Freight markets pulled back a bit last week as expected. The 4th of July is typically a week where shippers will push less volume off their docks as many take time off for the holiday. We should see a slower July in the near term, but the small contraction is not anything carriers need to be concerned about.

We discussed the July retraction in the freight markets last week when we discussed the Cass Shipment Index (SONAR:CFIS.USA), an index that measures the total shipment volume in America. The Cass Shipment index shows over the last 10 years (save for a single July in 2016) has a small reduction in shipment volumes each year versus June. There are multiple reasons for this reduction.

One of the main reasons volumes retract is the overheated inventory push that occurs in May and June for retail outlets to be ready to capture sales when consumption peaks. Just like many human behaviors, nothing happens at an even pace. As consumption happens more rapidly, production and shipping must anticipate the quickening pace. Just like a sprinter, this overactive production is not sustainable over long periods as no one is staffed to handle these surges for long periods of time.

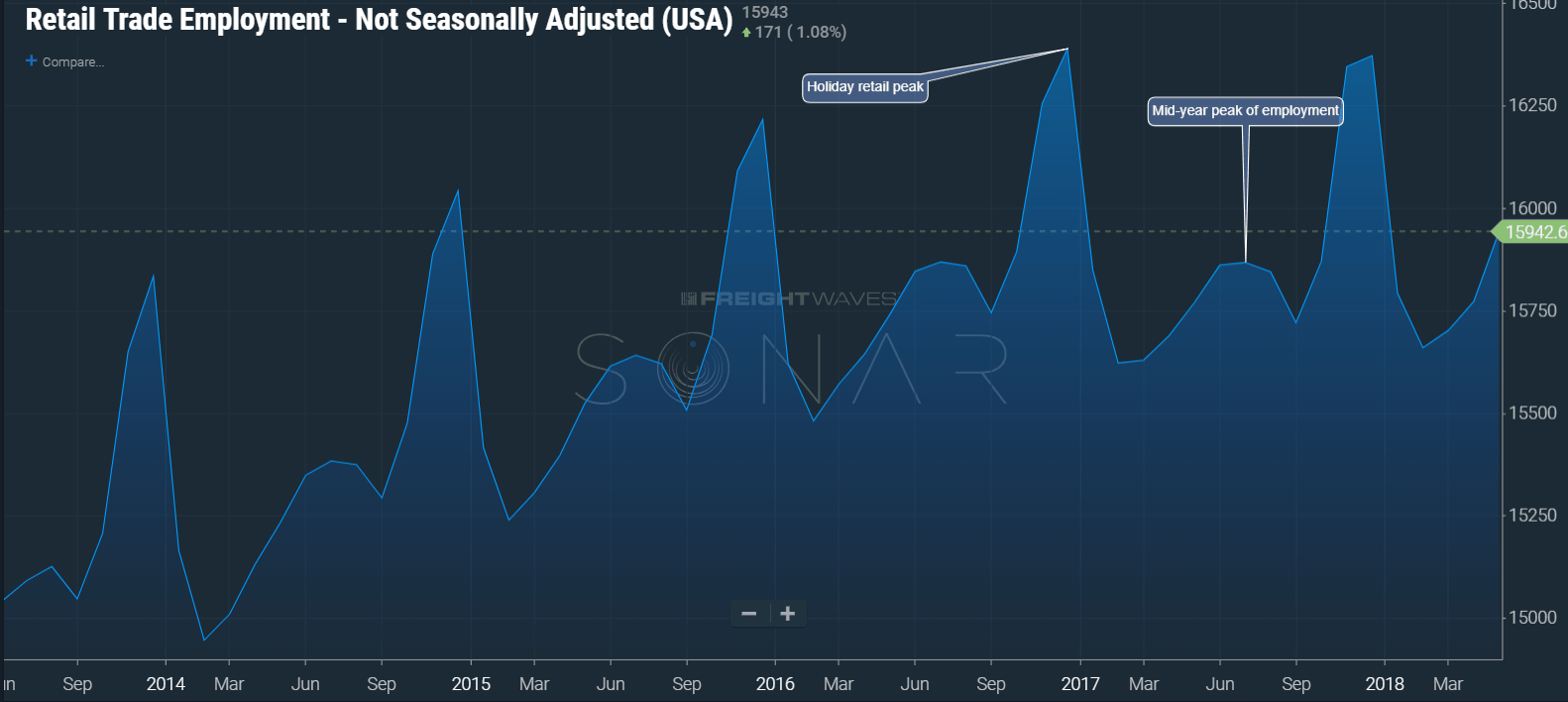

July tends to be a miniature version of the retail explosion we see at the end of the year between Thanksgiving and Christmas. People are more active in the warmer months and spend more time outside. The natural tendency means they will also be more active consumers. This seems like common sense, but hard data validates it as well. In SONAR we have data available for seeing the broader economic trends such as the Bureau of Labor Statistics (BLS) Employment level data.

The BLS Employment level data is a good way of seeing what the broader economic conditions are in broken out segments of the economy. Employment trends tend to mirror activity in their industries. If a segment is doing well or growing more people are employed. In the 5-year chart above, illustrating the Retail Trade Employment levels without seasonal smoothing (SONAR: REEN.USA), you can see each July has a mid-year bump in retail employment levels corresponding with summer peaks of seasonal sales.

What this means for freight is shippers tend to be in a rush to get volume on the shelves prior to the mid-summer season peaks as they do in the winter holiday season. The retail employment pattern does not correlate perfectly to total shipping patterns, but it does explain a big part of seasonal shipping cycles.

The retraction in volumes is reflected in the national tender rejection index (SONAR: OTRI.USA), which fell for the 8th consecutive day to 23.62% this week after peaking at almost 27% at the end of June. The tender rejection index (TRI) is a measurement of carrier willingness to accept a load at a contracted rate. When the TRI decreases, carriers are more willing to accept their contracted rates. Carriers have trucks available and there is not other freight that pays more than the contracted rate available in a low or decreasing TRI scenario. I would not expect this movement to last as production comes back online to replenish dwindling inventories.

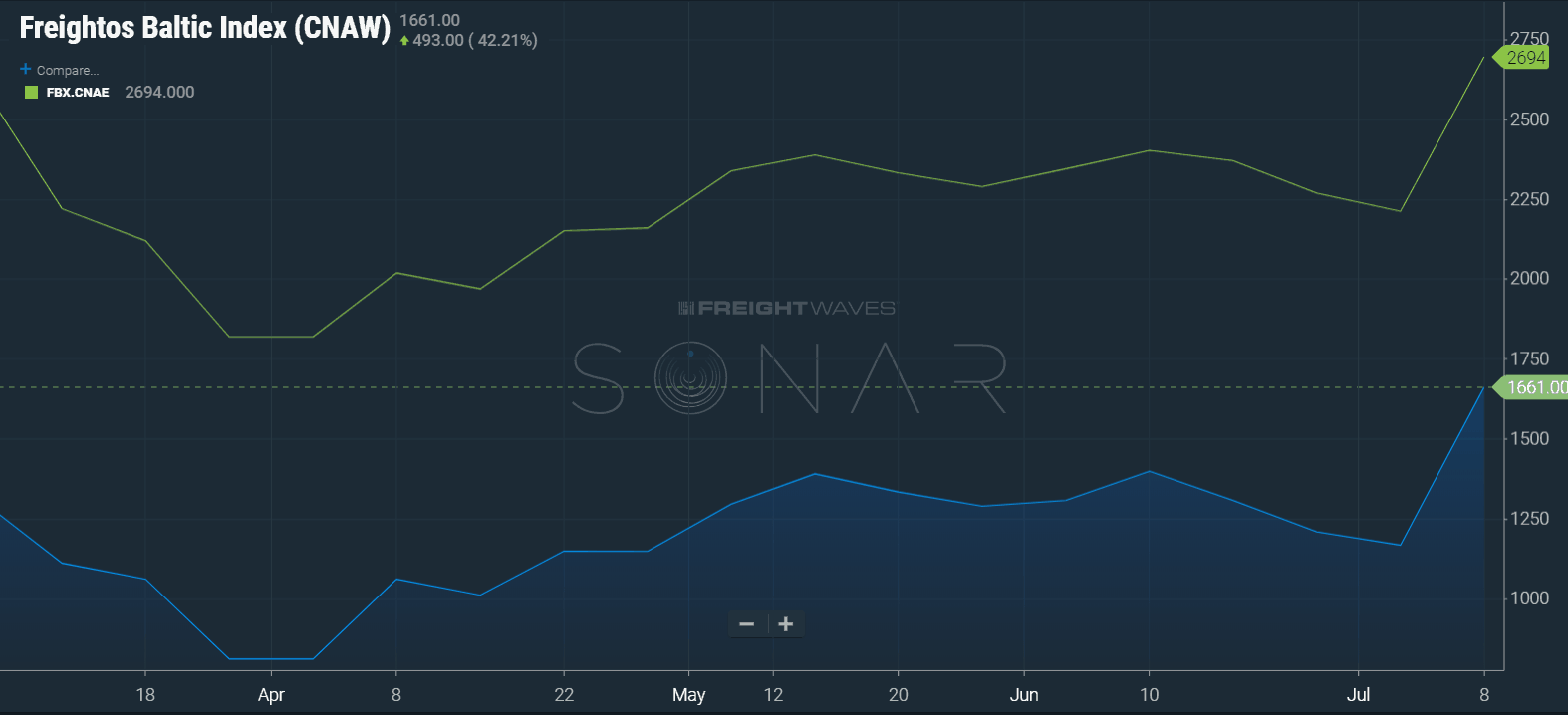

Another piece we are watching with looming trade war threats are containers and their subsequent pricing. This week the Freightos Baltic Exchange Indices from China to the North American coasts, a group of indices that measure 40-foot container spot rates shipping across the oceans, (SONAR: FBX.CNAW, FBXCNAE) spiked as overseas shippers are trying to push freight out in front of any future tariffs. The maritime carriers are probably taking advantage of the confusion to grab some additional revenue, creating a more exaggerated effect in the spot market. We will be watching the port city markets in the coming weeks to see if this is a short-lived event or something more long term.

Check out this week’s weekly market update video for a quick look at the overall market:

Check out this week’s weekly market update video for a quick look at the overall market.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.