Forward Air saw a downturn in several key metrics in the quarter but still beat Wall Street estimates of its earnings.

The company, which is a less-than-truckload (LTL) carrier as well as providing other “asset-light” services including last-mile delivery, posted non-generally accepted accounting principles (GAAP) earnings per share of 67 cents, which was well above the Wall Street consensus of 40 cents per share, that consensus number coming from SeekingAlpha. Its net income per diluted share was 61 cents per share.

Its revenue of $332 million was ahead of forecasts by $4.5 million and up 5.8% from last year.

The recent performance of the company was good enough that it has increased its dividend. The new dividend is 21 cents per share, up from 18 cents per share, payable to shareholders at the close of business Nov. 25. The latest yield on Forward Air’s stock is 1.17%.

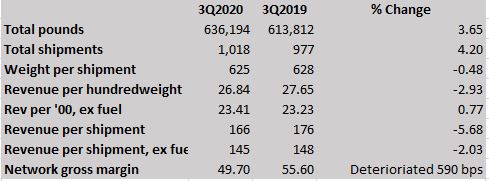

Some of the LTL metrics at the company showed weaker numbers than the prior year. Revenue per hundredweight was $26.84, down from $27.65. But when fuel is taken out, the revenue per hundredweight of $23.41 was slightly better than the $23.23 level of last year.

Revenue per shipment excluding fuel was down to $145 from $148. The company’s network gross margin slid to 49.7% from 55.6%. Forward Air’s overall operating margin was 7.1%, down from 9.3%.

Although net income beat estimates, it was still down 19.3% from last year, sliding to just under $17 million, a drop of slightly more than $4 million. Free cash flow was $18.7 million, down from $35.2 million.

The non-GAAP measure of EBITDA dropped 14.5%, a decline of $5.5 million to $32.7 million.

In a prepared statement accompanying the earnings, Forward Air CFO Michael Morris projected a stronger fourth quarter. Revenue growth would be between 6-10%, up from the 5.8% third-quarter growth. Net income per diluted share was forecast by Morris to be between 71 cents and 75 cents, which would be up from the third-quarter number of 61 cents per share.

The tight driver market can be seen in Forward Air’s figures for purchased transportation. Forward spent $175 million on purchased transportation, up from $150.2 million last year.

More articles by John Kingston

Strong used truck market key to Ryder’s Q3 performance

Earlier Ryder writedowns on unused fleet value positive for bottom line

Saia’s record OR driven by higher yield on small revenue increase