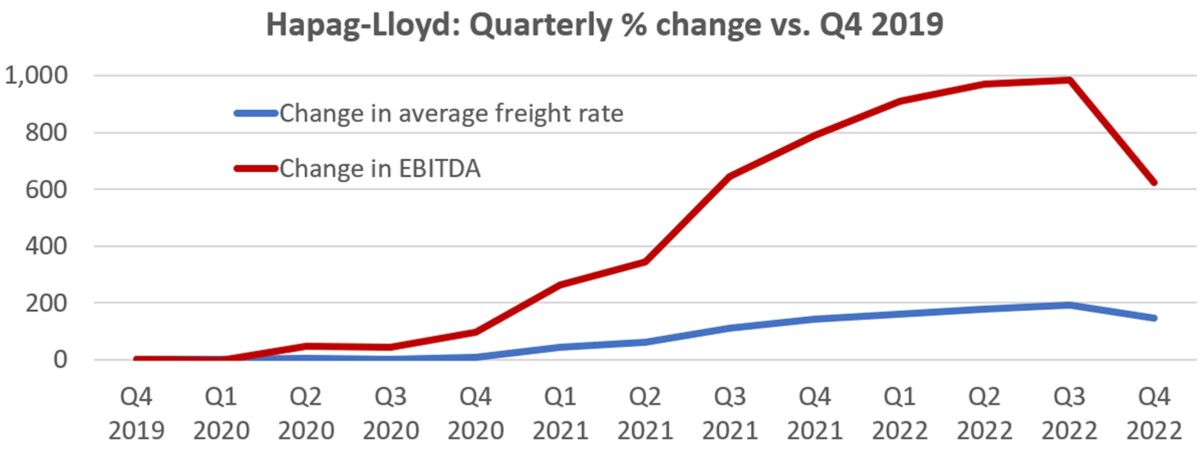

Spot container shipping rates in many trades have already collapsed back to pre-COVID levels. But container liner earnings are still nowhere near where they were pre-pandemic. Ocean carriers are still earning billions more per quarter than they used to.

German carrier Hapag-Lloyd reported earnings before interest, taxes, depreciation and amortization of $3.8 billion for the fourth quarter of 2022. That’s over seven times EBITDA in Q4 2019, pre-COVID.

The Bloomberg consensus forecast is for Hapag-Lloyd to post EBITDA of $5.6 billion for full-year 2023, 2.5 times EBITDA in 2019. Deutsche Bank thinks Hapag-Lloyd’s EBITDA will be $7.7 billion, 3.5 times 2019 earnings.

Fall in spot rates comes first

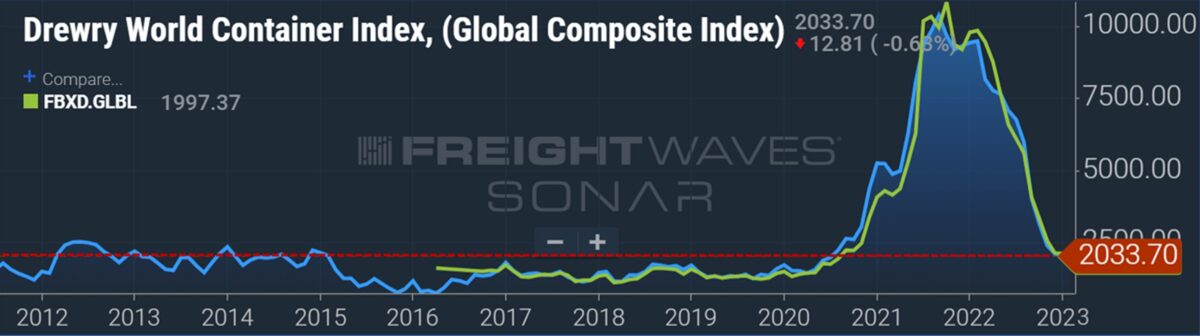

Spot index data over the past decade shows just how extreme of an anomaly the COVID era actually was. Global spot rates averaged around $2,000 per forty-foot equivalent unit in 2012-14. They fell to around $1,300 per FEU in 2015-16 amid the Hanjin bankruptcy. They averaged around $1,450 per FEU in 2017-19.

The pandemic era’s goods-buying spree propelled the global spot average to an unprecedented peak of over $10,000 per FEU in late 2021. Global averages of the Drewry World Container Index (WCI) and Freightos Baltic Daily Index (FBX) are now back to around $2,000 per FEU.

Most of the east-west spot rate indexes have now normalized. (The still-booming trans-Atlantic westbound trade from Europe to the U.S. is an exception.). The pace of descent flattened in December and January across most global trades. The cliff-like rate plunge seen in August-October has ended.

Trans-Atlantic strength is still keeping the global averages higher than in 2017-19, while in other lanes, including Asia-West Coast, spot rates are all the way back to pre-pandemic levels.

Fall in contract rates comes next

With spot rates having already plunged, why are Hapag-Lloyd’s earnings still so much higher than pre-pandemic? One reason is the lag effect in revenue recognition. Depending on timing, cargo booked in a particular month may not show up in a carrier’s revenue line until the following quarter.

But the main reason is that the majority of ocean carrier revenue is not booked on spot, it’s booked on annual contracts, and the decline in contract rates lags the decline in spot rates.

As industry expert John McCown has repeatedly emphasized: “Earnings in the container shipping industry are on a different curve than what has occurred with spot rates, as the large majority of loads move under contract rates.”

Most annual Asia-Europe contracts reset on Jan. 1 and most annual Asia-U.S. contracts on May 1. In some cases, carriers agreed to lower annual rates in the middle of last year’s contract — Zim (NYSE: ZIM) has acknowledged doing so — but only after spot rates fell well below contract rates.

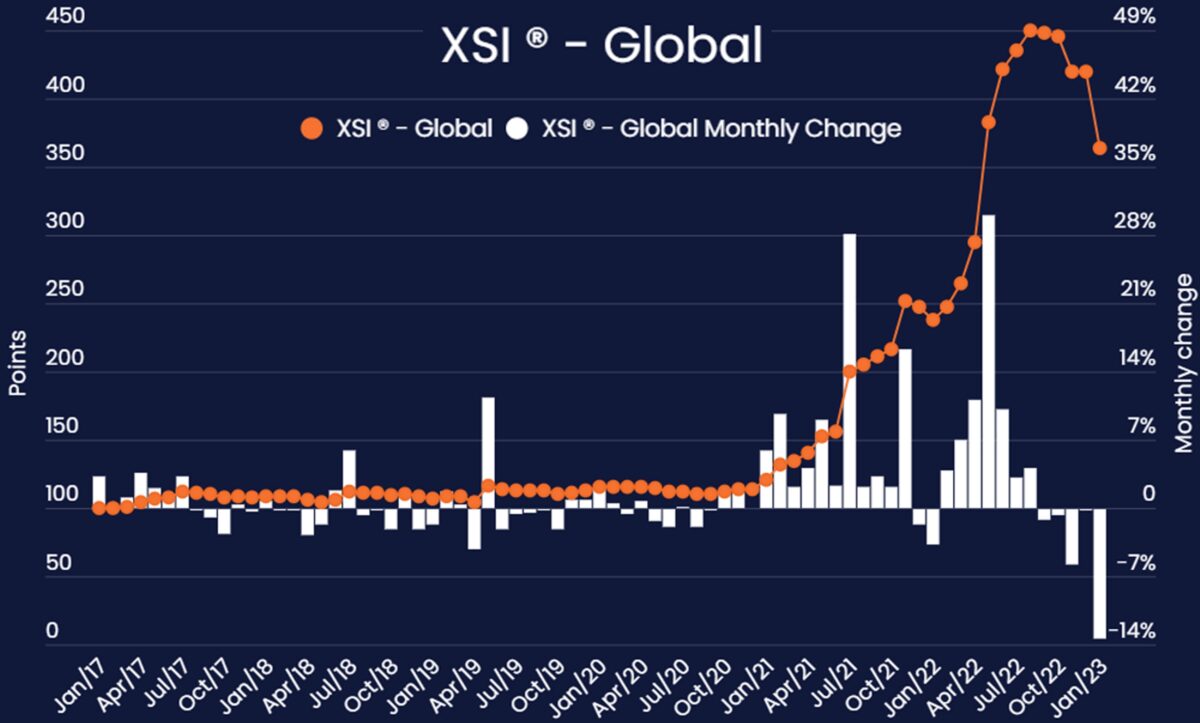

Long-term rates are tracked by Norway’s Xeneta.

Whereas the global WCI and FBX spot rate indexes peaked in September 2021, Xeneta’s XSI long-term index didn’t peak until 11 months later, in August 2022.

The XSI fell moderately in the fourth quarter, then registered its largest-ever month-on-month plunge — 13% — in January. Even so, the XSI was still at 364 points last month, 3.4 times higher than the 2017-19 average.

Hapag-Lloyd’s results confirm the central importance of contract rates. In Q4 2022, its average freight rate, including both contract and spot, was $5,250 per FEU, almost double the average FBX and WCI global spot index levels during that period.

The carrier’s Q4 2022 rates were 2% above rates in Q4 2021, a time when the supply chain crisis was peaking. They were 2.5 times Hapag-Lloyd’s average rate in Q4 2019, pre-COVID.

The carrier’s average rate fell 15% in Q4 2022 versus Q3 2022. That is a much more moderate drop than the average decline in the FBX global composite spot index, which plunged 48% quarter on quarter.

Fall in earnings after fall in rates

The other reason carrier earnings are still nowhere near pre-COVID levels: Carrier bottom lines jumped much faster than rates during the COVID boom, due to very high operating leverage.

Rising average freight rates multiplied by total volume drove revenues up much faster than costs (fuel, container handling, crewing, chartering, etc.). As a result, profits still have a long way to fall.

Most carriers, including Hapag-Lloyd, didn’t see earnings peak until Q3 2022, a year after spot rates began falling.

Hapag-Lloyd’s EBITDA declined sharply in the fourth quarter versus the third, down $1.9 billion, or 33%. Yet it still came in $3.3 billion or 622% higher than EBITDA in Q4 2019.

The question ahead is how the lag effect will play out. Will the normalization of spot earnings be followed by the same normalization of contract rates and eventually, carrier EBITDA and net income sinking back to pre-COVID levels, or even below those levels?

Or will there be a surprise to the upside: no global recession, sturdy U.S. consumer demand, carrier capacity management offsetting newbuilding arrivals, retailer inventory levels winding down and needing replenishment, and volumes (and rates) edging back up during the next peak season?

“We think momentum in the space continues to be negative and therefore we remain cautious on the sector,” Deutsche Bank analyst Andrew Chu wrote in a client note. “We forecast that container shipping profits will normalize quickly, although it is hard to forecast numbers given the operating leverage in the business, a macro slowdown and significant supply — plus-10% — coming into the market.”

Click for more articles by Greg Miller

Related articles:

- Just how big are the global container shipping alliances?

- How will Maersk-MSC split redraw container shipping landscape?

- Good times still rollin’ for shipping lines in trans-Atlantic trade

- Here’s how container shipping lines can escape a crash in 2023

- ‘Surge finally over,’ US imports back near pre-pandemic levels

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels