Bulk commodity shipping stocks kept rising in May even as the broader market fell, offering shelter from the storm. Not so in June. With few exceptions, dry bulk and tanker stocks that previously held up are sinking. Declines for container shipping stocks have accelerated.

Shipping stocks have been “unable to escape the torrent,” wrote Clarksons Platou Securities analyst Frode Morkedal. “Demand destruction is a major source of concern.”

Ben Nolan, shipping analyst at Stifel, said, “The equities of a number of sectors in shipping are extremely sensitive to the shift in the broader market.”

In the past week alone, shipping stock sentiment have been hit by a World Bank warning on stagflation; a report from FreightWaves maintaining that import demand is “dropping off a cliff”; the announcement of an 8.6% inflation gain for May, the highest increase since 1981; and resurgent COVID restrictions in Shanghai and Beijing.

The Dow Jones Industrial Average (DJIA), S&P 500 and NASDAQ Composite all hit fresh 52-week lows on Monday. Shipping stocks sank across the board.

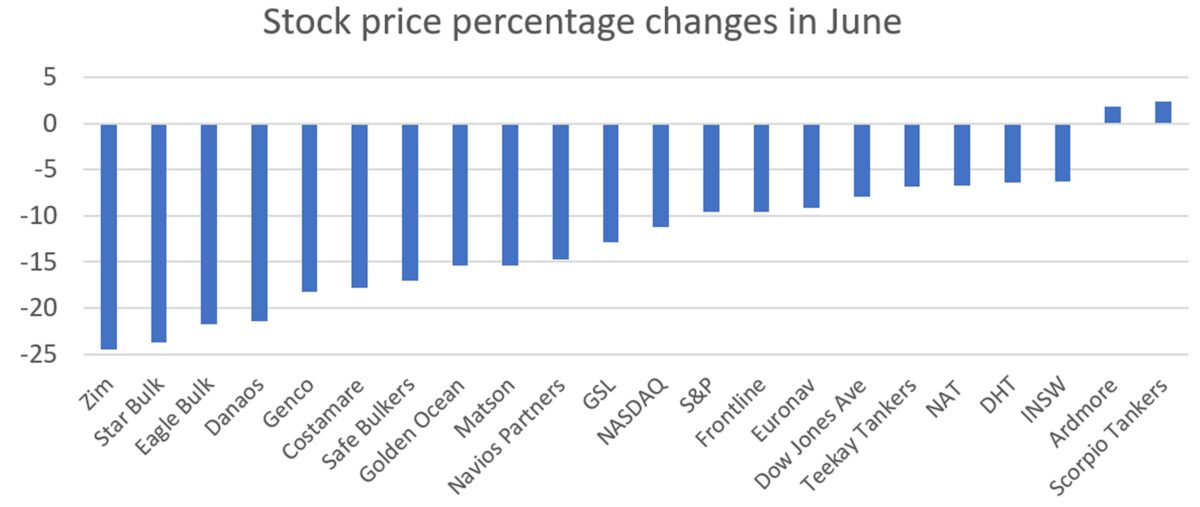

Shipping stock moves since June 1

Container and dry bulk names have been the biggest losers this month.

As of Monday’s close, shares of liner companies Zim (NYSE: ZIM) and Matson (NYSE: MATX) were down 25% and 15%, respectively, versus their June 1 open. Container-ship lessor Danaos (NYSE: DAC) was down 21%, while Costamare (NYSE: CMRE) — which leases container ships and owns dry bulk ships — was down 18%.

Among the dry bulk owners, Star Bulk (NASDAQ: SBLK) was down 24% month to date, Eagle Bulk (NASDAQ: EGLE) 22% and Genco Shipping & Trading (NYSE: GNK) 18%.

Container and dry bulk stocks have fallen faster than the DJIA, S&P 500 and NASDAQ Composite, whereas tanker stocks have lost less ground than the indexes. “Energy-related shipping equities were more insulated,” noted Nolan.

DHT (NYSE: DHT), which operates very large crude carriers (VLCCs; tankers that carry 2 million barrels of crude), is down only 6% this month, despite the fact that VLCCs are still mired in their worst below-breakeven slump in three decades.

Product tanker stocks have been the best performers in June.

Shares of Ardmore Shipping (NYSE: ASC) and Scorpio Tankers (NYSE: STNG) are actually still up 2% for the month, despite falling with the rest of the shipping names on Monday.

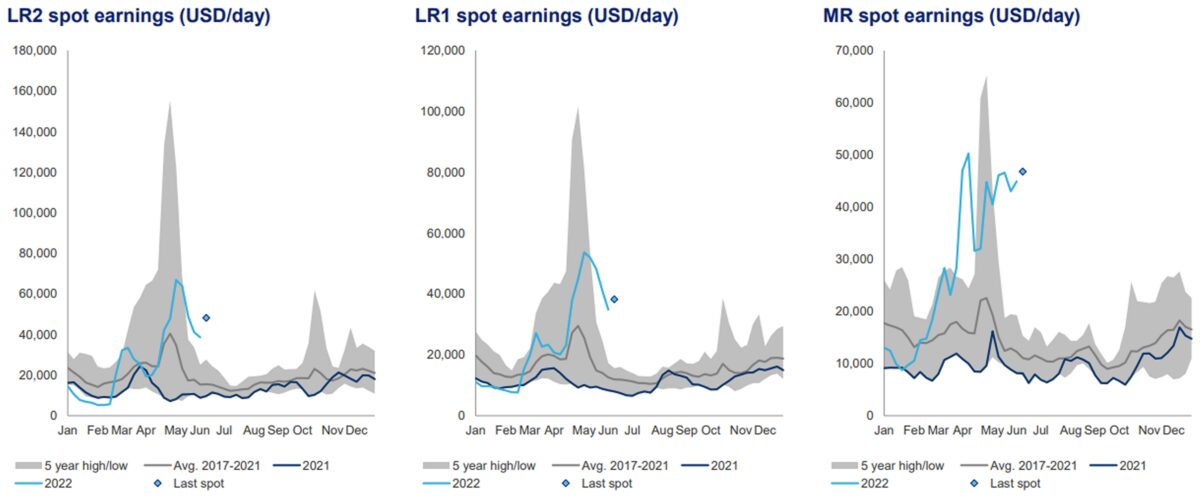

Product tanker spot rates remain sharply higher than the five-year average, at $40,000-$50,000 per day, according to Clarksons. Rates are being buoyed by trading dislocations from the Ukraine-Russia war and the global scramble for scarce diesel and gasoline.

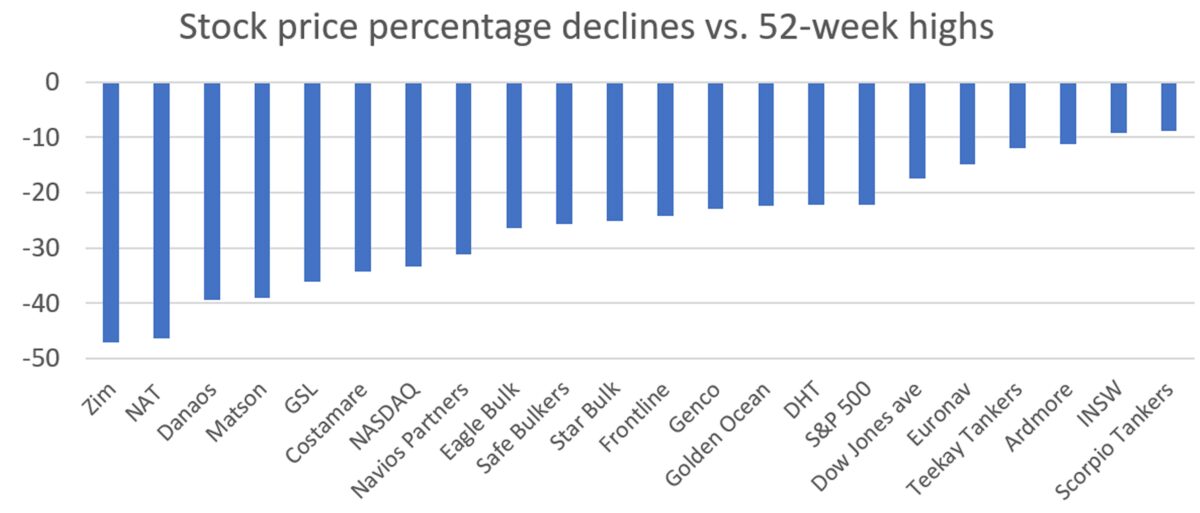

Declines vs. 52-week highs

Shares of different shipping segments hit their 52-week highs at different times.

Container shipping shares generally peaked around late March. The turning point coincided with a plunge in domestic transportation stocks on fears of a looming freight recession, initially fed by reports from FreightWaves.

Container shipping shares are also falling due to a decline in spot rates from their highs, despite the fact that spot rates remain exceptionally strong, contract rates are much higher this year and liner companies expect to earn even more in 2022 than last year.

In contrast to container shipping stocks, most dry bulk and tanker stocks hit 52-week highs in late May. Dry bulk stocks have fallen much faster than tanker stocks since then. As a result, container shipping stocks and dry bulk stocks have seen sharper drops from 52-week highs than tanker stocks.

The exception is Nordic American Tankers (NYSE: NAT), which owns Suezmaxes (tankers that carry 1 million barrels of crude). Shares of NAT are down 46% from a 52-week high reached a year ago.

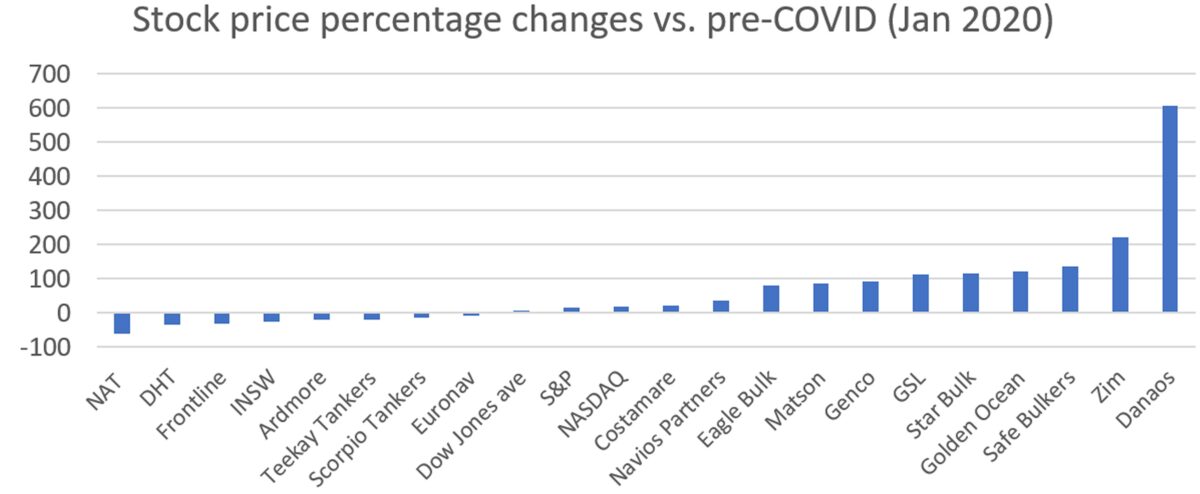

Shipping stock performance during pandemic

Looking further back, different shipping segments have seen very different stock behavior during the pandemic era.

Dry bulk and container shares fell sharply in H1 2020, at the onset of COVID. Container stocks rebounded first, in H2 2020. Dry bulk stocks began their run-up in early 2021.

Both dry bulk and container stocks have far outpaced the broader market indexes. Since Jan. 1, 2020, Danaos is up an astonishing 607%, despite the recent pullback. Zim went public on Jan. 27, 2021, at $15 per share. Even with its recent slide, it’s still up 222% from the IPO price.

Among dry bulk names, Safe Bulkers (NYSE: SB) is up 138% since pre-COVID, Golden Ocean (NASDAQ; GOGL) 121% and Star Bulk 116%. Container-ship lessor Global Ship Lease (NYSE: GSL) is up 114%.

Tanker stocks followed a totally different path. Pre-COVID, tanker rates and share prices were strong, driven by tensions in the Middle East and U.S. sanctions.

In the pandemic era, tanker stocks initially rose as ships filled with floating storage cargoes in Q2 2020, then fell back thereafter as bloated inventories cut transport demand. Tanker equities have recently been supported by the Ukraine-Russia war and sentiment on increased fuel demand for air and land-based transport.

Because tanker rates and sentiment were high pre-COVID, most tanker stocks are now trading lower than they were on Jan. 1, 2020.

NAT is down 61%, DHT 34%, Frontline (NYSE: FRO) 32% and International Seaways (NYSE: INSW) 24%. Unlike container and dry bulk stocks, the tanker stocks — including product tanker names like Scorpio — have underperformed the DJIA, S&P 500 and NASDAQ Composite across the COVID era.

Click for more articles by Greg Miller

Related articles:

- Container shipping jackpot continues: CMA CGM profits soar

- Russia tanker business is alive and well. Oil exports ‘remain strong’

- The world is ‘crying out for diesel.’ Product tankers could win big

- Blockbuster container shipping results collide with sinking sentiment

- Gimme shelter: Shipping stocks still rising amid Wall Street storm

- Commodity shipping stocks are trouncing Dow transport average

- COVID-era shipping stocks: The (super) good, the bad and the ugly