Here it comes. An unprecedented flood of new container ships is about to enter service. The pace of deliveries will pick up in earnest next month, surge much higher in the second quarter, go higher still in the second half, even higher throughout 2024, and stay strong in 2025.

“The colossal orderbook is like a sword of Damocles hanging over the market, with a raft of new ship deliveries in the next months inevitably triggering a return of overcapacity,” warned Alphaliner in a new report on Tuesday.

“The change will be obvious from mid-March,” Alphaliner analyst Stefan Verberckmoes told FreightWaves, adding: “This newbuilding wave is coming at a time of shrinking demand.”

Maritime Strategies International (MSI) estimates that deliveries will total 717,900 twenty-foot equivalent units in Q2 2023, up 62% sequentially from the current quarter, with deliveries rising to 764,800 TEUs in Q3 2023.

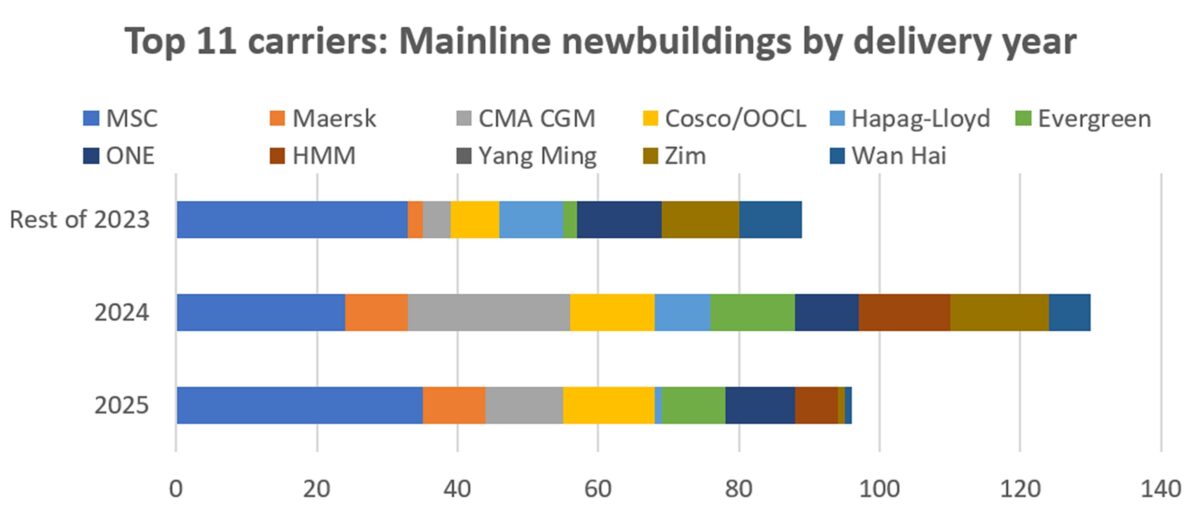

Mainline vessel deliveries per carrier

The overall orderbook stood at 7.69 million TEUs as of Feb. 1, just under 30% of the on-the-water fleet capacity, according to Alphaliner.

Of the total, 2.48 million TEUs (32%) was set for delivery this year, 2.95 million TEUs (38%) next year, and 2.26 million TEUs (30%) thereafter.

In Tuesday’s report, Alphaliner analyzed deliveries of new ships to be deployed in mainline trades by the top 11 carriers. These numbers are particularly important to importers in the U.S. and Europe served by mainline vessels.

The stats show 89 new mainline vessels for delivery in the remainder of 2023, followed by 130 next year and 96 in 2025, for a total of 315 over the next three years. (Including newbuildings for non-mainline trades — i.e., smaller ships, intra-Asia ships, feeder vessels — Alphaliner data shows these 11 carriers have a total of 499 newbuildings on order.)

Mediterranean Shipping Co. (MSC), the world’s largest ocean carrier, is taking delivery of by far the most mainline capacity through 2025. It has 92 such vessels in the pipeline, including 33 in the remainder of this year.

CMA CGM has the second-most mainline vessel orders, at 38, most for delivery next year. Cosco (including OOCL) has the third-highest tally at 32. OOCL held a naming ceremony for its newest ship, the 24,188-TEU OOCL Spain, at China’s NACKS shipyard on Feb. 16.

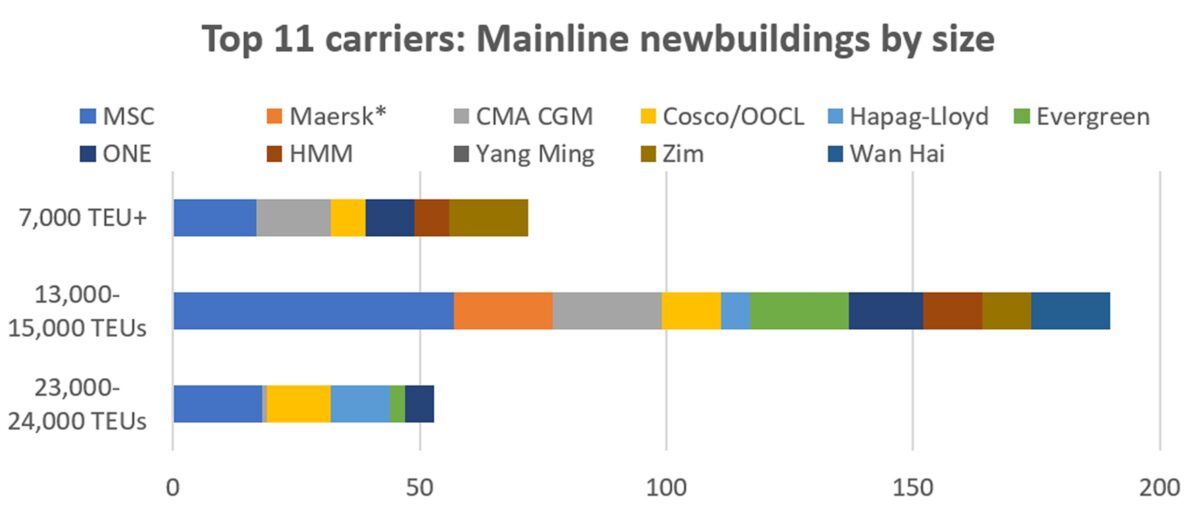

Mainline vessel deliveries by size

Alphaliner also looked at the size categories of these newbuildings, dividing them into three categories: “Megamaxes,” with capacity of 23,000-24,000 TEUs, vessels that will be deployed in the Asia-Europe trade; “Neopanamaxes,” ships with capacity of 13,000-15,000 TEUs that can transit the Panama Canal; and other mainline vessels, with capacity of 7,000 TEUs-plus. Deliveries of Neopanamaxes and other mainline vessels will impact the U.S. ocean freight market.

Neopanamaxes are by far the largest category, representing 60% of the total mainline newbuildings to be delivered through 2025. Megamaxes account for 23% and other mainline newbuildings 17%.

MSC is heavily focused on more flexible Neopanamaxes. They represent 62% of its mainline vessel deliveries through 2025, according to Alphaliner data. Neopanamaxes account for 58% of CMA CGM’s mainline vessel orders.

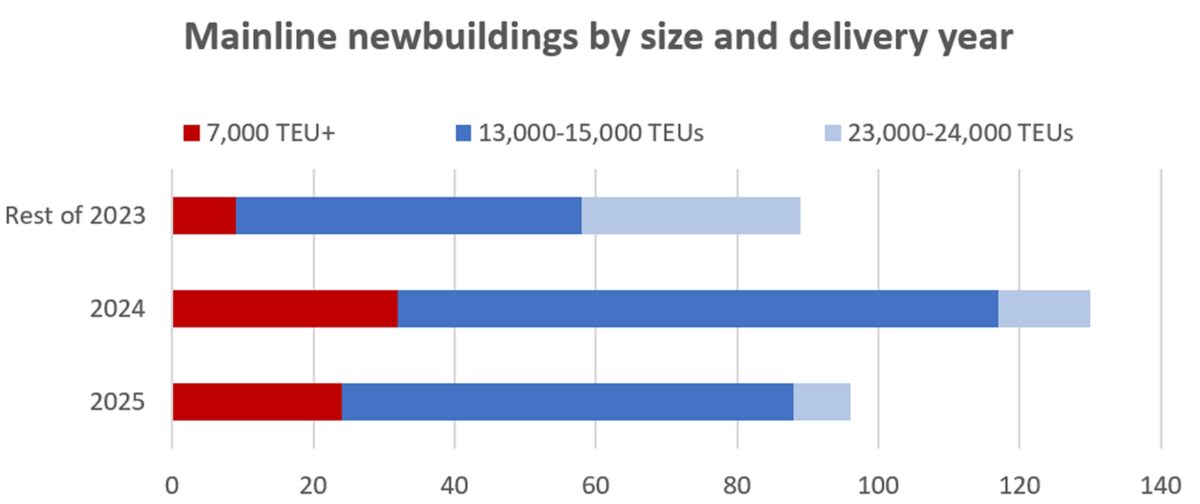

In terms of delivery timing, the largest wave of Megamax arrivals (60% of the total) is arriving this year, raising concerns on imminent Asia-Europe overcapacity.

Alphaliner cautioned that “an armada of Megamax newbuildings” is set to join the Asia-Europe trade “at a time of weakening demand.”

Deliveries of Neopanamaxes and other mainliner vessels will be heavy throughout 2023-25, but particularly so next year (44% of total deliveries), implying heightened capacity pressures on trans-Pacific rates in 2024.

Effects on carrier strategy

Matt Cox, CEO of trans-Pacific carrier Matson (NYSE: MATX), addressed the orderbook dilemma during a quarterly call on Tuesday.

“What I think will happen and what should happen is that the international ocean carriers, operating through their global alliances, will ultimately resize their fleets in the trans-Pacific and globally,” Cox said.

“There is a large orderbook. Those vessels are going to be delivered. Some of them will be delayed. We will also see an advanced level of scrapping. And for vessels that are chartered — which represent about 50% of the global fleet — many will be returned to the vessel owners when the charter periods are over.

“You’re going to see a combination of resizing [strategies] that are going to occur, even potentially laying up vessels,” added Cox. He expects these strategies to intensify “over the coming months.”

Differing views on order splurge

The overwhelming consensus is that carriers will face a tough few years as a result of their ordering spree. But opinions diverge on just how bad it will be, and just how rational or irrational carrier ordering behavior has been.

At one end of the spectrum is the view that carriers have stupidly shot themselves in the foot yet again, succumbing to the classic boom-and-bust shipping cycle pattern, over-ordering and locking in losses for years to come — that their ordering behavior is “madness.”

According to this view, the capacity on order is far more than the global market will ever need. As vessel supply exceeds demand for an extended period, at least some carriers will go for market share, creating a lengthy rate depression that will ultimately erase much of carriers’ COVID-era windfall profits.

At the other end of the spectrum is the view that ocean carriers need new ships. Pre-COVID, there was a long period of extreme under-ordering when carriers were under severe financial stress. The global fleet became old. According to VesselsValue, the average age of the world’s container ships is now 14.6 years.

Newly constructed vessels are much more fuel efficient than older tonnage, and fuel is one of carriers’ top costs. Newbuildings can also incorporate dual-fuel capabilities, allowing carriers to “future proof” against environmental regulations.

Container lines order new ships when the freight market peaks because that’s when they have the financial wherewithal to do so. Shipping-line balance sheets have never been stronger than they are today. This has allowed them to easily finance newbuildings to replace older tonnage and lower their future operating costs.

As newbuildings are delivered, carriers will scrap the older ships they own and let older chartered tonnage go off-hire. The portion of carriers’ fleets that is chartered as opposed to owned is far higher than new capacity on order. According to Alphaliner data, on-the-water chartered tonnage of the top 11 carriers is currently 76% or 4.6 million TEUs times higher than the aggregate tonnage on order by those carriers.

Many of the charter durations will extend beyond newbuild delivery dates, meaning there will be a temporary overhang and legacy chartering costs will eat into some of the carrier profits earned during the boom.

But ultimately, after a challenging transition period, carriers will end up with a new, fuel-efficient fleet that’s right-sized to demand, and they’ll still have some of that pandemic windfall on their balance sheets — or so the optimistic theory goes.

Click for more articles by Greg Miller

Related articles:

- Container trade’s next turn: Price wars, cheap contracts, new ships

- Maersk: Container shipping contract rates will sink to spot levels

- Just how big are the global container shipping alliances?

- Lag effect: Why liner profits stay high much longer than spot rates

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- Tidal wave of new container ships: 2023-24 deliveries to break record

- Here’s how container shipping lines can escape a crash in 2023

Don Starr

I HOPE THE INDUSTRY IN THE WEST COAST PORTS PICK UP.

GOOD ARTICLE.

Alex D.

I had forgotten about how electric systems love corrosion… Sea air and road brine will be the death of the on. Highway electric trucks… But hay I don’t service CA. So not my problem

Don B

What about ELECTRIC carrier’s!!!!