The volume surge in freight primarily as a result of restocking store shelves is continuing and has reached a significant milestone in a key supply/demand metric.

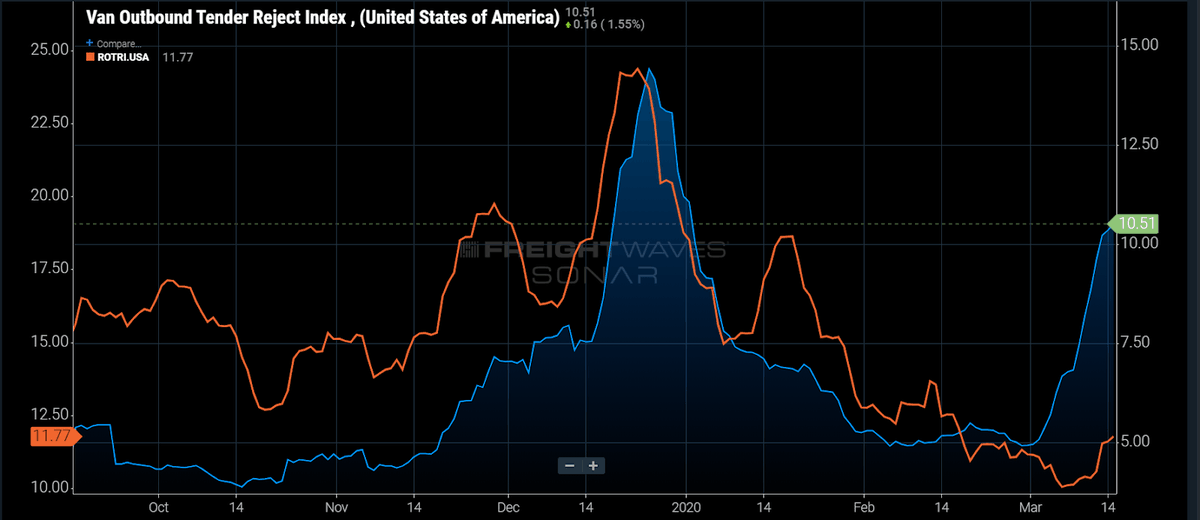

FreightWaves’ outbound tender rejection index (OTRI) has surpassed year-ago values. The OTRI measures carrier willingness to accept loads tendered to them by shippers under a previously agreed upon contract. It is expressed as a percentage of loads rejected to total loads tendered.

With the surge in demand for trucking services given the need to restock shore shelves, the OTRI stood at 9.76% Monday. Outside a brief surge in December, it’s the highest it’s been since the start of 2019 when the OTRI was on its long slide toward the sub-5% level through much of the summer.

The Outbound Tender Volume Index gauging the volume of freight was measured Monday at 11570.35. It crossed last year’s level several weeks ago. The OTRI includes supply-and-demand components so it is considered a more transparent indicator of capacity.

“This is a pretty big moment in the freight market,” FreightWaves carrier expert Zach Strickland said Monday on “FreightWaves NOW” in discussing the numbers. “It indicates increased spot market activity, increased rates and increased margins.”

Friday on “FreightWaves NOW,” Strickland said other spikes in the OTRI often happen because of a contraction in the supply of trucks, such as around the holidays. “But now we’re seeing a straight-up demand increase,” he said.

Seth Holm, senior research analyst on FreightWaves’ Freight Intelligence Group and the shipper analyst for FreightWaves’ market expert team, noted in Friday’s Daily Pickup that the Allentown, Pennsylvania, market has been one of the strongest for demand. “A significant portion of the increase in Allentown can be attributed to the large Procter & Gamble distribution center located near there,” Holm wrote in his commentary. “P&G is a major beneficiary of the panic-buying and destocking of toilet paper under its Charmin brand. We believe shippers that sell consumables and consumer staples will fare better and be exposed to far less downside as the coronavirus spreads.”

Strickland noted on “FreightWaves NOW” that some smaller markets have seen eye-popping increases in their localized OTRI, citing Augusta, Maine, as one example. The OTRI there now exceeds 40%.

Monday on “FreightWaves NOW,” shipper analyst Luke Falasca noted that the volume surge is strong enough that even a usual backhaul market like Denver has seen a surge in volumes moving out.

David Lindsey

I don’t see where all the new demand is. Maybe in certain parts of the country. As for us flatbed carriers and especially those of us in the oilfield, the future looks bleak

Keith Grayson

I’ve seen rates go up a little , but wait times at food warehouses have doubled. I have had trucks wait 6-7 hours to get unloaded this past week and brokers won’t pay detention time.

Charles Baker

# Shut it down

Charles Baker

This the time truckers should go on strike and let’s see how great America can really be without us since DOT want to pass all these stupid rules and regulations

Dana Tomason

It’s the worst in 20 years. We are all going broke. Whatever this number measures, it’s not improving anything on our end. Period. We’ve got a month or two for things to turn around or there won’t be anybody to offer this crap to.

Steven

2019 its over and Shippers played with fire sending many trucking companies out of business.

Many brokers did the same in keeping as much as 50% to their profits.

Get ready for a big demand in truck availability since many will close their business for few months….like my self.

Johny

It doesn’t matter it goes up as much as it will trucking company don’t pay shit to truck drivers. Plus shipping and receiving folks doesn’t have respect at all for truck drivers.

I don’t just say I am truck driver and I know how it is.