On Sept. 9, 2021, French container shipping giant CMA CGM announced an unusual step for a profit-focused enterprise with listed bonds: It put all increases in spot rates on hold until Feb. 1, 2022. The decision was made to “prioritize its long-term relationship with customers in the face of an unprecedented situation in the shipping industry.”

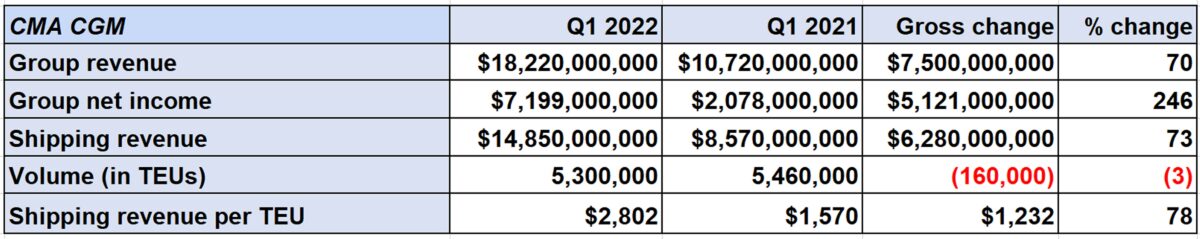

Even so, CMA CGM’s profits and revenue per container carried have increased ever since.

CMA CGM is the world’s third largest shipping company by capacity, according to Alphaliner. On Friday, CMA CGM reported Q1 2022 net income of $7.2 billion, 3.5 times net income in Q1 2021, topping its previous record quarterly results in Q4 2021 ($6.7 billion).

CMA CGM doesn’t release fleet capacity figures but Alphaliner calculates these numbers. A year ago, Alphaliner reported that CMA CGM’s fleet of owned and chartered ships had capacity of 3,012,168 twenty-foot equivalent units. It currently puts CMA CGM’s fleet size at 3,300,522 TEUs, a year-on-year increase of 9.6%.

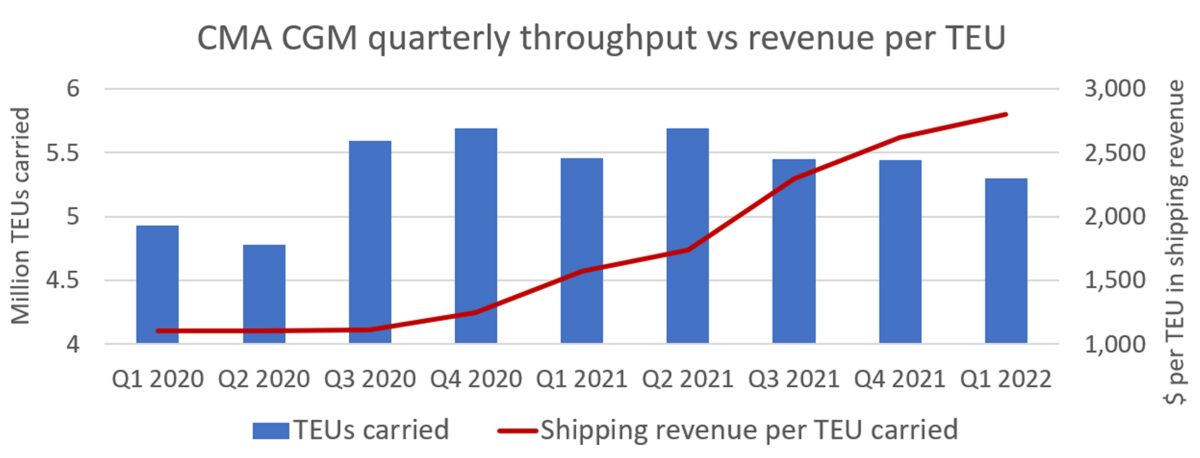

Despite a larger fleet, the French liner company’s quarterly throughput has been ebbing. A year ago, in Q2 2021, CMA CGM moved 5.69 million TEUs. In the latest quarter, it moved 5.3 million TEUs. The company attributes volume headwinds to “port and inland congestion which has led to longer transit times for vessels.”

CMA CGM revenue per container kept rising

As with other ocean carriers, CMA CGM’s massive surge in revenues and profits in the face of constrained throughput was driven by increased freight rates.

While CMA CGM does not report its average quarterly freight rate, it does report shipping revenues. Its shipping revenue in Q3 2021 — prior to the spot rate freeze — was $2,292 per TEU. Since then, revenues per TEU increased 22% to $2,802 per TEU in Q1 2022.

How have shipping revenues per TEU increased during a spot rate freeze?

One reason could be increased contract rates and increased contract coverage. At the time of the spot rate cap, Vespucci Maritime CEO Lars Jensen commented, “The development indicated by CMA CGM would appear to lead in a direction where the prioritization will lean more towards contractual customers and customers with stronger pre-existing relationships.”

Xeneta, which tracks contract rates, said on May 31 that long-term rates are up 151% year on year.

Another possible driver of CMA CGM’s revenue-per-TEU growth during the spot-rate cap period: A sizable portion of the spot capacity for the freeze period may have already been booked when the cap was announced and/or more spot volumes may have been booked at the cap rate.

Randy Giveans, formerly the shipping analyst of Jefferies, speculated at the time of the CMA CGM rate freeze: “This is only from September to February and I would assume that CMA CGM capacity is already almost full from September to February. They don’t say how much capacity this applies to or how impactful this will be. It could be like a gas station after Hurricane Ida telling people it’s not going to increase gas prices when it only has 8 gallons left in its tank.”

Macro risks ahead

Looking forward, the French carrier expressed the same macro concerns as many other ocean carriers.

“The group is closely monitoring the evolution of the current geopolitical situation and its consequences on the macroeconomic outlook.

“Even if the group remains confident about its financial performance prospects for 2022, the current environment and its medium and long-term consequences remain uncertain. The sharp rise in energy prices, combined with price inflation of many raw materials, is weighing on retail consumption and could have a negative impact on the economic situation and the outlook for global trade.”

Click for more articles by Greg Miller

Related articles:

- Blockbuster container shipping results collide with sinking sentiment

- Container shipping rates: Still sky high but falling back to Earth

- Has the peak of container shipping’s epic boom already passed?

- China lockdowns are not causing shipping chaos, say liner CEOs

- Demand for shipping containers is falling. Transitory or turning point?

- Despite rising risks, shipping lines on track for another record year

- Shanghai lockdown is not causing global supply chain chaos (yet)

- Container shipping at the crossroads: The big unwind or party on?

- How invasion of Ukraine could ease shipping logjam off US ports