Labor challenges and equipment “bottlenecks” throughout the supply chain limited freight shipments in July but costs surged again, largely due to those capacity headwinds, according to data released by Cass Information Systems Thursday.

The shipments component of the Cass Freight Index (NASDAQ: CASS) declined 3.1% (seasonally adjusted) from June but remained 15.6% higher year-over-year and 0.5% higher than July 2019. Part of the decline was due to weaker rail shipments as chassis shortages hamper intermodal freight flows and vehicle production remains constrained by parts and semiconductor shortages.

However, freight costs remain historically high. The expenditures index was up 43.1% year-over-year and 22.7% above the 2019 period. An index reading of 3.51, down 4.8% (seasonally adjusted) sequentially, was the second-highest reading in the 30-plus year history of the dataset.

| July 2021 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | 15.6% | 0.5% | -4.4% | -3.1% |

| Expenditures | 43.1% | 22.7% | -5.9% | -4.8% |

| TL Linehaul Index | 13.4% | 6.9% | -0.8% | N/A |

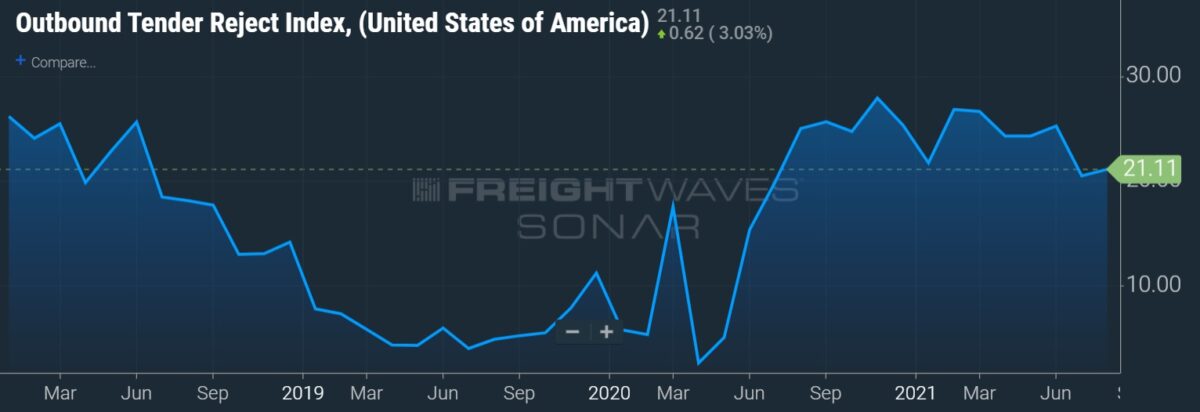

The increase in the expenditures component was mostly driven by elevated transportation rates as the industry struggles with a lack of workers, including drivers, and the chassis and containers needed to move the freight.

Inferred freight rates, expenditures divided by shipments, increased 23.8% year-over-year in the month and were 40 basis points ahead of the year-over-year growth rate recorded in June. Sequentially, inferred rates dipped 2.3% (seasonally adjusted), which was a modest giveback of the 12.3% advance posted in June.

A change in mix toward smaller, low-cost less-than-truckload shipments was noted as the likely catalyst for the decline. Looking forward, rates are expected to remain elevated given capacity shortages but the growth rates are likely to cool.

“Tougher comparisons in the coming months will naturally slow these y/y increases further, but extraordinary growth rates will continue in the near-term, driven by increases in both shipment volumes and freight rates,” Tim Denoyer of ACT Research stated in the report.

Cass’ truckload linehaul index, which captures changes in per-mile TL linehaul rates excluding the fluctuations in fuel and assessorials, increased 13.4% year-over-year and was 6.9% higher than July 2019. The index was down 0.8% from June but “we would caution shippers not to get too excited and carriers not to worry too much, as this appears to be due to mix rather than a trend change,” Denoyer said.

An increase in length of haul was cited as a detractor as many shipments are being transloaded by truck off the West Coast due to port congestion and slower rail service. Per-mile rates typically step lower on longer distances.

“By contrast, the public truckload carriers saw length of haul continue to decline in their recently reported Q2 results, and their rates, in revenue per mile, net fuel, showed a 17.6% y/y increase,” Denoyer said. “From our perspective, the mix-neutral truckload market rate increase was somewhere between this and the 13.6% y/y increase in the Cass Truckload Linehaul Index in Q2.”

He expects the linehaul index will remain high in the near term and that rates will see upward pressure as rail service improves and TL lengths of haul return to normal.

Looking ahead

Denoyer said volumes are likely to see continued pressure due to capacity constraints but the “outlook for this peak season is clearly strong.” Heightened consumer demand and 121 containerships awaiting a berth at a North American port were pointed to as supportive of future shipments.

“Freight demand fundamentals remain strong, based on a cash-flush U.S. consumer balance sheet, tight inventories, and an industrial sector struggling to grow into record orders with fiscal stimulus likely on the way,” Denoyer said.

He said recent ACT data shows the very tight driver market is turning as drivers “are starting to come back in greater numbers.” However, “recent early signs of momentum in hiring could be interrupted by new COVID-19 variants.”

Data used in the Cass indexes is derived from freight bills paid by Cass, a provider of payment management solutions. Cass processes $26 billion in freight payables on behalf of more than 8,000 subscribers annually.