It’s a tale of two oceans: The price to ship containers of cargo eastbound from Asia to the U.S. across the Pacific continues to recede from record levels. In contrast, the price to ship containers westbound across the Atlantic from Europe has risen through 2022 and is still hovering near all-time highs.

Vessel backups remain historically severe off Savannah, Georgia, New York/New Jersey and Houston, whereas conditions have dramatically improved off Los Angeles/Long Beach. Reduced congestion is negative for spot pricing. Thus, Asia-West Coast rates are falling faster than Asia-East Coast rates.

The East Coast port congestion that’s tying up ships coming from Asia via the Panama Canal is simultaneously soaking up capacity arriving from Europe. Trans-Atlantic vessel capacity is much more limited than in the trans-Pacific, with the balance remaining in favor of shipping lines — even more so due to congestion. Consequently, trans-Atlantic spot rates remain historically strong, bucking the global trend.

Trans-Pacific prices continue to slide

Some spot indexes showed trans-Pacific spot rates temporarily plateauing earlier this month, but trans-Pacific rates have since resumed their gradual slide. There’s no evidence of a floor yet.

“This is going to be a slack season to write home about,” a freight forwarder source told Platts, referring to the traditional peak season. “There’s no way in hell they can get a rate increase through in this market.”

Drewry’s weekly assessment for Shanghai-Los Angeles fell 5% in the week reported on Thursday, to $6,521 per forty foot equivalent unit. That’s down 41% y/y. Given East Coast congestion,

Drewry’s Shanghai-New York assessment fared better. It was flat last week, at $9,710 per FEU, down 28% y/y.

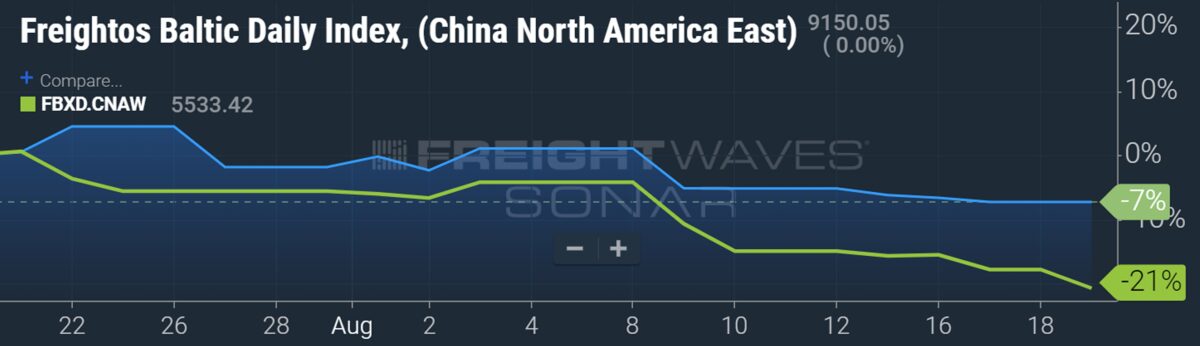

The Freightos Baltic Daily Index (FBX) China-West Coast assessment fell to $5,533 per FEU on Friday. That’s its lowest level in 15 months and down 70% y/y. (FBX includes premium surcharges in its trans-Pacific numbers; Drewry does not. Because premiums were very high a year ago and are no longer charged, the FBX index declined much more steeply than the Drewry index.)

The FBX China-East Coast assessment was at $9,150 per FEU on Friday, down 54% y/y. Pricing trends continued to diverge over the past month, with the FBX East Coast index shedding 7% of its value and the West Coast index dropping 21%.

Trans-Atlantic rates stay high after rise

European services call at East Coast ports mainly from Le Havre, France; Bremerhaven, Germany; Antwerp; Belgium; London, U.K.; and Sines, Portugal. Mediterranean services mainly serve the East Coast after stops in Algeciras and Valencia, Spain.

According to the indexes, it’s now more expensive to move spot cargo westbound across the Atlantic from Europe to the East Coast than it is to move cargo eastbound across the Pacific from Asia to the West Coast — even though the sailing distance across the Pacific is almost twice as long (meaning that carriers are now earning dramatically more per FEU-mile in the trans-Atlantic than the trans-Pacific).

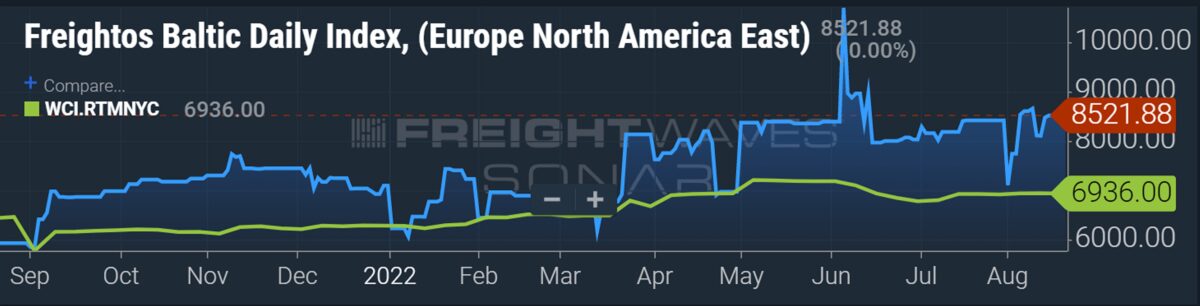

Drewry’s latest weekly assessment for the Rotterdam-New York route was $6,936 per FEU, up 8% y/y.

The FBX Europe-East Coast index was at $8,522 per FEU, up 44% y/y.

Drewry’s assessment is just below highs hit in early May, while the FBX is around the sustained high it has been at since May, with the exception of a brief one-off spike in early June.

Rates still almost 5 times pre-COVID levels

Even with spot rates falling on most global routes save the trans-Atlantic, freight pricing remains exceptionally profitable for ocean carriers. Furthermore, shipping lines have at least half of their volume on contracts. According to multiple carriers, annual contract rates are in the vicinity of current spot rates.

Highlighting just how profitable this remains for carriers, rates are far above where they were pre-COVID. Trans-Pacific and trans-Atlantic spot rates have gone in opposite directions over recent months, yet when compared to pre-pandemic levels, they’ve taken different paths to the same result.

As of Friday, the FBX Europe-East Coast index was 4.9 times higher than it was three years ago. The FBX Asia-West Coast index — despite a substantial drop since hitting record levels — was also 4.9 times higher than it was three years ago.

Click for more articles by Greg Miller

Related articles:

- Despite billions in canceled orders, container imports stay near peak

- Turning point? Port of LA boss sees imports ‘easing’ lower in August

- Container line Zim hit by exposure to falling spot rates

- No precipitous plunge in container shipping rates, just ‘orderly’ decline

- Container shipping spot rates still falling: What will be the new normal?

- Asia-US container shipping rates are flashing two bearish signals

- Record container ship traffic jam as backlog continues to build