“Encouraging conversations with customers” was one of the highlights from Werner Enterprises’ (NASDAQ: WERN) earnings call with analysts Wednesday evening. Werner President and CEO Derek Leathers said demand is strong throughout the country, particularly in the West, as truck supply is tight.

The company reported adjusted earnings per share (EPS) of 62 cents for the second quarter, significantly better than the 40-cents-per-share consensus estimate.

The Omaha, Nebraska-based truckload (TL) carrier raised its outlook for rate per total mile in its one-way segment. The new guidance calls for the metric to range between down 1% to up 2% year-over-year for the back half of 2020.

When pressed why the guidance isn’t higher, Leathers said the company took a conservative approach to its rate outlook but noted several favorable rate catalysts, among them: declines in the qualified driver pool; driving schools producing only 60% the number of graduates currently compared to pre-COVID levels; and increased insurance costs potentially forcing more carriers out of business. Further, the carrier has completed roughly 80% of its bid season, leaving 2021 rate renegotiations as the next major opportunity to take pricing higher.

Leathers said Werner isn’t pulling forward annual rate negotiations but is attempting to take additional share within accounts that are seeing heightened demand. He said the addition of this capacity could come at rates that are at or above spot market rates.

Second-quarter results

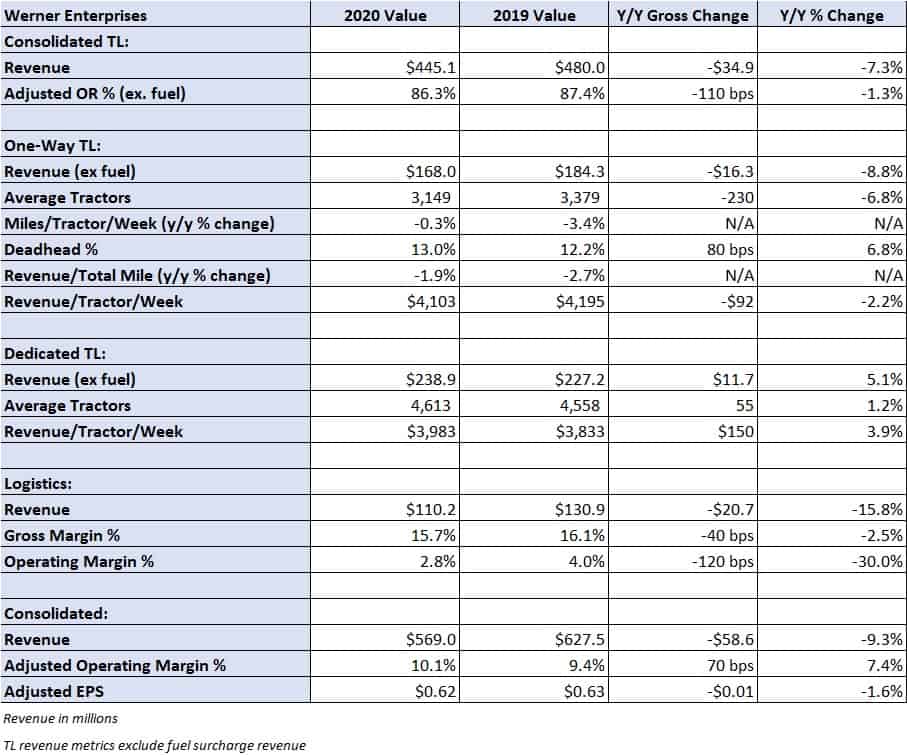

Werner reported a 9.3% year-over-year decline in consolidated revenue to $569 million, which was largely offset by a 70-basis-point adjusted operating margin improvement to 10.1%.

Revenue in the company’s trucking segment was down 7.3% year-over-year, with revenue per tractor per week declining 2.2% in the one-way segment, up 3.9% in dedicated. Revenue per total mile was up modestly as dedicated pricing remained strong in the period. The division posted an 86.3% operating ratio (OR), 110 basis points better than second quarter 2019.

Werner’s logistics segment reported a 15.8% year-over-year decline in revenue. TL logistics revenue declined 24% as volumes were down 9% and revenue per load was off 15%. Lower TL rates and fuel prices were the reasons. The division’s gross margin compressed 40 basis points in the quarter to 15.7% as the cost of capacity began accelerating in May.

Consolidated margin improvement was driven by a 60-basis-point reduction in compensation and purchased transportation expenses combined as a percentage of revenue. Also, fuel expense as a percentage of revenue was 430 basis points lower year-over-year. These cost improvements were partially offset by increased insurance and claims expense and a $3.6 million reduction in gains on equipment sales.

Management said Werner’s liability insurance policies will renew on August 1. They expect premiums for the policies to increase by $7 million annually.

The adjusted EPS result excluded 4 cents per share in incremental depreciation expense associated with a change in the lifespan of trucks that will be sold in 2020 along with a smaller insurance and claims accrual for a prior accident.

Werner ended the second quarter with $65 million in cash, $175 million in debt and $345 million in available liquidity. The carrier paid down $75 million in debt during the quarter. Werner’s net debt-to-last-12-months’ (LTM) earnings before interest, taxes, depreciation and amortization (EBITDA) was 0.5x and under the 2.5x debt covenant.

Net capital expenditures (net capex) guidance remains at $260 million to $300 million as the company looks to maintain average equipment ages. The guidance is back-half loaded given manufacturing delays in the first half of the year. After generating free cash flow (FCF) of $180 million in the first half of the year, total FCF is expected to be $150 million in 2020 as capex accelerates in the back half.

In June, Werner announced Leathers had been appointed to the board as a member and vice chairman when founder and Executive Chairman Clarence “C.L.” Werner stepped down.