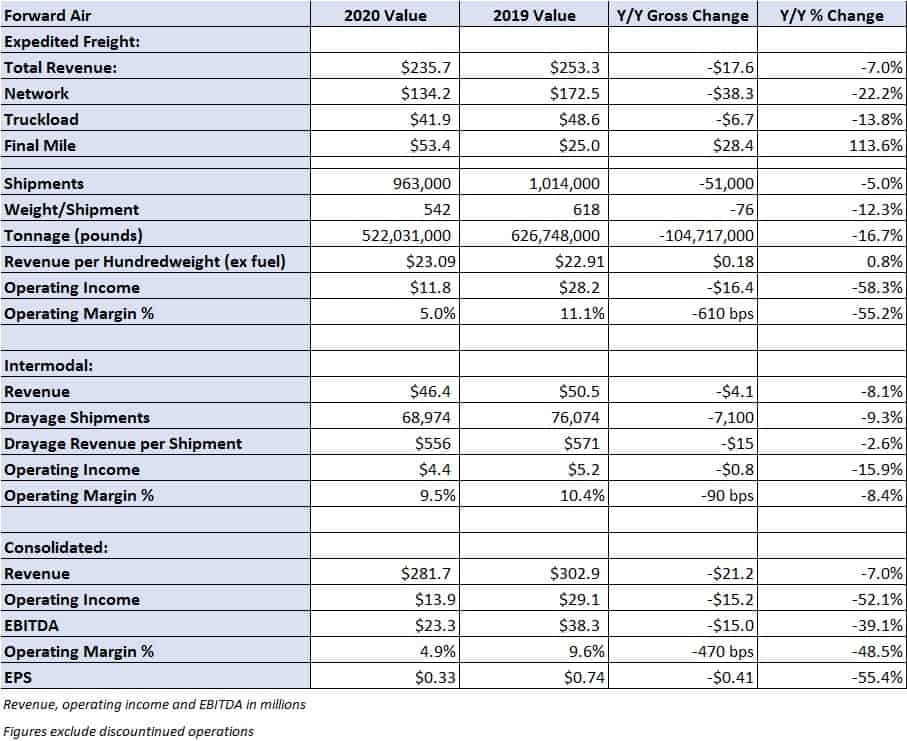

After the Thursday trading session, the company reported earnings per share (EPS) from continuing operations of 33 cents, 2 cents per share higher than Seeking Alpha’s consensus estimate. The company generated EPS of 74 cents in the second quarter of 2019.

Schmitt said the company is seeking the “sweet spot” in the $40 billion LTL industry, which he believes is larger than the $700 million share it hauls now. High-velocity, tight time frames along with a minimal freight claims ratio is the service offering the company wants to grow. The expansion is a way to leverage the current investment Forward has made in its network and also a way to supplement lost freight from airlines, cruise lines trade shows and concerts.

Asked how many LTL terminals could be added, Schmitt said “a handful would be good for this year.”

Earlier this week, Forward announced it was expanding capacity by approximately 30% at its central LTL hub in Columbus, Ohio. The expansion will add 35 doors, increase yard space and house a driver recruitment center. Some of the company’s existing facilities in the area, including its truckload (TL) brokerage operations, are expected to be consolidated onto the new campus. The total project price tag is $30 million to $40 million, with a completion date of late 2022.

In addition to IT investments and efficiency initiatives, the company has added to the roster to see through its organic and inorganic growth plans. Forward recently brought back its IT senior operations leader and recently announced the hiring of Scott Schara as its chief commercial officer effective Aug. 31. Schara held the same position with Coyote Logistics since June 2019 after joining the company in 2010.

During the second quarter, LTL tonnage declines continued to diminish, inflecting positively in July. April tonnage was down 26% year-over-year, with May tonnage declining 13%. In June, tonnage was down 9% but the company reported year-over-year improvement in revenue and net income. Management said July tonnage is up 1.5% year-over-year but cautioned the company remains in the recovery phase as airport-to-airport tonnage keeps building.

Guidance

The company reinstated quarterly guidance. Third-quarter revenue is forecast to increase 1% to 5% year-over-year with EPS from continuing operations between 40 and 44 cents. The EPS outlook is bracketed by a wide range of third-quarter consensus estimates ranging from 35 to 51 cents.

The outlook for revenue growth is largely tied to recent acquisitions, which are providing a favorable year-over-year comparison. Asked why margins implied by the EPS guidance weren’t stronger, management pointed to rising purchased transportation costs as tonnage increases and the potential for driver pay increases if the market continues to tighten. A less favorable freight mix was also cited as a reason.

Divesting pool distribution

In April, the company decided to divest its pool distribution segment due to the capital-intensive nature of the business. The unit runs high-frequency, time-sensitive shipments to several locations within a region for large, national retailers and distributors.

Pool distribution’s results are now reported under discontinued operations, with its assets and liabilities listed as “held-for-sale” on the balance sheet. Forward’s discontinued operations reported a $6.1 million, or 22-cent-per-share, net loss in the second quarter. The segment is expected to see a small operating profit by September.

Second-quarter results

Total revenue declined 7% year-over-year to $281.7 million, with a 52.1% decline in operating income. The 33-cent EPS number included nonrecurring items. The period included a $2.1 million fair value gain on an earn-out, which was partially offset by $1 million in severance expense and $700,000 in credit risk reserves on accounts of customers “negatively impacted by COVID-19.”

Expedited freight revenue was off 7% year-over-year at $235.7 million. Tonnage declined 16.7%, with revenue per hundredweight excluding fuel, or yield, increasing 0.8%.

Final-mile revenue more than doubled year-over-year to $53.4 million due to recent acquisitions: FSA Logistix in March and Linn Star Holdings at the end of 2019.

The company generated free cash flow (FCF) of $17.8 million, $3.4 million higher year-over-year. Forward ended the quarter with $80.9 million in cash and the company plans to relax its cash position, with debt leverage declining to 0.8x by year end from 1.1x currently. Management expects to remain FCF positive in both the third and fourth quarters of 2020 and said the company will resume share repurchases.

On M&A, management said they continue to “remove ceilings” and are taking a “no-wait” approach to their organic and inorganic initiatives. Forward completed three acquisitions last year and management said more deals are to come in 2020.

Shares of FWRD are down 2% in midday trading compared to the S&P 500, which is flat.