From Chattanooga to Birmingham, from Memphis to Atlanta, the region is home to a growing number of freight and logistics companies

Share:

Location, location, location … and a qualified workforce. Chattanooga, TN, has all of those, and because of that transportation and logistics companies, particularly startups, are flocking to “Gig City.”

The area is ideally situated to move freight, and that has been a big reason for its popularity. In fact, according to a freight study by Cambridge Systematics, Chattanooga ranks No. 1 of all metropolitan cities when it comes to freight movement. The Thrive 2055 study, commissioned by the Chattanooga-Hamilton County Transportation Planning Organization, found that approximately 80% of all the nation’s freight travels through Chattanooga on its way to its final destination. This is due in large part to the convergence of three Interstates – I-75, I-24, and I-59.

Click to enlarge graphics

Some 81.5% of all freight transportation spend is in the U.S. trucking and logistics markets and there are approximately 500,000 active trucking companies, 3.5 million drivers and 16,000 freight brokers in the country. And Chattanooga is right in the center of all this, making it easy to see why it is getting a reputation for being part of “Freight Alley.”

The study also found that 42% of the region’s employment and 40% of its economic output ($6.6 billion) was related to “logistics-dependent” companies involved in manufacturing, transportation and warehousing, construction, mining, agriculture, retail/wholesale trade, and utilities. The report predicted that the dependence on these businesses would grow in the future. Additionally, 80% of the U.S. population is within a two-day truck transit time from Chattanooga.

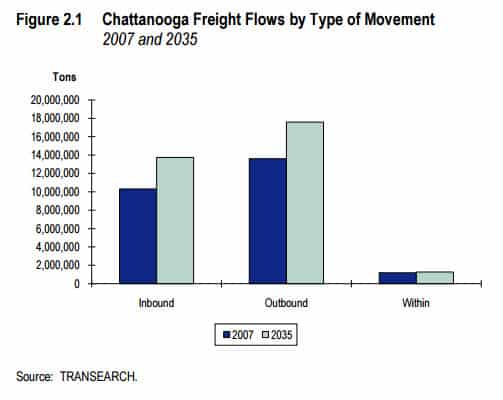

“Total freight volume (by weight) in Chattanooga will grow from about 25 million tons in 2007 to 33 million tons in 2035, despite the recent recession,” the report notes. “Most of this freight will be inbound or outbound, reflecting Chattanooga’s position as a regional distribution center, manufacturing base, and freight hub.”

Where is Freight Alley?

Freight Alley is not actually an alley, instead it is an area that roughly defines freight traffic moving throughout the Atlanta-Birmingham-Chattanooga area.

Click to enlarge

In many ways, Chattanooga is the centerpiece of Freight Alley and it has several benefits going for it, including fast Internet (it is ranked 6th in the world, offering 10 gigabit speeds) and transportation expertise. The area is home to well more than 50 freight-related entities, including major carriers such as U.S. Xpress, Covenant Transport, Western Express, P&S Transportation, Boyd Bros. and CRST Malone. Coyote also has a significant presence in Chattanooga by way of the acquisition of Access America in 2014. Lipsey Logistics, originally funded by a water company executive out of Atlanta, established its logistics home in Chattanooga primarily because of the talent-base that is found in Chattanooga. Lipsey is widely regarded as the leading FEMA broker in the U.S., providing natural disaster logistics for federal and state governments.

UPS, FedEx, AmeriCold, Kenco, Averitt Express, OHL, Saia, Forward Air, and LandAir also call Freight Alley home. Ingram Barge, the largest barge company in the U.S., is also located in Nashville (See chart for a more complete listing of companies).

And there is the nearby University of Tennessee-Knoxville, which is ranked as the No. 3 university in the nation for logistics. Georgia Tech also has one of the most respected supply-chain programs in the country, ranking at No. 5 in the U.S and is widely respected as one of the top data-mining and business intelligence universities in the world using applied scientific principles in its supply-chain research and education.