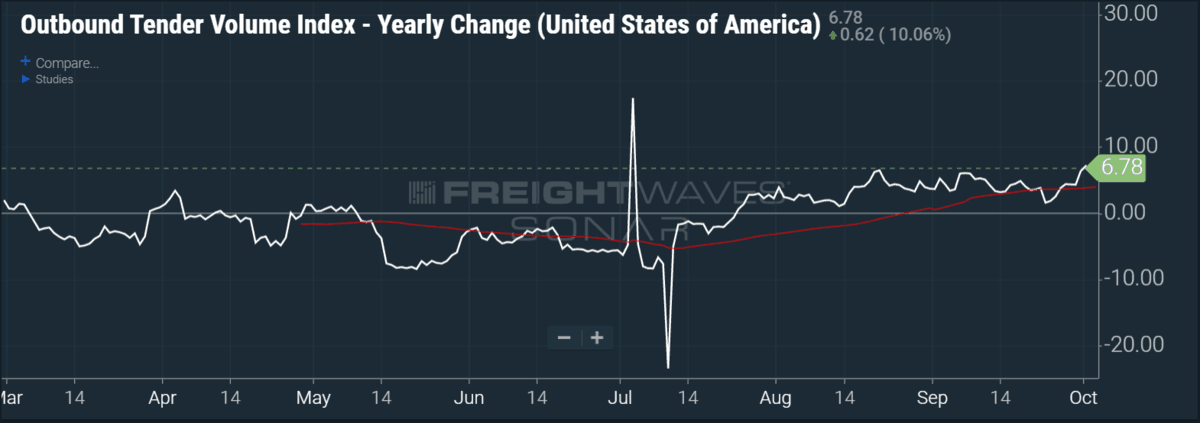

Outbound tender volumes (OTVI.USA) rose by 6.78% year-over-year this week, setting a year-to-date high in growth terms. This continues their upward trajectory and extends their multi-week winning streak dating back to late July, when OTVI first crossed over to positive on July 24. It has been positive on a year-over-year basis since.

Nationally, outbound tender volumes were up 6.78% year-over-year this week. Month-over-month volumes are tracking up 11.80% and week-over-week volumes slipped -3.31%. Overall, the volume picture remains extremely solid. Our optimism is tempered with one caveat: volumes fell off sharply in early October last year, meaning the current 6.78% year-over-year run rate is at least partially artificially inflated due to easy comparisons. We would expect volumes to continue to increase on a year-over-year basis through the end of the year – and definitely stay positive – but at a more measured pace than almost 7%.

On a market-by-market basis, only five out of the 15 major markets FreightWaves tracks were positive on a week-over-week basis, reflecting the -3.31% week-over-week decline for national outbound tender volumes. On the upside, Fresno led the way for the second straight week, up 3.58%, followed by Cleveland, up 3.11%, and Memphis, up 1.34%. Detroit volumes continue to be hammered by the UAW strike, falling 26.02% year-over-year and -16.28% week-over-week. Besides Detroit, on the downside, the worst markets week-over-week included Houston (down 13.68%), Newark (down 12.98%) and Miami (down 7.16%).

National rejection rates rise this week, uptrend intact

National tender rejections now sit at 5.30%. OTRI.USA briefly broke above the 6% level for the first time since March back on September 17 but have since taken a modest step back. On a week-over-week basis, OTRI.USA rose by 11 basis points (bps). Month-over-month, it is up 64 bps and year-over-year it is down 1,088 bps compared to 16.18% at this time last year. On a trending basis, OTRI.USA looks solid, having risen in seven out of the last nine weeks with tender rejections rising off of the 3.75% bottom experienced in mid-August. National tender rejections are a healthy 12.8% above their 60-day moving average.

Year-over-year comparables for national rejection rates are still extraordinarily difficult due to the daunting 2018 numbers in which rejections never fell below double digits. As a result, on a year-over-year percentage basis, OTRI.USA is down 67.24%.