This article brought to you courtesy of NEXT Trucking

Transloading services are becoming an increasingly popular option for international shippers looking to beat the cost of carrier haulage by an ocean carrier and to better manage their inventory.

Transloading refers to moving freight cargo from an international 40- or 45-foot ocean container to a domestic 53-foot intermodal rail container, over-the-road truck trailer or consolidating freight to a less-than-truckload carrier. Forklift drivers unload pallets or floor-loaded cartons from inbound ocean containers to a staging area, where warehouse workers will bundle up inventory for outbound trips.

More than simply moving goods from one box to another, transloading can require a host of additional services including verifying the container’s manifest, palletizing and bracing freight within the container, shrink wrapping and labelling, and pick-and-pack services for retail stores.

Unlike traditional warehousing where goods will sit for days in the shipper’s facility, goods will usually only sit in a transload facility for about eight hours.

Thanks to being the largest gateway for containerized freight into the U.S., Southern California “has a large number of transload and crossdock facilities both near San Pedro Bay Ports and in the Inland Empire, which provides the region a competitive edge in meeting the demand for both import and export cargo,” the Southern California Association of Governments (SCAG) said.

According to a study commissioned by the Alameda Corridor Transportation Authority (ACTA), retailers such as Home Depot, Kohl’s and Williams-Sonoma are among the shippers that use transload services to move freight from ports to their retail stores.

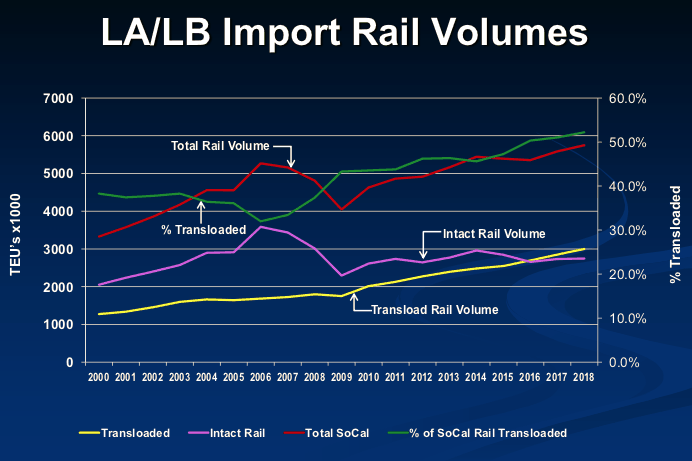

ACTA Chief Executive Officer John Doherty said “big retailers have been transloading since 2000 while middle-sized retailers started to do it leading up to the recession. Now smaller players are taking a look at it.”

Doherty said the number of ocean containers coming through Southern California that get transloaded has grown 50 percent since 2000. That compares to a relatively flat number of ocean containers that are carried intact by rail.

In total, about one-third of containers coming through Southern California are transloaded, Doherty estimates. Another third are delivered intact via rail while another third are loaded on trucks for trips up to 500 miles.

Transloading “is still on the rise,” Doherty said. The front-loading of containers into the U.S. last year drove another spike in demand for transloading, Doherty said, further straining warehouse and distribution capacity.

“Many retailers said ‘let’s just get this stuff into the country and then we will worry about where it goes,” Doherty said.

Drayage carriers, as well, are looking to offer transloading in addition to port trucking. But the high capital costs of offering transloading limit the number of carriers that can provide that service. Out of 467 drayage carriers listed as serving the Los Angeles intermodal region by drayage.com, only 208 offer transload services.

Large Southern California transload operators include NFI’s Cal Cartage subsidiary, Toll Global Logistics, Maersk’s HUDD Transportation, Yusen Logistics, STG Logistics and Performance Team.

NEXT Trucking is one of the newest participants in transloading. It set up a 18-acre facility 10 miles from the Southern California ports. Kim Hassing, operations manager at NEXT, said the company seeks to reduce even further the turn time for containers being transloaded from the eight-hour benchmark.

“By combining data with manpower, it’s possible to offer transloading services that solve the first mile, virtually eliminating any time that freight isn’t on the move,” Hassing said.

Setting up transloading services requires a container yard and up to 50,000 square feet of warehouse space for the sorting operations. It’s more difficult than ever to set up a transload facility, because many of the cities and municipalities surrounding the Los Angeles and Long Beach port complex enact regulations to limit industrial development.

Likewise, transloading requires coordinating data between shippers and their logistics providers. Shippers will notify third-party logistics providers via an electronic-data-interchange (EDI) about containers expected to arrive on an incoming vessel. Shippers will also send notices about how the freight is to be sorted for shipment to inland regions or for local distribution.

With demands for nimbler inventory management growing, “we are getting a lot more requests from shippers for transloading,” said Rick LaGore, chief executive officer of intermodal marketing company InTek Freight and Logistics. “They just want better control of their freight.”

Third-party logistics providers typically price transloading services based on the cubic meters of goods inside a container. They are typically low-margin, high-volume services, LaGore said. But they can provide customer stickiness as the transload provider becomes a deeper part of the shipper’s supply chain.

LaGore said shippers are tapping transloading services because the cost of a door-to-door move for an international container from an ocean carrier is higher than a port-to-port move with transloading.

The cost-benefit analysis is also changing as ocean carriers get stricter on free time for containers and start charging higher detention and demurrage fees. With a marine container offloaded at a nearby transloading facility, the container can be returned much more quickly.

Freight forwarders also use transloading services as a way to offer competitive rates for door-to-door moves for smaller shippers, LaGore said.

“The issue is that the steamship lines are not giving shippers competitive rates for door-to-door moves,” LaGore said. “It forces the shippers to ask ‘does it make more sense to do a move straight through to my distribution center or does it more sense to transload it?’.”

LaGore added, “Some shippers might be using transload services and not even know it.”

Along with cost, shippers may employ transload services to better manage their inventory. LaGore said transloading offers shippers with multiple destinations more flexibility in determining the final destination for in-transit goods and allows for the right inventory to reach the right store or warehouse.

“You typically see it in spring time when it might be colder in one region and warmer in another and a shipper wants to divert more freight to another location,” LaGore said. “It gives them more control over their inventory management.”

Shippers can also utilize transloading to manage cash flows around inventory. LaGore gives the example of a marine container coming into Southern California and being transloaded to a foreign-trade zone in Chicago. Forward positioning of inventory closer to the market means shippers only have to pay duties once the container is unloaded for consumption.

“It typically takes a more sophisticated shipper to utilize transloading services,” he added. “They can get another three or four days of cash flow from their inventory if they use transloading right.”

LaGore said many transloading facilities were strained by the container import surge of 2018. Their ability to handle any surge for the upcoming peak season will hinge on yard management and the level of coordination between shippers and their logistics providers.

“It’s unbelievable how packed some of these yards can be,” LaGore said.