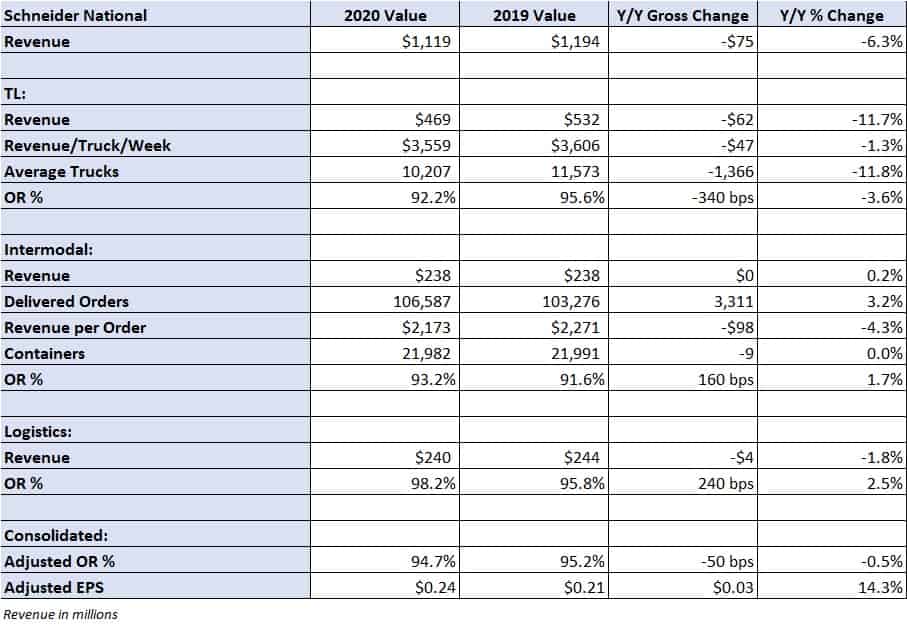

Schneider National (NYSE: SNDR) reported adjusted earnings per share of $0.24, well ahead of the consensus forecast of $0.19.

Total revenue declined 6.3% year-over-year to $1.12 billion. The bulk of the revenue decline was attributed to the closure of its First to Final Mile (FTFM) offering and the loss of a large customer in the company’s import/export segment.

The truckload (TL) segment reported an 11.7% year-over-year decline in revenue largely due to a similar decline in average trucks in service due to the closure of FTFM. Revenue per truck per week was 1.3% lower at $3.559. The division’s operating ratio improved 340 basis points to 92.2% even with a $7.6 million decline in gains on equipment sales compared to the prior year. Schneider lost $4.8 million on the disposal of equipment in the quarter. However, the closure of FTFM presented a tailwind during the first quarter of 2020 as that division operated at a $12.1 million loss in the comparable period of 2019.

Management still expects the second quarter to be the worst of the COVID-19-related downturn, with steady improvement occurring in the back-half of the year. Schneider’s TL volumes are down upper single-digit percentages in late April, with intermodal volumes down in the upper teens.

Commenting on current trends, Schneider CEO and President Mark Rourke said, “while there is still much to play out, we are starting to see encouraging signs that some impacted customers and suppliers are in the process of reopening or ramping up their operations.”

Schneider has suspended its 2020 earnings guidance given the “uncertainty regarding the timing and pace of recovery.”

Shares of SNDR are down a little more than 1.5% in early trading.

The company will host a conference call to discuss these results with analysts and investors today at 10:30 a.m. EDT.