Truckload carrier Heartland Express leveraged record rates and gains on equipment sales to post earnings per share of $1 in 2021, an all-time high for the company since it began trading publicly in 1986. Cost inflation was more than offset by pricing and gains, producing an 80.2% adjusted operating ratio for the full year.

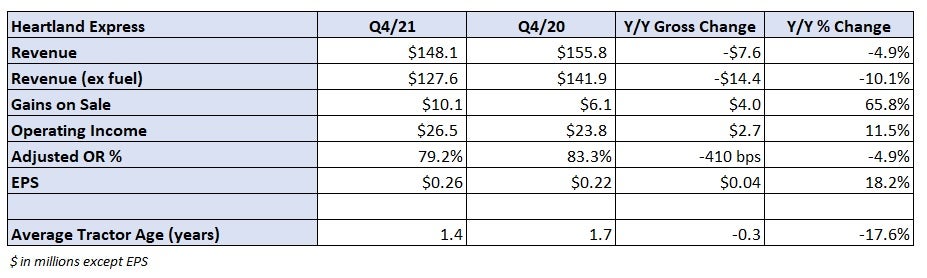

Earnings in the 2021 fourth quarter came in at 26 cents per share, 4 cents higher year-over-year and in line with analysts’ expectations, Heartland (NASDAQ: HTLD) announced Thursday.

“2021 presented us with many unique challenges and opportunities. Heartland’s financial strength and discipline allowed us to take advantage of market opportunities, which are reflected in our financial results,” CEO Mike Gerdin stated in a press release.

Revenue in the quarter was down 5% year-over-year at $148 million, 10% lower excluding fuel surcharges. Higher TL rates and gains on sale were only partially offset by fewer miles driven, which was the result of driver recruiting and retention headwinds. The carrier does not provide any operating metrics around utilization and pricing.

As a percentage of revenue, expenses moved lower on most lines of the P&L, with fuel being the obvious exception. Adjusting for fluctuations in fuel surcharge revenue, the fourth quarter produced a 79.2% OR, 410 bps better year-over-year.

A surge in used equipment values, the result of production delays at the original equipment manufacturers due to parts shortages and labor disruptions, pushed gains on sale to $10 million, $4 million higher year-over-year. Excluding the increase, the adjusted OR would have been roughly 300 bps worse and EPS would have been 4 cents lower.

“Throughout 2021, freight demand was strong and we were able to capitalize on rising freight rates and better utilization across our operating fleet,” Gerdin continued. “2021 was an extremely challenging year for hiring and retaining professional drivers. We implemented creative compensation packages and driving opportunities to better attract and retain drivers.”

Headwinds at the OEMs didn’t keep Heartland from replacing equipment. The company’s average tractor age fell to 1.4 years from 1.7 years at the end of 2020. Heartland has been working to update the fleet at Millis Transfer, which it acquired in 2019.

“We continued to refresh our fleet of revenue equipment and also focused on significant renovations and upgrades across our terminal locations to provide updated facilities and comforts for our drivers,” the press release said.

The carrier ended the year with $158 million in cash, a 39% year-over-year increase, and no debt. Cash flow from operations was $123 million in 2021, $78 million of which was used to pay dividends and repurchase stock.

“Looking forward, we expect more of the same from the freight environment with strong demand for goods across the board in 2022. Increasing costs are expected to continue to drive increasing freight rates throughout the year,” Gerdin concluded. “Further, we believe that the expected environment in 2022 will continue to be a challenge for supply chains but should reward carriers who operate from a strong financial position.”

The FREIGHTWAVES TOP 500 For-Hire Carriers list includes Heartland Express (No. 35).

Click for more FreightWaves articles by Todd Maiden.

- P.A.M. Transportation posts big Q4

- Prologis: Logistics real estate vacancies will see all-time low in 2022

- All J.B. Hunt segments log growth for better-than-expected Q4