The warnings are loud and clear: If container lines suffer the same demand loss and rate drop they did during the 2009 financial crisis, 2020 will be catastrophic — but if demand falls and rates don’t, the coronavirus crisis should be survivable.

It’s a classic “prisoner’s dilemma” scenario for ocean carriers. Each of the major alliances — 2M, Ocean Alliance, THE Alliance — must take it on faith that one of the others won’t slash rates to snatch a bigger slice of the smaller cargo pie.

Liner companies have a better chance of solving the prisoner’s dilemma now than in 2009 because the industry has become much more consolidated in the intervening years through takeovers and commercial alliances.

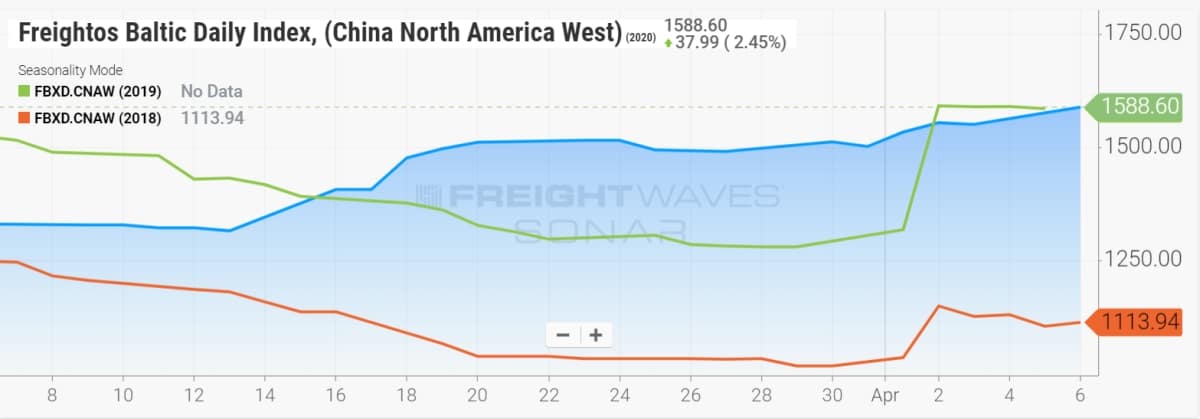

Their success or failure will be evident in daily spot rates for container shipping. The Freightos Baltic Index tracks the daily price to transport a forty-foot equivalent unit (FEU) container on the main routes.

It’s still early, but so far, it appears the carriers are holding firm.

Rate trends

In the trans-Pacific market, rates from China to U.S. West Coast ports such as Los Angeles and Long Beach, California (SONAR: FBXD.CNAW) are up 6% week-on-week (through Monday), in line with rates a year ago, and up 43% from two years ago.

Rates from China to East Coast ports such as New York/New Jersey; Charleston, South Carolina; and Savannah, Georgia, (SONAR: FBXD.CNAE) are up 3% week-on-week and year-on-year, and up 31% from two years ago.

Looking at Freightos’ global composite index (SONAR: FBXD.GLBL), rates are up 4% week-on-week, 5% year-on-year and 40% from two years ago.

Positive signs

Eytan Buchman, chief marketing officer of Freightos, said on Tuesday, “High air rates have some shippers looking to switch to ocean shipping. This shift, along with carriers continuing to blank [cancel] a large number of sailings, has kept ocean rates stable this week.

“On a positive note,” he added, “though enterprise shippers in non-essential industries like retail are doing their best to cancel orders, many SMBs [small and midsize businesses] with much smaller inventory needs seem to be active and unaffected yet by the shift in demand.

“Despite a lull during the shutdown of Chinese manufacturing and being below typical levels, U.S. SMB importers using the Freightos.com marketplace continue to ship goods, with last week’s number of shipments up 11% from the previous week and down only 2% over the same period last year.” Click for more FreightWaves/American Shipper articles by Greg Miller