On its Thursday evening earnings call with analysts, management from intermodal marketing company Hub Group (NASDAQ: HUBG) said several customers are approaching them to talk about peak season capacity needs. A number of customers have indicated the recent strength in demand in the West will likely continue through peak season and possibly November as inventories remain depleted and restocking continues.

Management said intermodal volumes were up 5% year-over-year in June and 8% in July, significantly better than the mid-teen percentage declines seen in April and May. They expect volumes to be up in the high-single-digit range year-over-year for the rest of 2020.

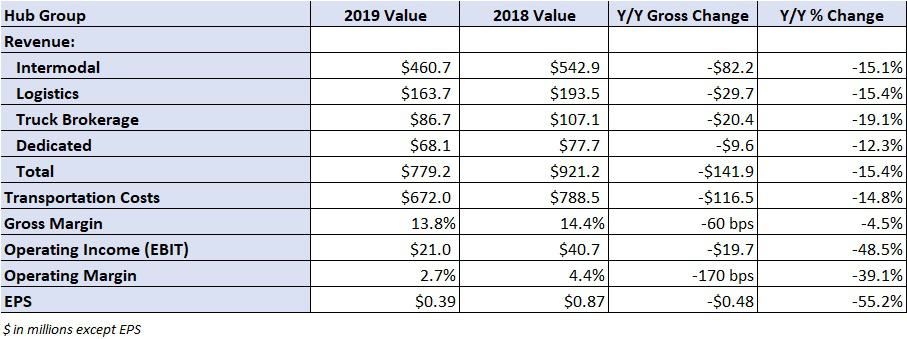

The OakBrook, Illinois-based company reported second-quarter 2020 earnings per share of 39 cents, well ahead of the 24-cents-per-share consensus estimate. The result included 21 cents per share, or $7 million, in donation, consulting and severance expenses. The company reported earnings per share of 87 cents in the year-ago quarter.

“We were pleased to see business conditions improve throughout the quarter, with nearly all of our customers resuming their shipping activity by the end of the quarter,” said Chairman and CEO Dave Yeager in the company’s press release.

Intermodal turning positive

During the second quarter, intermodal revenue declined 15% year-over-year to $461 million as volumes declined 8%. During the height of the pandemic, more than 20% of Hub Group’s customers were closed. Now approximately 90% of its customers are operational. Local-West shipments were down 3%, transcontinental loads were down 7% and volumes in the East declined 11% during the quarter.

By comparison, U.S. intermodal traffic on the Class I railroads was 13% lower year-over-year in the second quarter. Hub Group’s primary rail partners Norfolk Southern (NYSE: NSC) and Union Pacific (NYSE: UNP) reported intermodal traffic declines of 16% and 17%, respectively.

Demand for intermodal has been soft to say the least. However, truck markets have tightened and diesel prices appear to have bottomed for the recent cycle. This has resulted in smaller declines in intermodal traffic on the rails in recent weeks. Weekly year-over-year declines have been in the mid-single-digit range recently, down only 2.4% in the most recent week, compared to low-teen percentage declines throughout May.

Further, intermodal spot rates, not applicable for most companies as they work off of contract rates, have been moving higher since late May. Rates in all domestic lanes are up more than 20% since the end of May. Key lanes like Los Angeles-Chicago and Los Angeles-Dallas saw rates nearly double over the same time period before contracting in the latest week. Those lanes are still up 60% in the past two months.

Rates in the East remain low as lengths of haul are shorter and affordable truck capacity remains available. A firming in intermodal spot markets, along with tightening TL capacity, is a shot in the arm for contractual intermodal negotiations.

Addressing intermodal rates, management said 71% of 2020’s bids have been completed, resulting in contractual rate increases in the low-single-digit range. Pressed on the 2021 bid season, management said mid-single-digit rate increases are possible if the current market tightness continues.

Intermodal gross margin declined 220 basis points in the second quarter due to softer volume and price, an unfavorable freight mix, and increased rail costs. Management believes gross margins will decline sequentially in the second half of the year as rail costs continue to increase.

No guidance

The company didn’t reinstate its previously withdrawn guidance. However, management said they remain on track to achieve $40 million in annualized cost savings by the end of the year, with approximately $20 million in total savings being realized in 2020. Non-driver headcount is down 14% and the company continues to make progress on its utilization and optimization improvements on its drayage and dedicated assets. Further, most of the donation, consulting and severance expenses have been completed.

Cash and capex

Hub Group generated $71 million in net cash from operations during the second quarter, with an ending cash balance of $203 million after repayment of $100 million on its revolver. The company plans to record $65 million to $75 million in capital expenditures (capex) for the remainder of 2020. This includes the purchase of containers, tractors and trailers, as well as IT investments. The company announced it has increased container purchases by 3,500 units and ordered more than 200 tractors to support the expected growth in the back half of the year.

Hub Group recorded capex of $24 million in the second quarter, taking first-half 2020 capex to $49 million. The increased guidance moves expected full-year capex to a range of $114 million to $124 million, in line with the original plan when the year began.

However, that plan included $35 million in capital allocation for the construction of a new office building on the Oak Brook campus, which was previously paused at the beginning of the pandemic. Management said they will incur $20 million in construction expense on the project in 2020. They remain uncertain on what to do with the property and said all options — selling, renting and occupying — remain on the table. The decision will likely hinge on future workplace mandates versus their employees’ work-from-home capabilities. The estimated completion time for the project is six months.

Logistics, brokerage and dedicated

Logistics revenue declined 15% year-over-year to $164 million, partially offset by continued growth from the CaseStack acquisition. Gross margin improved 190 basis points due to the implementation of new, higher-margin business.

Truck brokerage reported a 19% year-over-year revenue decline to $87 million as loads declined 12%. Gross margin improved 100 basis points from technology improvements and increased usage of the company’s carrier network.

Dedicated revenue was down 12% year-over-year to $68 million as the company exited some accounts. Gross margin increased 200 basis points. Management expects dedicated revenue to be down in the back half of the year.