The highlights from Thursday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

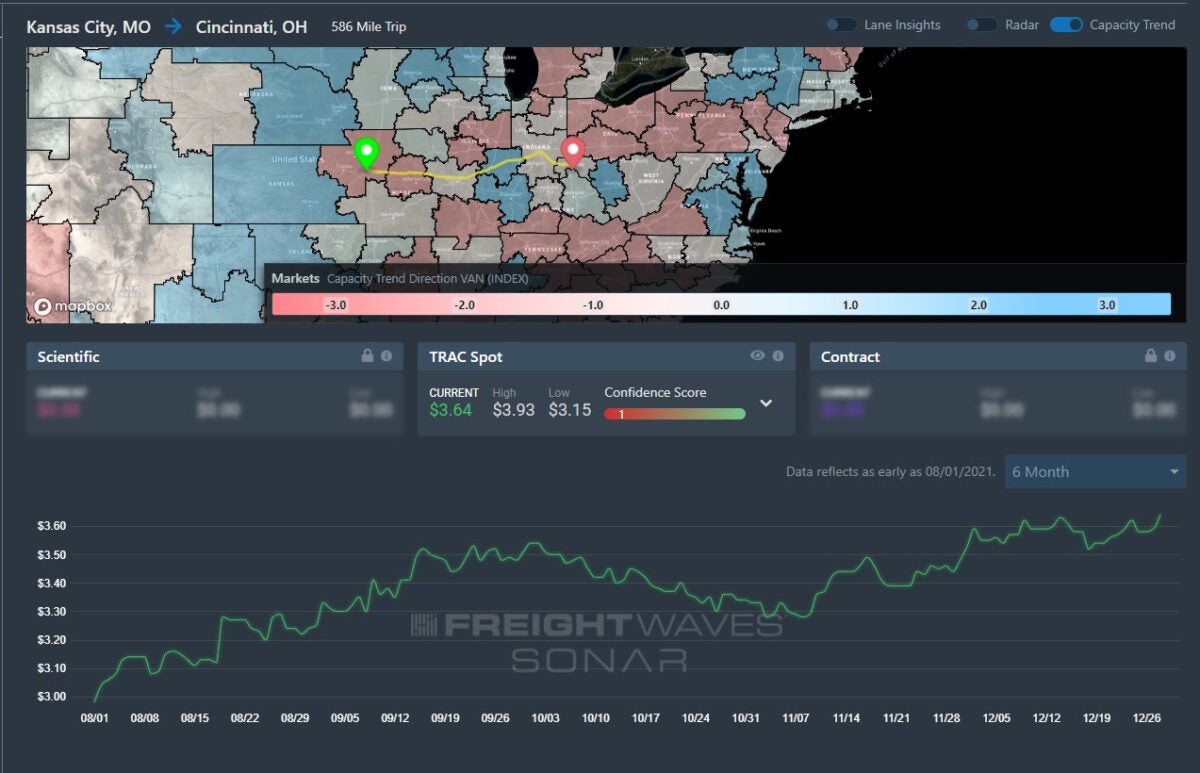

Lane to watch: Kansas City (Mo.) to Cincinnati (Ohio)

Overview: Outbound tender rejection rates from Kansas City to Cincinnati reach their highest level since mid-November. Outbound tender levels remain volatile in the Kansas City market.

Highlights:

- The Kansas City market continues to experience tender rejection volatility (from 23.5% at the end of November to 30.2% in late December).

- Outbound rejections remain high from Kansas City to Cincinnati at 28.77%, with a lack of capacity driving rejections.

- FreightWaves TRAC spot rates from Kansas City to Cincinnati remain elevated at $3.64 per mile as rejected tenders become spot market opportunities.

What does this mean for you?

Brokers: The Kansas City market remains volatile, with the Kansas City to Cincinnati lane fluctuating between $3.15 to $3.93 per mile with current spot rates around $3.64 per mile. Ensure a margin buffer when quoting spot loads as capacity remains tight. Because of the market volatility, transparency and communication are key when managing customer expectations.

Carriers: Market volatility and high tender rejection rates indicate other carriers in the market are struggling to cover committed freight. High spot rates provide an opportunity to increase revenue but the rate volatility will make timing key, as day of week and truck ready time will become key factors when negotiating rates.

Shippers: Tender rejections appear to follow a cyclical cycle with rejection levels alternating from 23% to 30% every two to three weeks. If carriers cannot cover committed freight, brokerages can be a great indicator of market direction based on their spot quotes (but will come at a premium price).

Lane to watch: Atlanta to Oklahoma City

Overview: Capacity continues to tighten in Atlanta, driving spot rates higher.

Highlights:

- Capacity in Atlanta continues to tighten; rejection rates have increased 118 bps week-over-week (w/w) to over 18%, the highest they have been since early October.

- Signals in Oklahoma City indicate that capacity could continue to loosen; the Headhaul Index has fallen by 4.58% w/w.

- FreightWaves TRAC spot rates from Atlanta to OKC are at the highest level in three months, currently at $2.80/mi, including fuel surcharge.

What does this mean for you?

Brokers: Focus on covering loads out of Atlanta early as capacity will likely continue to tighten. As capacity tightens in Atlanta, expect upward pressure to persist on spot rates, especially on loads into backhaul markets like Oklahoma City.

Carriers: Keep the upward momentum on rates into backhaul markets; you hold the pricing power in Atlanta. Rates have risen by 7% in the past two weeks to the highest level in more than six months. Try to continue to push rates up closer to the high end of the FreightWaves TRAC range of $2.97/mi.

Shippers: Lead times in Atlanta have been extended to nearly 3.5 days around the holidays, as expected. Expect to keep the lead times longer throughout the next week as the capacity situation isn’t likely to resolve itself immediately. Expect that carrier networks will face disruptions throughout the rest of the week and securing capacity will become more expensive.

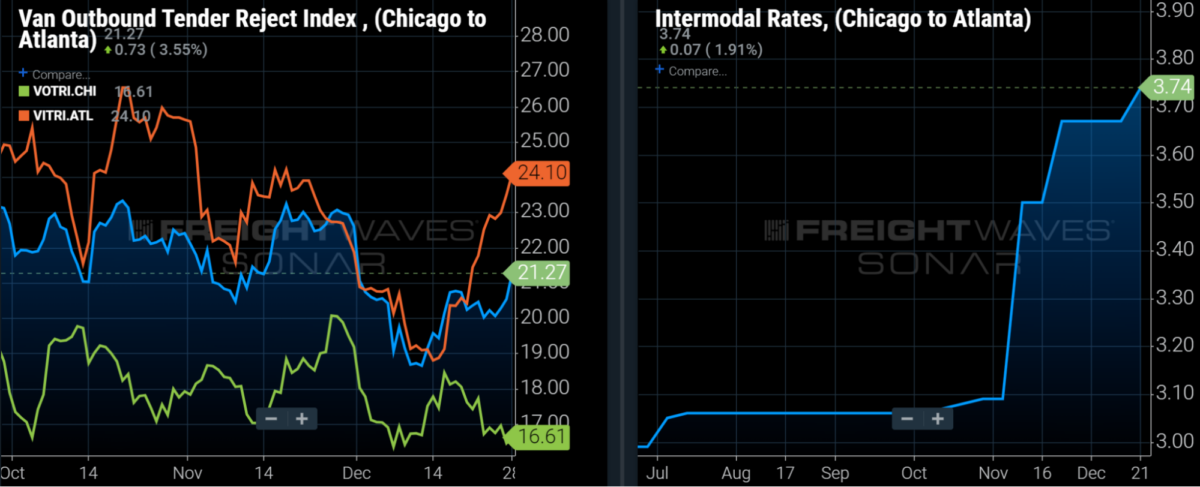

Lane to watch: Chicago to Atlanta

Overview: Tender rejection rates rise as van carriers become more reluctant to head to Atlanta.

Highlights:

- The spot rate that brokers are paying for dry van capacity declined slightly from $4.13/mile in mid-December to the latest rate of $4.05/mile. Quotes include fuel surcharges.

- Door-to-door intermodal spot rates are up 5% from early November to $3.74/mile, including fuel surcharges, or 7.7% below the most recent dry van truckload spot rate.

- The dry van tender rejection rate in the lane has risen from 18% in mid-December to 21.3%, primarily due to carriers rejecting more inbound Atlanta loads.

What does this mean for you?

Brokers: When bidding for capacity, keep in mind that $4.05/mile is the average rate that brokers are paying for capacity, with $4.34/mile and $3.79/mile representing rates in the 67th and and 33rd percentiles, respectively. All quotes include fuel.

Carriers: Before accepting tenders to Atlanta, you may want to look for loads to a tighter freight market given that the Atlanta outbound tender rejection rate of 17.2% is 440 basis points (bps) below the national tender rejection rate. The current Atlanta Van Headhaul Index is 7, which indicates a balanced market. The index is also down from a high of 35 in mid-December, which is more indicative of a headhaul market.

Shippers: The spread between dry van truckload and intermodal rates is a relatively small 7.7%, which indicates a lack of excess intermodal capacity in the lane. That relatively small spread and lingering service issues may not be enough to entice spot shippers to utilize rail intermodal.