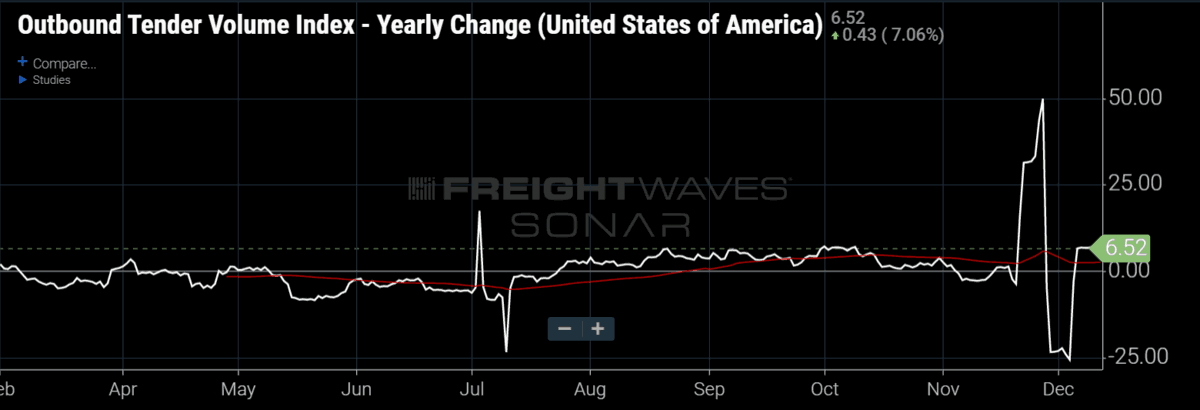

Outbound tender volumes (OTVI.USA) rose 7.48% week-over-week. Nationally, outbound tender volumes rose 6.52% year-over-year this week. Month-over-month volumes are up 7.06%.

It appears as though peak season has finally arrived and we are indeed having a peak season in 2019 thanks to a strong consumer.

Thirteen of the 15 markets FreightWaves tracks were positive on a week-over-week basis. Markets with the largest gains in OTVI.USA were: Savannah, Georgia (28.21%); Memphis, Tennessee (18.05%); and Laredo, Texas (17.16%). The two markets that experienced week-over-week drops were Los Angeles (-3.73%) and Fresno, California (-0.3%).

National rejection rates breakout to the upside persist

National tender rejections (OTRI.USA) are on a sustained tear, finishing up the week at 7.92%. While this is four basis points (bps) below last week’s finish, OTRI.USA has risen 239 bps in the past month.

OTRI.USA has now broken above the 6% level for four consecutive weeks.

On a year-over-year basis, rejections are still down 510 bps from 13.02% last year. On a trending basis, OTRI.USA continues to strengthen, having risen in 14 of the last 17 weeks, with tender rejections rising off the 3.75% bottom experienced in mid-August. National tender rejections have now moved comfortably above their 60-day moving average by 29.62%.

Year-over-year comparables for national rejection rates are still difficult due to the daunting 2018 numbers when rejections never fell below double digits but are on the precipice of starting to ease. As a result, on a year-over-year percentage basis, OTRI.USA is down 39%. As can be seen in the chart below, comparisons start to ease soon though in the January and February 2020 time frame.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@www.freightwaves.com, Seth Holm at sholm@www.freightwaves.com or Andrew Cox at acox@www.freightwaves.com.

Check out the newest episode of the Freight Intel Group’s podcast Great Quarter, Guys here.