Is faltering consumer demand curbing imports, allowing port congestion to finally ease, releasing container-ship capacity and causing ocean spot rates to sink? Is this the beginning of “the big unwind”?

Or does waning West Coast port congestion stem from temporarily lower exports out of China due to COVID lockdowns, combined with a congestion shift toward East Coast ports? Is the economy still strong and the ocean freight market still fundamentally firm, with the port crunch to worsen in the second half, pushing spot rates higher?

“The problem is you can still tell plausible stories in each direction,” Flexport economist Phil Levy told American Shipper. “We keep looking for all the signals to light up one way and for something irrefutable to happen. But there continues to be strong signals on both sides.”

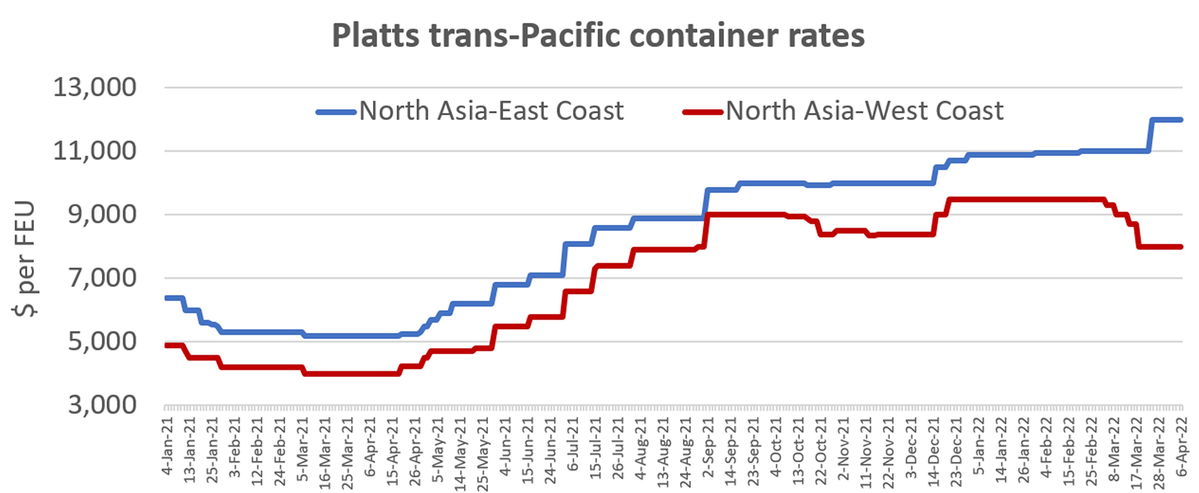

Trans-Pacific spot rates

Different freight indexes are telling different stories.

“At the moment [Asia-West Coast] demand is fairly low, almost unseasonably so,” said George Griffiths, managing editor of global container freight at S&P Global Commodity Insights. “We always see a lull post-Lunar New Year with rates coming off slightly. But this year they have fallen further than they normally do.”

S&P Global Platts currently assesses Asia-West Coast rates at $8,000 per forty-foot equivalent unit, not including premium surcharges. That’s down 16% from $9,500 per FEU in early March.

In contrast, Platts currently puts Asia-East Coast rates at an-all time peak of $12,000 per FEU, up 10% year to date.

The weekly Drewry assessment for Shanghai to Los Angeles came in at $8,824 per FEU on Thursday. That was down 20% from $10,986 in early March — roughly mirroring the Platts numbers. Yet Drewry put the Shanghai to New York rate at $11,303 per FEU, down 19% from a January high of $13,987 — the opposite of the rising trend reported by Platts.

Xeneta puts the Far East-West Coast spot rate at $8,752 per FEU, plus optional premiums of $1,967-$5,503. This is up 9% from $8,021 on Jan. 2, the opposite of the downward trend on this route shown by Drewry and Platts.

The Freightos Baltic Daily Index (FBX) — which shows higher rates than others because it includes premiums in its trans-Pacific assessments — was at $15,817 per FEU on Thursday for the Asia-West Coast route. That’s up 15% year to date. The Drewry assessment for this lane is down 21% year to date.

In the past, various indexes have given very different dollar assessments (due to different methodologies) but they generally moved up and down in the same direction over time. Now, even the directions shown by the indexes are diverging.

Port congestion in flux

Spot rates are heavily affected by port congestion. There were just 41 container ships waiting for berths in Los Angeles and Long Beach on Thursday, down sharply from the all-time high of 109 on Jan. 9.

The queue was just 33 on Monday — only five ships higher than on the same day last year.

Southern California port congestion “eased faster than expected,” wrote Bank of America analyst Ken Hoexter on Thursday.

“I think lots of sailings have been pulled at the last minute, so queues have fallen somewhat,” said Griffiths.

Xeneta Chief Analyst Peter Sand told American Shipper, “The West Coast is getting some breathing space due to fewer boxes leaving Asia [due to COVID lockdowns] but also, more importantly, shippers shifting inbound volumes from the West Coast to the East Coast.

“Shippers are really shifting cargo to the East Coast more dramatically than they have before,” he said. “They are fleeing the West Coast in fear of massive disruptions from upcoming negotiations with the labor unions [on the port worker contract that expires July 1].”

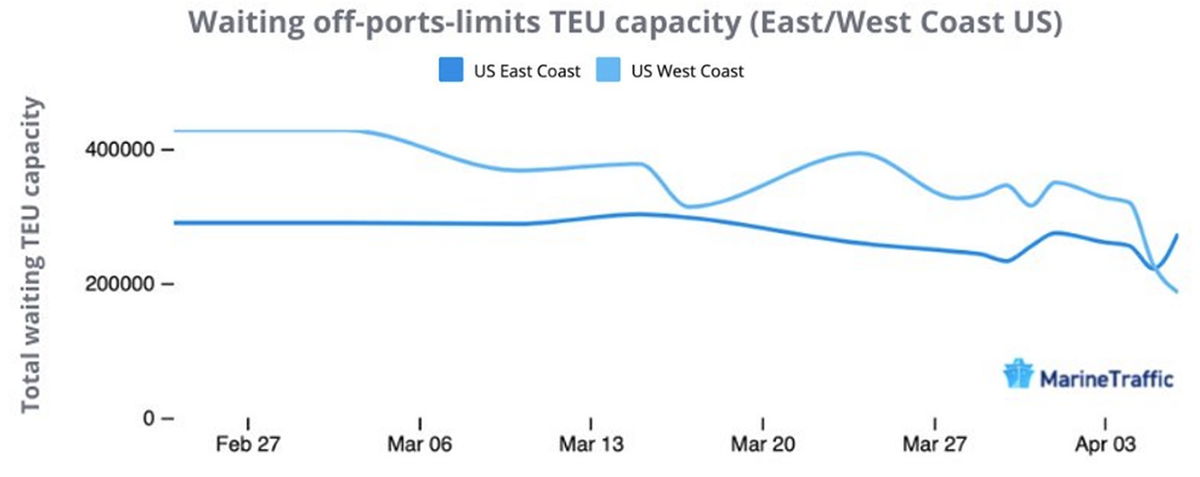

MarineTraffic tracks the capacity of ships (measured in twenty-foot equivalent units) waiting to get into West Coast ports versus East Coast ports.

The MarineTraffic data reveals a major reversal: The East Coast now has more capacity waiting than the West Coast. As of Wednesday, ships waiting in the East Coast queue had 87,000 TEUs more capacity than those in the West Coast queue.

Data provider eeSea also tracks port congestion levels. It uses ship-positioning data to calculate a congestion ratio: ships waiting for berths at regional ports as a percentage of the total number of ships at berths as well as waiting.

The eeSea data reveals that Los Angeles/Long Beach congestion has fallen sharply year to date as East Coast congestion has risen. The congestion percentage off Shanghai and Ningbo in China was lower than U.S. levels until the middle of last month. Chinese congestion levels are now higher than Southern California’s, according to eeSea.

Conflicting signals

Deciphering all these market signals has become increasingly complex. Spot rates appear to be pulling back, but not by all accounts. Congestion looks like it’s falling, but it may be just shifting to other ports, and declines may reverse when Shanghai lockdowns end. U.S consumer demand plays a role as well, but how much and for how long remains unclear.

Lars Jensen, CEO of consultancy Vespucci Maritime, wrote in a commentary published by the Baltic Exchange that China’s COVID lockdowns will reduce demand for space on ships sailing out of Shanghai in the very near term, meaning “there will be more vessel space available for other ports in the region and the expectation should therefore be for downward pressure on freight rates. Once we see a reopening, the expectation should be for a surge of cargo coming out of Shanghai” which “will lead to a sharp upward pressure on freight rates.”

Jensen acknowledged a wildcard is “growing concern in the U.S. as to the impact inflation has on consumer spending. If consumer spending drops, this … would put a large dampener on export volumes out of China.”

This wildcard might already be in play. Bank of America just downgraded nine transport stocks “on demand concerns and pricing declines.” FreightWaves’ trucking data shows a sharp slowdown in domestic freight demand, including in non-port markets. Retailer Restoration Hardware recently confirmed a sudden drop in demand for its household goods.

“The trucking data is some of the most compelling I’ve seen arguing for a slowdown and there is [weakness] for things like home furnishings especially,” said Levy. These could be “early warning signs” of broader weakness.

Other indicators point to continued freight strength. “Prices are soaring, the labor market is incredibly tight, inventory-to-sales ratios are still below pre-pandemic levels, and many would argue — due to just-in-case over just-in-time [strategies] — that you’d want that ratio higher [than pre-pandemic].”

“If I had to come down on one side, I think it does start to look like a slowdown. But there is a lot of uncertainty. And what’s true in the freight market is true for the economy writ large,” Levy said.

“You’ve got a good chunk of the Fed saying, ‘Hey look, this is all about to slow down. We don’t really need to do very much and inflation is going to come down on its own.’ And you’ve got the whole other school of thought weighing in heavily and saying, ‘What are you doing? You’re way behind the curve. You’ve got to slam on the breaks and raise interest rates.”

What’s happening within the Fed is “a parallel debate” to the one underway in shipping, he said.

Click for more articles by Greg Miller

Related articles:

- Retail boss warns on supply chain, likens demand risk to ‘Big Short’

- East Coast ports about to get slammed by a lot more ships

- Is this the calm before California ports’ next cargo storm?

- Supply chain whack-a-mole: West Coast eases, East Coast worsens

- What COVID spike, massive lockdowns mean to shipping

- Different container indexes, vastly different rates. Which is right?