The coronavirus outbreak could start to be affecting North American intermodal rail volumes on a weekly basis, the Association of American Railroads (AAR) said.

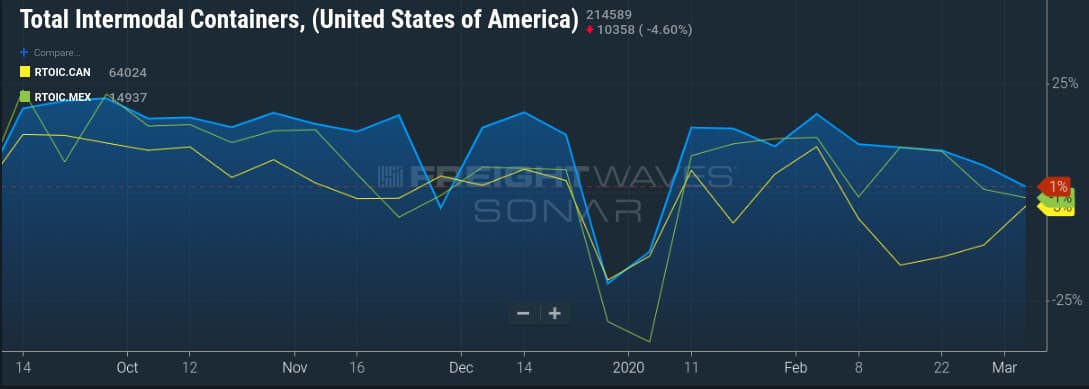

For the week ending March 7, North American intermodal traffic was down nearly 12% from the same period in 2019, AAR said. While Mexican intermodal volumes fell 3% to 17,114 intermodal units and Canadian intermodal traffic was down 5.3% to 64,025 intermodal units, U.S.intermodal volume fell by double digits percentage-wise, slipping 14.1% to 232,561 intermodal containers and trailers.

The slump in intermodal volumes could be tied to the drop in Chinese manufacturing output and the drop in ocean vessels arriving at West Coast ports, which in turn were outcomes from the coronavirus outbreak that occurred in China, according to AAR’s senior vice president John T. Gray.

But other factors, such as weather, can also come into play and affect rail volumes, Gray said.

“Comparing rail traffic from one week to another must be done with caution because many different factors can come into play, especially in the winter when the weather can play a big role,” Gray said. “That said, rail intermodal loadings last week were down noticeably more than the norm over the past year.”

He continued, “With the number of ships arriving at West Coast ports from Asia down sharply due to the coronavirus, it stands to reason that railroads are beginning to feel an impact too, at least in terms of intermodal. It’s impossible to quantify that impact with precision.”

On a year-to-date basis, North American intermodal traffic is down 6.2% to 3.3 million intermodal containers and trailers.

Meanwhile, North American carloads are 4.3% lower on a year-to-date basis, at 3.9 million carloads. On a weekly basis, North American carloads were relatively flat, slipping 0.6% to 333,368 carloads.

Rail stocks react to coronavirus concerns, oil market slump

Transportation stocks, including those of the railroads, have been volatile this week as the financial markets were hit by a one-two punch. Concerns about a wide-scale coronavirus outbreak in North America, coupled with lower oil markets due Saudi Arabia’s efforts to shake Russia, have made Wall Street jittery.

“Security prices across the board have been discounting in an increased probability of a global recession as a result of reduced economic activity in response to the coronavirus,” said Mike Baudendistel, FreightWaves’ market expert for rail, intermodal and equipment. “Railroad stocks are no exception given that the large majority of their traffic is sensitive to either the consumer economy, the industrial economy and/or commodity prices, all of which have their respective issues currently.”