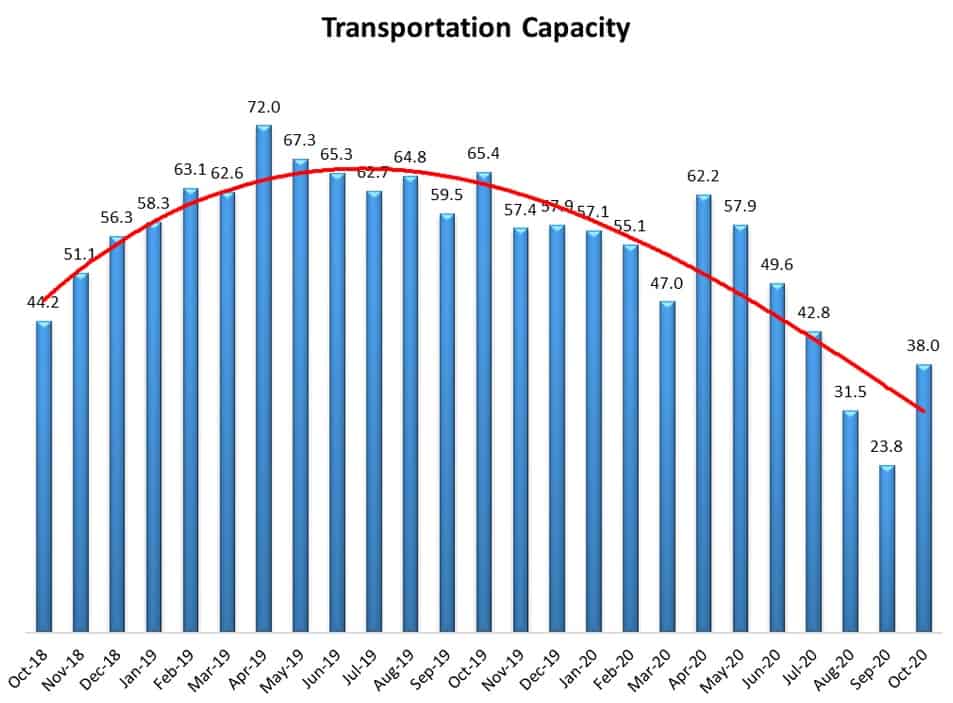

An October supply chain survey shows the rate at which transportation capacity is declining slowed from September’s all-time record pace. The capacity index jumped 14.2 percentage points in the month to 38%, which is still firmly rooted in contraction territory.

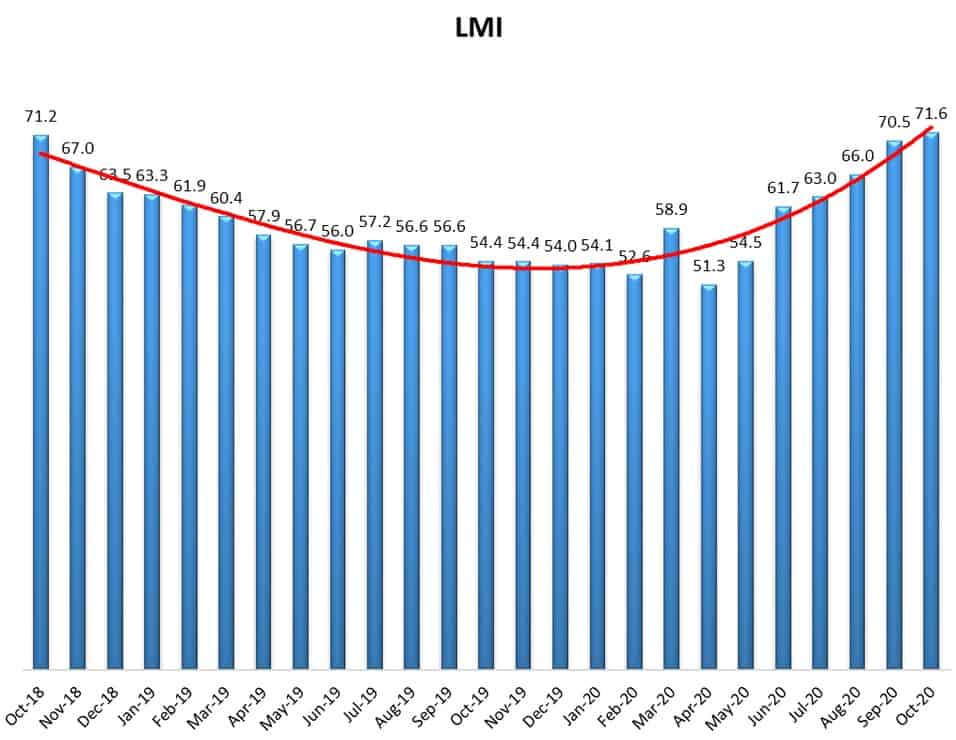

The Logistics Managers’ Index (LMI), a survey of leading logistics executives, is a diffusion index wherein a reading above 50% indicates expansion and a reading below 50% indicates contraction. The survey is intended to capture the rate of change in key supply chain trends in areas like transportation, inventory and warehousing.

“Finding sufficient transportation continues to be an issue for many firms (particularly customer-facing firms); the three lowest scores for the last two years in the Transportation Capacity index have come in the last three months,” according to the report.

Future expectations for a tight transportation capacity dynamic loosened among respondents. Forward-looking expectations see capacity contracting at a rate of 59.5% compared to September’s level of 48.1%. “This suggests that respondents have become more bullish on Transportation Capacity and expect more to come online over the next 12 months,” the report stated.

The overall LMI was up 1.1 points to 71.6%, which implies the logistics industry is growing at a “rapid pace.” The index stands at its highest level since June 2018 and up more than 20 points from the April low. “Firms are reporting increasing levels of inventory, contracting capacity and increasing levels of both utilization and price,” the report said.

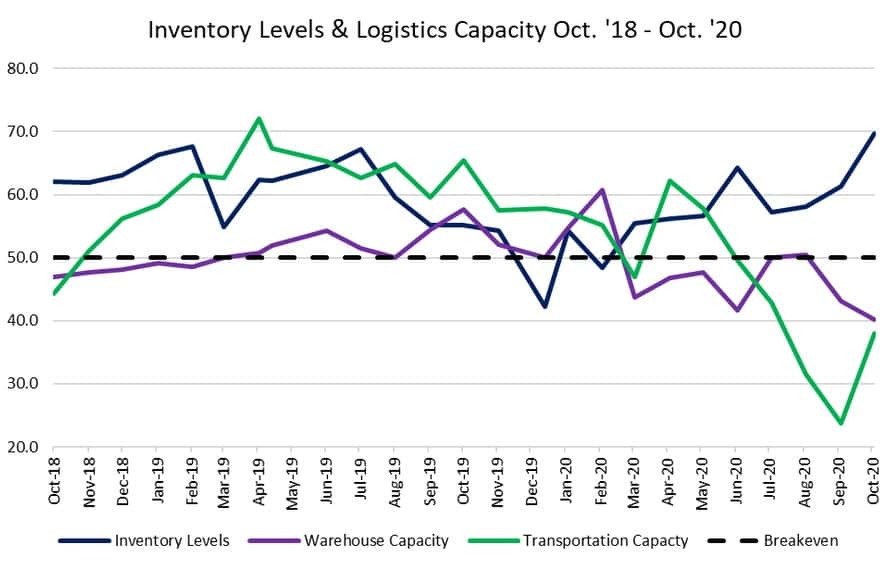

Surging demand for e-commerce fulfilment and final-mile solutions have been sparked by an increase in online spending of physical goods. On Friday, the Commerce Department reported personal consumption expenditures, household spending, increased 1.4% in September, the fifth consecutive monthly increase. Spending on goods was up 2%, with spending on services up 1.1%

The pandemic-induced pull forward of the e-commerce evolution has increased the need for larger inventories and more warehouse space. Transportation and logistics networks are being stressed by the rapid rise in demand.

“Because e-commerce is growing at quadruple the predicted rate, it has been difficult for firms to procure the infrastructure necessary to fulfill consumer demand,” the report continued.

Growth in inventory levels climbed 8.2 points higher to 69.6%, the highest mark in two years. The implication is that companies are building inventories “at a faster rate than they traditionally do in October.”

The warehouse capacity index stood at 40.2%, the lowest-ever reading with the warehouse utilization index climbing higher again during the month to 71.9%, the fourth consecutive monthly increase.

“At this moment it appears that demand for logistics services will continue to grow; both retail and manufacturing are up as the economy continues to recover,” said the report.

The report did note potential headwinds, including a rise in lockdowns across Europe and fresh rounds of white-collar layoffs.

“If quarantine policy and employment trend back towards the negative, the retail-driven demand for logistics services may begin to subside. [Whether] or not the economy slows back down remains to be seen. But at the moment, we cannot add logistics infrastructure quickly enough to keep up with burgeoning demand.”

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.