The U.S. economy, though certainly aided by exorbitant fiscal stimulus, did prove one long-held truism — the American consumer is resilient, nearly impossible to break, and he or she will continue to spend almost regardless of the circumstances (even including the biggest quarterly drop in real GDP in 90 years since the Great Depression). Consumers drove the economy and the freight market throughout the back half of 2020, and for at least the first half of 2021, the thesis is intact.

Although there are freight volume headwinds on the horizon in the form of a shift back to services spending, and a shift back to spending away from home, there is enough momentum for the freight bull run to continue. Widespread vaccinations will release a wave of pent-up demand for travel and leisure, but the potential for a third round of stimulus and the extraordinarily high savings rate suggests consumers will have a war chest in 2021. Where will they spend their money? Let’s look at the biggest consumer trends of 2020 to get a better idea of the year ahead.

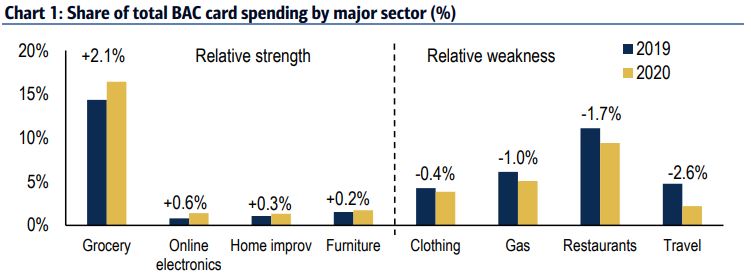

At home spending – As lockdowns were enacted and consumers hunkered at home, spending shifted significantly from outside of the home to in. The most pronounced shift came from a decisive increase in the share of dollars spent on groceries, which was offset by a pullback in spending at restaurants. Without the ability to travel or the need to dress up for work, consumers opted for entertainment electronics like TVs and speakers and kitchen appliances like air fryers and Ninja blenders.

From services to goods – Traditionally, consumer spending makes up about 70% of the overall U.S. economy (and about 40% of overall exposure to for-hire truckload in the U.S. by our estimates). Within that 70%, historically two-thirds of consumer spending comes from services, while approximately one-third is derived from goods (both soft and durable) — in other words the type of stuff that gets transported in trucks.

In 2020, the traditional split between services and goods experienced a sharp mix shift towards goods (and away from services). The traditional 67%/33% split of services/goods blew out to closer to 60/40, with goods accounting for 40 cent of every dollar of consumer spending.

The most glaring example here is the lack of travel spending, which includes airlines and lodging. While travel spending was down significantly (airlines -53% yoy; lodging -45% yoy), spending on furniture and home improvement was up ~20%.

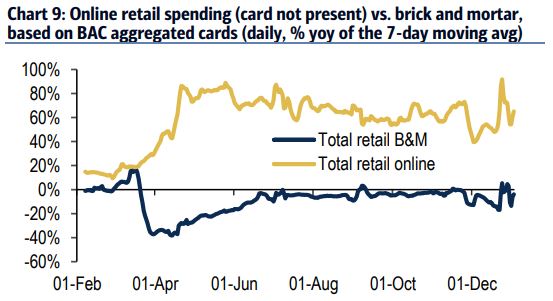

E-commerce explosion – Depending on who you ask, online sales penetration accelerated 3, 5, or maybe 10 years in 2020. With consumers stuck at home, both retailers deemed essential and those that were not quickly pivoted online with new service offerings like delivery, BOPIS, and robust returns processes. According to the Commerce Department, online spending was up 37% yoy as of the latest report in Q3.

So what does this mean for 2021?

The first half of 2021 is likely to look a lot like the second half of 2020 from a consumer spending perspective. The second half of 2021, on the other hand, is likely to be characterized by a bonanza of demand for consumer services unlike any we have seen in decades.

“Consumers, after being locked down at home for approximately one and a half years, are likely to spend eye-popping amounts on services in the second half of 2021 and in 2022 once vaccinated in sufficiently large numbers,” Passport Research Senior Analyst Seth Holm told me yesterday.

Back to services – Although the vaccine rollout has been slower than expected, it is coming. I don’t know about you, but a lazy vacation with airfare, a decent hotel and a week eating out sounds pretty damn good right now. Americans didn’t stop traveling in 2020—they just stopped getting on airplanes and staying at hotels. In a mid-September survey from Travelocity, one-in-four respondents said they had trips planned before the end of the year and 45% of families with children under the age of 18 stated plans of a leisure trip. According to AAA Travel, 80% of vacation trips were taken by car and places “known for outdoor recreation and socially distanced fun” were particularly popular.

At this pace, vaccinations won’t be widely available in the US until well into Q2 and Q3. Until then, consumers are likely to prioritize spending on durable goods and e-commerce just as they did in the second half of 2020, while services spending of all kinds (from travel, leisure, entertainment, hotels, restaurants, bars, etc.) is likely to remain weak and depressed.

Once a significant portion of the population is inoculated, I expect mean reversion and for the split of spending between goods and services to return closer to its long-run average in the second half of 2021, which will weigh on goods spending (and therefore truckload load volumes and demand).

From home to away from home – Another 2021 trend reversal will be a shift in goods spending from at home back to away from home. Although Global Workplace Analytics estimates that 25-30% of the workforce will be working-from-home multiple days a week by the end of 2021, many millions of Americans will be headed back to the office at some point this year.

COVID-19 caused a significant shift in consumer spending away from travel and restaurants toward home-related categories in 2020. Once COVID-19 vaccines are broadly disseminated, expect at least a gradual reversal of that shift. Without a doubt, demand for many categories such as home goods, furniture, fitness equipment, pools, and CPG like groceries and household goods — many of the big winners from 2020 — is likely to at a minimum plateau and probably face a modest downdraft. This shift should favor categories such as auto and auto parts, as well as apparel. After months of hunkering inside and working from home, apparel makers and department stores will benefit from pent-up demand.

Permanent e-commerce penetration – E-commerce is likely to still grow from 2020 in terms of absolute dollars but its penetration of overall consumer spending is likely to stagnate and peak temporarily as the world reopens and consumers go back to shopping at brick and mortar retailers. I believe most, if not all, of the share gains for e-commerce will prove permanent.

2021 – The Tale of Two Halves

Consumer spending will be a tale of two halves because while it should be positive and strong for the whole of 2021, it may be supercharged in the back half of 2021 as pent-up demand for services explodes. While an undoubtedly positive outcome for US economic growth, social stability and the labor market, it could be a mixed bag for retail and the freight industry in the second half of 2021 due to the drag from the mix shift back to services described above. Those who have thrived moving excess grocery and CPG freight last year will underperform those more exposed to manufacturing, especially autos, and apparel.

The wildcard here that is difficult to account for is that the overall economy should grow at a much brisker and accelerated pace in 2021, particularly as a $2 trillion stimulus package is looking more likely after the Democrat sweep in the Georgia Senate runoffs, and as the labor market recovers, the overall population is vaccinated and demand for services goes stratospheric. In other words, while the mix of goods relative to overall consumer spending is likely to fall in 2021, the question is whether goods spending can still muster to achieve a flat to modestly up level of year-over-year growth because the U.S. economy is forecast to grow by about 5%.

The macro variables that give indication of the overall health of the consumer are quite strong. The savings rate, which has come down from its April peak of 33%, remains more than double the previous 5-year average.Also, personal income was up 4% yoy in November, and spending power is up due to contributions from stimulus. If personal income rises in 2021 (with stimulus and economic recovery, it is probable) and the personal savings rate goes back down toward its long-term trend, that implies a big shot of consumer spending into the economy. For those predicting a second half freight slowdown (myself included), this thesis could keep the freight party rolling throughout the year.

Additionally, the unemployment rate at about 7% is still very high by historical standards, but way off of the peak and should continue to come down, and likely quickly, as the world is vaccinated. Credit Suisse expects the unemployment rate to reach parity with its “natural rate” of at or below 5% by 2022. Consumer confidence has experienced a v-shaped rebound since the spring 2020 trough and is hovering at high levels.

Final Thoughts. US consumers once again proved their resilience in 2020 and we should not doubt their ability to keep it up. A third round of stimulus would only aid spending and freight flows, and retail is positioned for a strong year. However, much like last year, it will be a case of haves and have nots. In 2020, the haves were grocers, home improvement stores, and electronics outlets. With vaccines in the picture, spending will shift to favor services and spending away from the home. That doesn’t mean goods spending will falter, rather it may still grow modestly yoy but its proportion of overall consumer spending will return towards historical averages.

Want more retail supply chain insights, try Point of Sale, my twice-weekly newsletter covering retail, the consumer, and the rapid evolution of retail supply chains. Click here to signup.