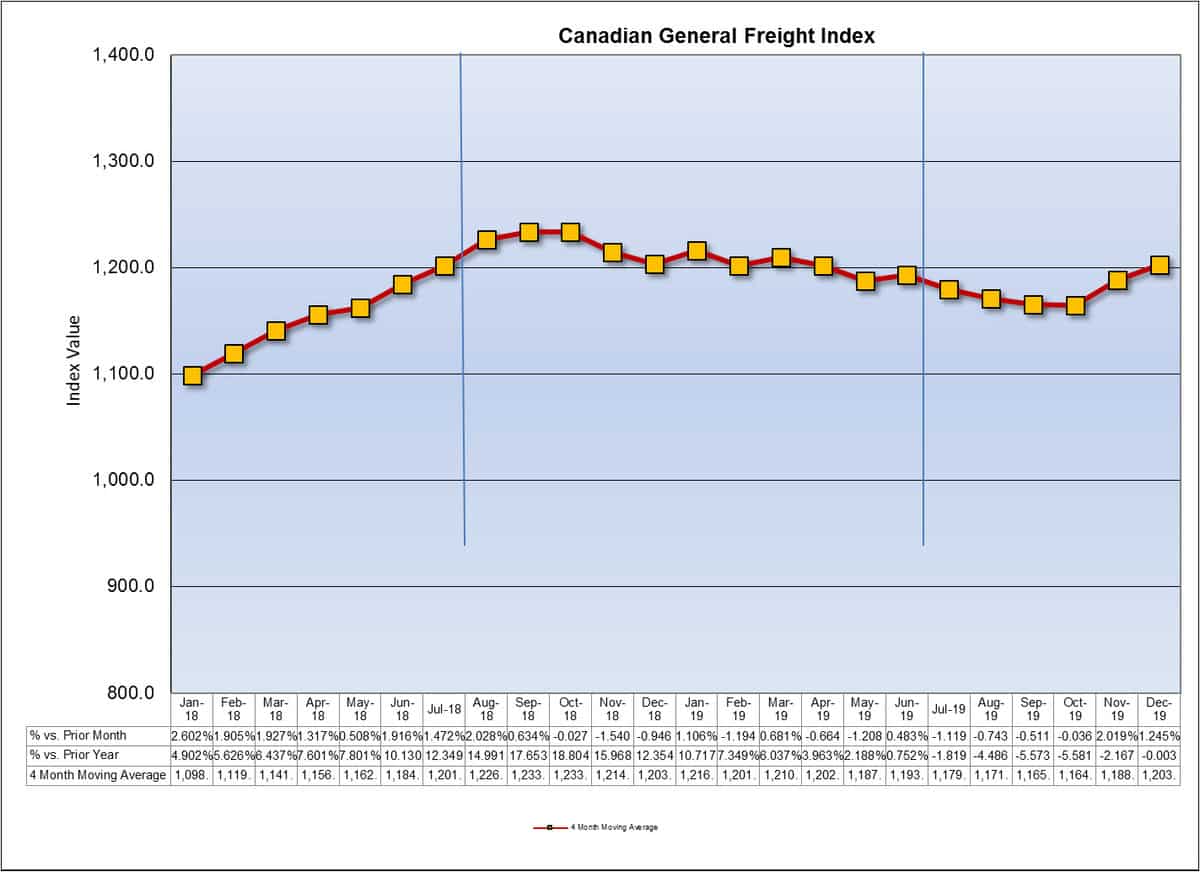

A strong increase in cross-border less-than-truckload (LTL) rates, largely from the U.S. to Canada, helped drive up freight costs for Canadian shippers in December, according to Canadian General Freight Index (CGFI) figures released today.

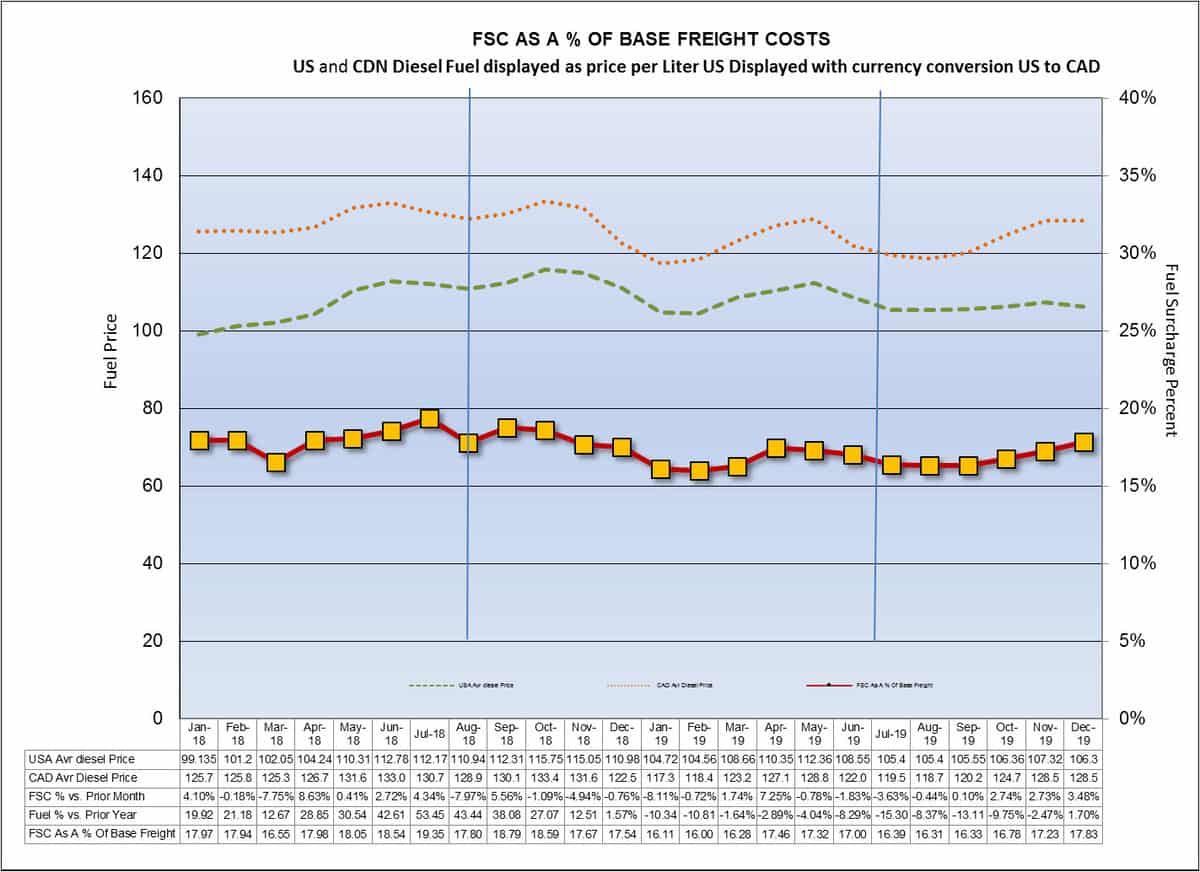

Freight costs increased by 1.25% in December from the increase in base rates and fuel prices, the February 27 report from Nulogx’s CGFI said. The monthly index, sourced from Canadian shipper transactions for over-the-road freight, also will soon appear on FreightWaves’ SONAR platform.

The biggest driver for the increase – pricing for northbound LTL freight from the U.S. to Canada as demand increases faster than capacity.

“I don’t know what’s driving it,” Doug Payne, President and chief operating officer of Nulogx, told FreightWaves. He speculated that consumer demand in Canada could be a factor.

Cross-border LTL rates in December were above levels of a year earlier. Domestic and southbound cross-border truckload remained below the previous year’s levels.

December’s increases follow a rise from November. Payne attributed part of the overall increase to the impact of the strike by Canadian National rail workers in November, and the resulting shift from the railroad to trucks.

Payne said he anticipates freight rates to continue to increase, with the uptick in northbound LTL continuing. The shift toward U.S. to Canada LTL happened several years ago, Payne said.

The long-term outlook remains unclear, due to the uncertain impacts of the coronavirus and the shakiness in the Canadian economy.

The coronavirus may drive up over-the-road rates, but also could hurt volumes depending on where and how the outbreak impacts the global supply chain, Payne said.

“It’s a double-edged sword,” Payne said.

Before the recent uptick, the CGFI shows that freight prices had a slow, stable decline in 2019 in contrast to the U.S.

“Canada is a different sort of beast,” Payne said.

Michael Evans

The Corona virus does seem to be affecting shipping all over the world. All of us here in the U.S. have our fingers crossed that it won’t have a big impact to our beautiful country. It is good news that LTL shipping is growing between the U.S. and Canada. Here’s hoping that it keeps improving.

Noble1 suggests SMART truck drivers should UNITE & collectively cut out the middlemen from picking truck driver pockets ! UNITE , CONQUER , & YOU'LL PROSPER ! IMHO

Meanwhile the Dow Jones Transportation Average Index , Dow Jones Industrial Average Index , the S&P 500 , the Nasdaq , All took a wild dive this week .

Apparently the January Barometer hasn’t lost its GOLDEN TOUCH (wink) I mentioned this occurrence in January 2020 as well .

Furthermore , the TSX was shut down at 2pm EST today due to a “glitch” , LOL !

Is this due to the so called “coronavirus” ? I beg to differ . Some of us have been calling this crash & the one in Oil prices likely to occur before the coronavirus breakout .

I personally kept referring to the DJTA not confirming the DJIA on this site many times and to be extremely vigilant concerning that point !

The coronavirus certainly isn’t helping , however, it’s not the cause to the market turmoil . You just watch . When a full blown economic recession will be declared , they’ll report that the coronavirus was the cause . However, we had ample warning in this cycle way before the coronavirus outbreak . We had inverted yield curves , consumer staples outperforming other sectors , precious metals & treasury bond prices increasing due to shifting capital out of riskier sectors into safe havens .That being said , I’d be vigilant at this juncture concerning TLT(iShares 20 + Year Treasury Bond Index) though .

In my humble opinion ………..