The headlines were attention-getting: crude prices go negative. As was widely reported on Monday night, the futures price of a barrel of West Texas Intermediate (WTI) crude oil for May delivery settled at negative $37.63 – a drop of $55.90 from its $18.27/barrel settlement price on April 10.

What this means is that if you owned a futures contract on a long position on Monday, you paid the buyer of that contract $37.63 to take delivery of the oil. What it doesn’t mean, though, is that truckers will be getting paid to fill up their trucks.

“With demand collapsing because of COVID-19 and Saudi Arabia and Russia involved in a now theoretically completed price war with no restraint on production, it means that crude supply was far outstripping demand,” wrote John Kingston, FreightWaves Market Expert on oil, in a Freightwaves.com article.

The collapse of crude prices have made it profitable long term for storage facilities to load up on cheap oil, but when more oil is set to be delivered, and there is no place to put it, the price collapses.

“So any trader that went into today’s trading with a long position had the real risk of having crude delivered to them with no place to put it,” Kingston wrote. “They had to sell to somebody with storage or had to close out their long position with somebody who had a short position. Clearly, a lot of traders with long positions had held out doing that earlier, hoping the market would reverse. When that didn’t happen, it was a race to the exits.”

And a price collapse. That collapse, though, does not necessarily translate into lower diesel prices because diesel fuel is more traditionally associated with Brent oil, not WTI. Brent dropped only 8.83% and the resulting ultra low sulfur diesel (ULSD) fuel price drop was 6.85 cents, down to 88.78 cents a gallon. The price fell again today to close down another 16.09 cents a gallon at 72.69.

That is the lowest price since April 2004, but not zero.

Breakthrough Fuel, which supplies fuel market products to shippers, explained in a blog posting that refineries shutting down combined with the essential work trucking is doing has helped prop up diesel prices, which nonetheless are still the lowest they’ve been since January 2016.

The wholesale price of diesel is $1.60 per gallon, as of Tuesday, Breakthrough reported.

“We expect the behavioral disconnect between crude oil and diesel to continue under current market conditions,” the firm wrote. “Diesel prices will likely hold stable based on demand persistence and measures taken at the refinery level.”

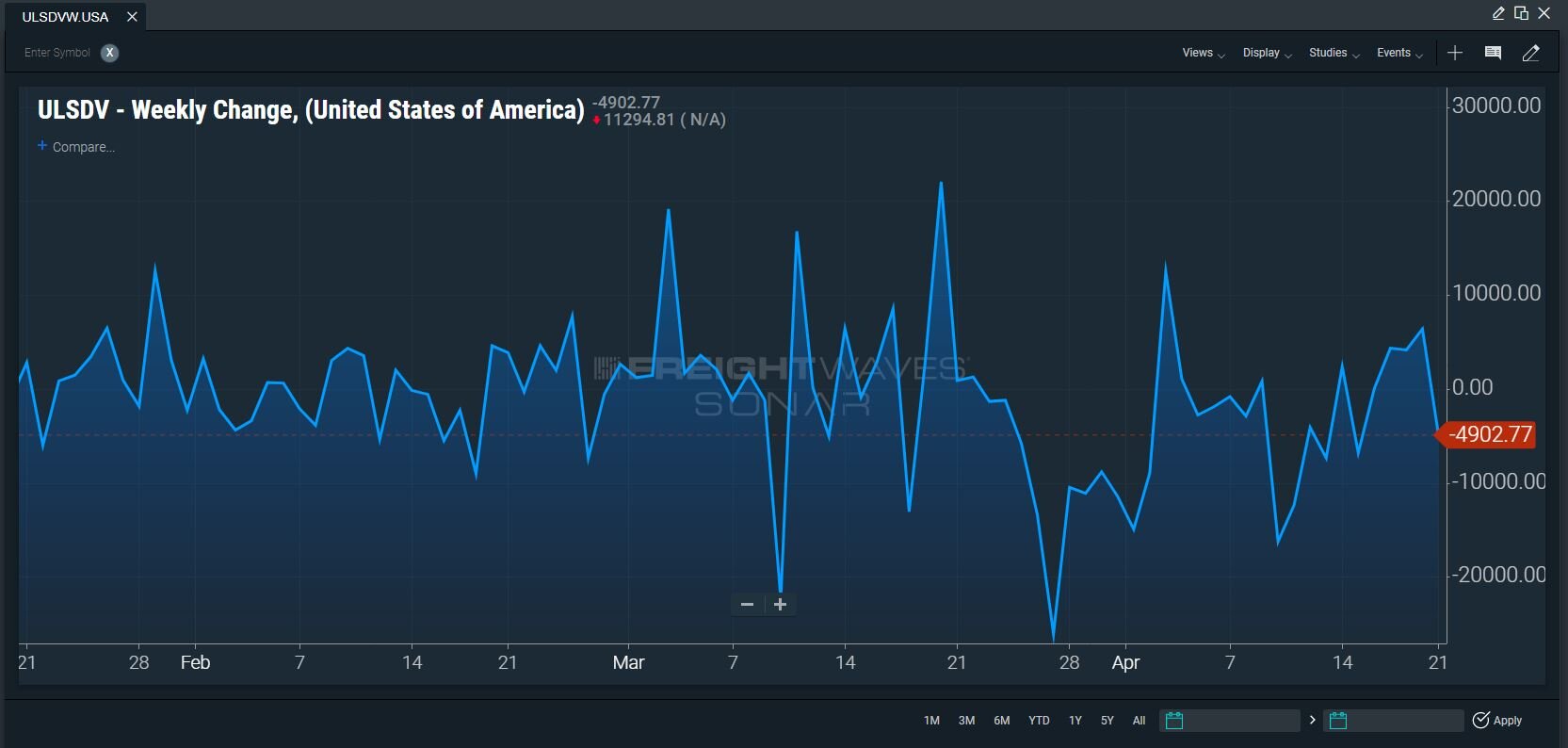

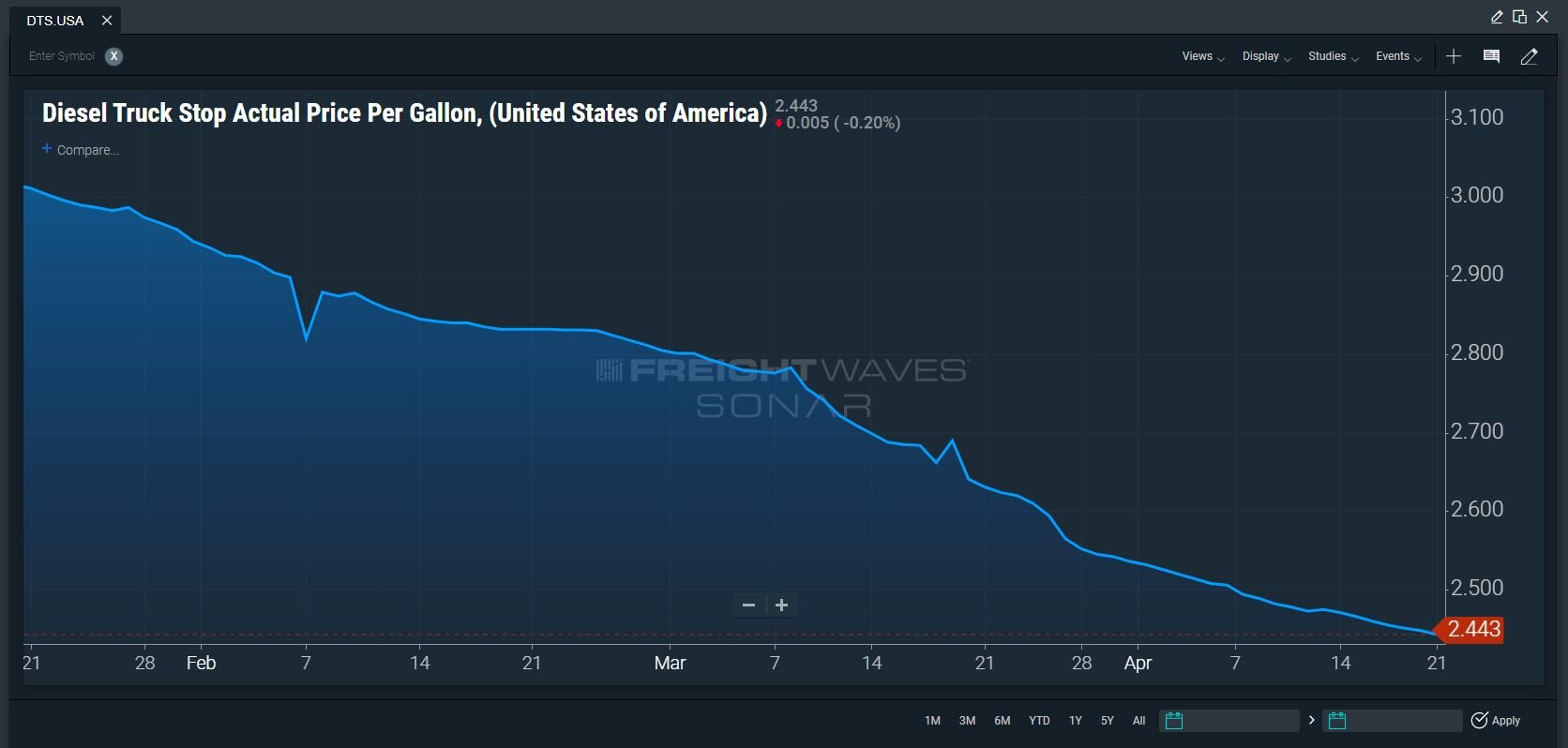

Data within FreightWaves SONAR platform shows that ultra low sulfur diesel fuel volumes (SONAR: ULSDVW.USA) have been on a rollercoaster ride since March 1, rising and falling. As of April 21, volumes are down 4,902 gallons to 11,294.81 gallons. At the same time, the price of diesel fuel at truck stops nationwide, as displayed in SONAR’s diesel truck stop actual price per gallon chart (SONAR:DTS.USA), has been on a steady decline. As of April 21, the price was $2.44 per gallon, down from $3.01 on Jan. 21.

The future price of diesel at the pump could be buoyed as some states – Georgia, Florida, Texas and Tennessee among them – begin to reopen their economies which would drive up demand for gasoline and diesel. The June futures contracts for WTI is reflecting some of this anticipated demand, trading above $20 a barrel, although it did fall 18% on Monday.

Tom Kloza, an oil analyst with Oil Price Information Services, told MSN the drop is “inside baseball.

“We’ll continue to see gasoline prices, diesel prices and jet fuel prices drift lower into May but one shouldn’t conclude that we’re going to see fuel given away or that we’re going to match these incredible, unprecedented drops we saw in crude oil today,” he said.

Where the price ends up will depend on demand and how quickly the stockpiles of oil can be burned off, something no one is able to accurately predict at this point.