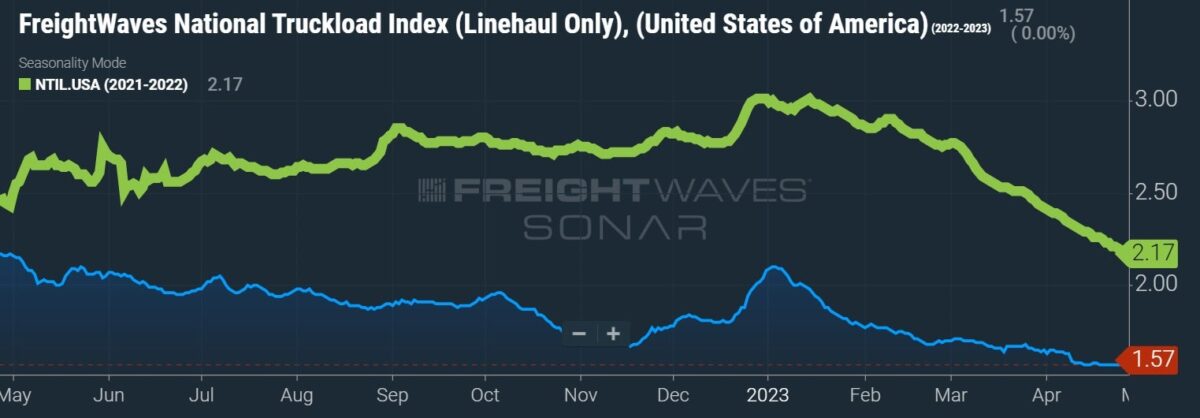

Freight broker Landstar System said Thursday the soft trends it experienced in the first quarter are actually a little worse so far in April. The company expects normal seasonal freight patterns to return in May but that is only because April has been so weak.

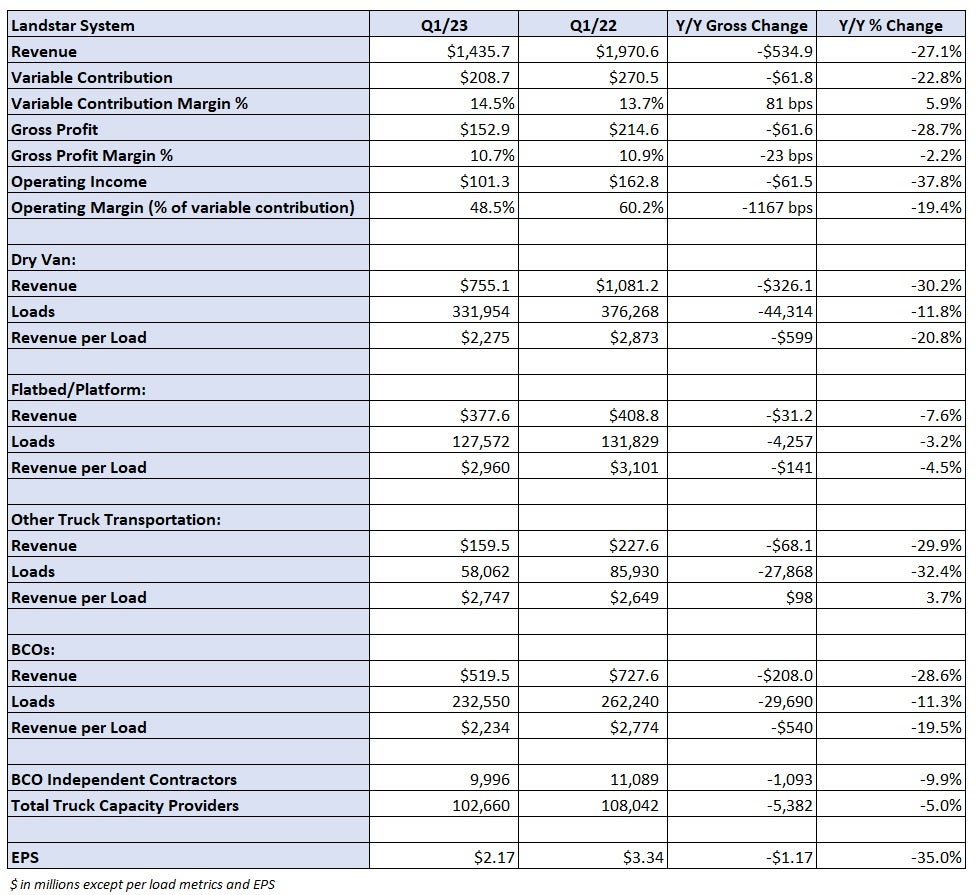

Revenue per load on loads hauled by truck was down 14% year over year (y/y) in the first quarter. The company expects the metric to step down between 1% and 3% sequentially in the second quarter. The weakness is broad based but more pronounced for consumer-related, dry van freight.

Dry van loads on the platform fell 12% y/y, with flatbed loads off just 3%. A loose dry van market with depressed spot rates resulted in a 21% y/y decline in revenue per load compared to just a 5% decline in flatbed revenue per load.

The y/y comparisons were to Landstar’s record first quarter 2022, when February marked the peak of the cycle for the company.

President and CEO Jim Gattoni said on a call with analysts that industrial end markets are holding up better than consumer-related freight demand. Total revenue from categories like metals and building products was down in the mid-20% range during the quarter while revenue from consumer durables (down 34%), foodstuffs (down 40%) and substitute linehaul (down 57%) was off more steeply.

Gattoni said part of the reason the flatbed business has seen a more muted decline is due to the fact it didn’t see the highs the dry van market did.

He thinks rates are pretty close to a bottom now.

Landstar normally sees a big gap in flatbed and dry van rates, with flatbed rates roughly 40-70% higher on average. The gap closed to just 25% in the first quarter of 2022, “as close as I’ve ever seen it.” Now it’s back to a 60-70% gap.

“I’m pretty comfortable saying that we probably see normal trends flow in after this second quarter … based on my theory of normal cycles.”

Landstar has experienced a downward pricing trend for the last 13 to 14 months and Gattoni said that the entirety of most cycles is only 18 to 24 months.

“I’m a believer in the cycle. It happened through the pandemic and I think it’s going to happen again.”

He said cost inflation for carriers is a key reason rates are likely bottoming.

“You just see relative stability. I’ve got 10 years of trends and our trends are performing at below historical norms — but not so absurdly that I’m worried that I’m going to go below pre-pandemic [rates].”

Revenue per mile on dry van loads hauled by business capacity owners (BCOs), which is a cleaner metric as it excludes fuel surcharges, was 26% lower y/y in the quarter. However, those rates were still 30% above the 2020 first quarter.

Landstar (NASDAQ: LSTR) reported earnings per share of $2.17 after the market closed Wednesday, 10 cents better than the consensus estimate but $1.17 lower y/y. The result was 2 cents above the high end of management’s guidance range.

Consolidated revenue fell 27% y/y to $1.44 billion, in line with management’s prior outlook, as total loads hauled by truck declined 12% and revenue per load was down 14%. The sequential decline in revenue per load from the fourth quarter was just 3.5%, roughly half the rate of decline the broker normally experiences.

Total truck capacity on Landstar’s platform was down 5% y/y with trucks provided by BCOs down 9% y/y (4% lower than in the fourth quarter).

Variable contribution, or revenue less purchased transportation and agent commissions, declined 23% y/y to $209 million. The contribution margin was up 80 basis points to 14.5% as purchased transportation costs as a percentage of revenue declined 200 bps.

Q2 guidance falls short

The company expects second-quarter revenue of $1.4 billion to $1.45 billion, compared to consensus revenue of $1.5 billion at the time of the print. The revenue guide implies a y/y decline in revenue of 28% as loads hauled by truck are forecast to decline between 14-16% with revenue per load off 12-14%.

Earnings-per-share guidance of $1.90 to $2 was well short of the $2.17 consensus estimate. The company’s annual convention in April and higher employee benefits costs in the second quarter are some of the reasons for the sequential decline from the first quarter.

“Landstar has no reason to believe history won’t repeat itself and we look forward to achieving higher highs when the freight economy turns,” Gattoni concluded.

More FreightWaves articles by Todd Maiden

- Old Dominion’s Q1 miss sends LTL stocks lower

- Teamsters add seat on Yellow’s board

- Yellow, Teamsters to hash out operational changes by reopening NMFA early

Real Deal Holyfield

Guess they need at add more eastern European agents to double broker loads in order to recoup those losses.

SURE SHOT LOGISTICS, LLC

OH IS THE DOUBLE BROKERING DOWN IN APRIL?