Despite relatively flat net profits, Canadian Pacific (NYSE: CP) reached a record-low quarterly operating ratio (OR) of 56.1% and earned record revenue in the third quarter, the company said on October 23.

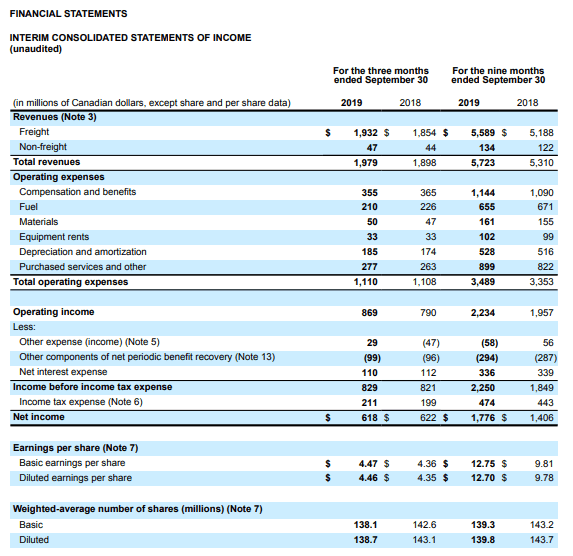

Third-quarter net income totaled C$618 million, a 0.6% drop from the C$622 million in net income for the third quarter of 2018. (A Canadian dollar equates to US$0.76.)

Third-quarter diluted earnings per share were C$4.46 versus C$4.35/diluted share for the same period of 2018.

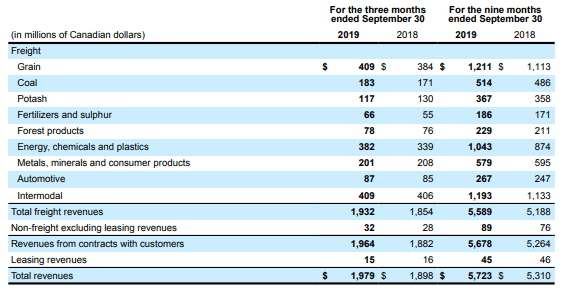

Record third-quarter revenue of C$1.98 billion helped the railway achieve a record-low quarterly OR despite the lower rail volumes and the economic headwinds reported by the overall rail industry. Revenue in the third quarter of 2018 was C$1.9 billion.

Third-quarter operating expenses were flat, at C$1.1 billion.

Meanwhile, CP’s OR was a record low 56.1%, compared with an OR of 58.3% in the third quarter of 2018 and an OR of 56.5% in the second quarter of this year.

“In spite of those micro headwinds, today’s strong results are undeniable proof points of this teams’ skill and ability maintain constructive tension in our day-to-day operating, managing cost, adapting resources real-time, which are all foundational in a true [precision scheduled railroading] PSR culture,” said CP Chief Executive Officer Keith Creel during his company’s third-quarter earnings call.

Performance metrics improved year-over-year, with terminal dwell down 16% to 5.8 hours and average train speed up 5% to 22.7 miles per hour.

Eyeing inland opportunities

As CP hit its financial targets for the quarter, the railway has also been focusing on long-term opportunities, including how to develop its inland real estate assets and entice customers away from the trucking market. John Brooks, CP’s chief marketing officer, pointed to transloading opportunities that CP is developing at its property near the Port of Vancouver.

CP has the ability “to go into these major metropolitan hubs across Canada and the U.S. We have the land that’s developable at a very low cost, to be able to attract these multi-commodity customers to our franchise,” Brooks said.

Although the transloading opportunities in Vancouver have focused on automobiles, CP is eyeing other commodities that could potentially use the property, such as transloading forest products for export and opportunities for intermodal, plastics and grain.

“We’re literally at the tip of the iceberg in terms of the first phase of development of that property,” Brooks said.

CP is also looking at how to transfer what it developed at Vancouver to other locations, such as Edmonton and Montreal.

“In those particular areas…you’ll see a lot of customers out there [that are] looking for optionality. They’re looking for rail alternatives that are currently trucking today,” Brooks said.

Near-term prospects

Both CP and Canadian National (NYSE: CNI) are watching if and when the Alberta government will allow additional volumes of crude to travel via rail. The government currently administers the crude-by-rail contracts but it may seek to transfer them to private companies.

CP expects it would have the capacity to move roughly 30,000-35,000 barrels per day in the fourth quarter and in early 2020. Although both railways acknowledge that crude-by-rail shipments would be curtailed should pipelines be built, both have said they’re eyeing opportunities in the interim.

“That crude space has been a dynamic area. There is no doubt about it. We’re not counting on it. But certainly, I view more optimism right now than not,” Brooks said.

Another segment where CP expects to see some near-term growth is Canadian grain. Wet weather had delayed the start of the Canadian harvests, resulting in lower grain volumes. But CP expects grain volumes to rebound in the fourth quarter and in 2020.