The COVID-era freight boom has accelerated the transformation of Maersk from a shipping line into a one-stop, end-to-end global logistics shop.

Maersk has used extreme market conditions to bring more ocean customers into long-term — and increasingly multi-year — contracts. Simultaneously, it has deployed windfall profits toward non-ocean acquisitions. On Tuesday, Maersk announced its latest purchase: Germany freight forwarder and airfreight specialist Senator International.

“The pandemic is helping us accelerate the [global logistics] integrator strategy,” affirmed Maersk CEO Soren Skou during a conference call on Tuesday.

“The third quarter was the best quarter in the history of the company and we’re actually delivering a quarter that is better than the best year for the company,” he continued, reporting that both Q4 2021 and Q1 2022 will be on par with the third quarter’s record performance “as demand remains strong as far out as we can see in our booking data.”

Senator acquisition

As its ocean-carrier competitors fill Asian shipyard slots with new orders, Maersk continues to spend its own capital on something other than new vessels.

Earlier this year, Maersk acquired e-commerce companies HUUB, Visible MSC and Europe B2C. Now, Maersk will purchase Senator International in a deal with an enterprise value of $644 million. Airfreight represents 65% of Senator’s revenues.

In addition to buying Senator, Maersk purchased two new Boeing 777 freighters to be deployed in 2024, as well as three leased three Boeing 767-300 freighters to begin service next year. The freighters will be operated by Maersk’s in-house air operation, Star Air, which currently has 15 aircraft.

The latest moves by Maersk will double its air volumes, and comes on the heels of CMA CGM’s decision to order two 777s and launch an air division next year.

Rate gains drive results

As in previous quarters, negative congestion effects on Maersk’s volume were far outweighed by rising freight rates.

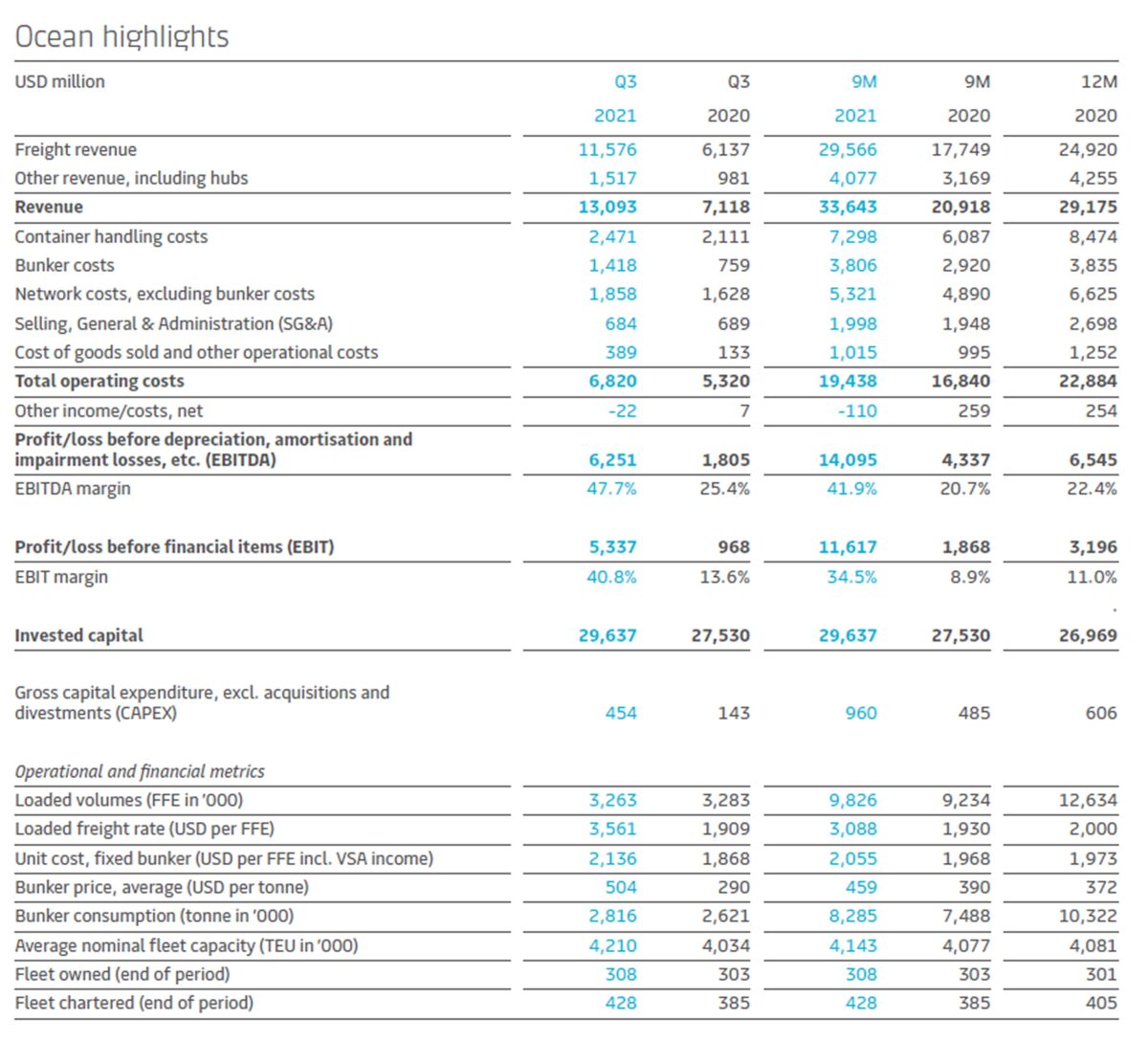

Maersk reported net income of $5.45 billion for Q3 2021 compared to $1.04 billion in Q3 2020. Earnings before interest, taxes, depreciation and amortization were $6.94 billion, up from $2.4 billion the year before and $5.06 billion in Q2 2021.

In the ocean division, EBITDA was $6.25 billion in Q3 2021, up from $1.81 billion the year before and $4.4 billion in Q2 2021.

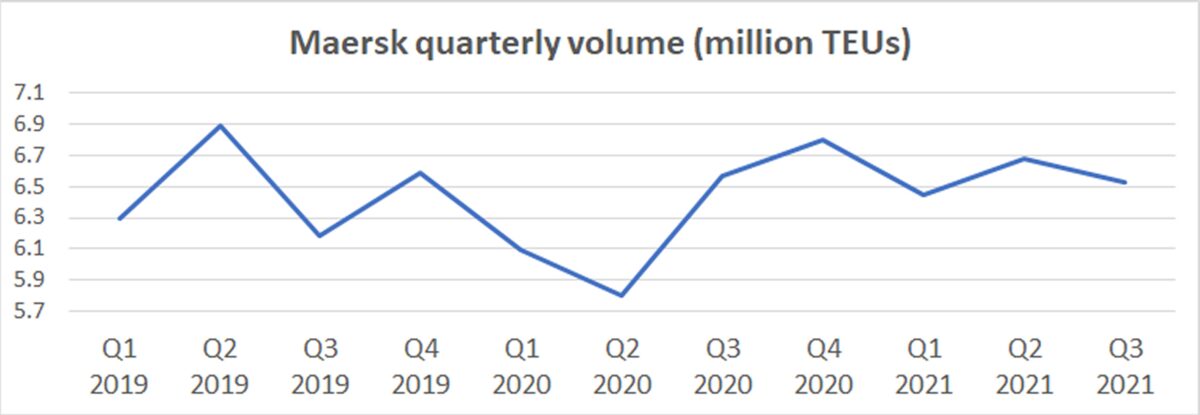

Maersk carried 6,526,000 twenty-foot equivalent units in the latest period, a decrease of 0.6% year on year and down 2.3% from Q2 2020 — despite the fact that Maersk’s fleet size increased in the third quarter versus the second. Maersk CFO Patrick Jany pointed out that volume in Q3 2021 was down 4% from Q3 2019, pre-COVID.

“That’s not due to lack of demand, that’s due to congestion and bottlenecks,” stressed Jany. “We cannot ship everything we have on the books because our vessels are in a big traffic jam.” Maersk executives estimated that about 10% of the company’s fleet is currently stuck in queues.

But rising freight rates more than offset volume headwinds. Maersk reported an average freight rate of $3,561 per forty-foot equivalent unit, including both spot and contract rates over all lanes, up 87% from a year ago and 17% higher than rates in the second quarter.

Focus on long-term contracts

Long-term contract coverage is a major element of Maersk’s strategy.

According to Skou, “A key pillar in building a more stable, higher quality ocean business is to develop stronger, long-term customer relationships, where we provide differentiated value propositions catering to the specific needs of each customer, tying the whole thing together with integrated end-to-end logistics solutions. We also want to reduce our exposure to the transactional and commoditized short-term port-to-port market, where we are a price taker and subject to wide swings in spot rates.”

Skou reported that Maersk has grown its long-term contract business in absolute volumes by more than 40% since pre-COVID. In 2022, 7 million FEUs — more than 65% of Maersk’s long-haul volume — will be on long-term contracts, with another 1 million FEUs from regional trades.

Maersk’s global average contract rate rose by 50% to around $3,000 per FEU this year, and is expected to rise again next year, albeit by a smaller percentage.

Skou said that Maersk “will be substantially done with contract negotiations” by February, “well ahead” of the normal deadline of May for trans-Pacific trade. “Frankly, we’re going to be done early this year,” he disclosed, referring to 2022 contracts, including Asia-U.S. contracts.

Maersk now has 1.4 million FEUs of its long-term business on multi-year contracts, up from 1 million FEUs previously. Skou said that the majority are at fixed rates for the first year, and in subsequent years, have fixed floors and ceilings with either yearly or half-yearly adjustment mechanisms.

Click for more articles by Greg Miller

Related articles:

- No relief from ‘ridiculously expensive’ container shipping rates

- ‘Seismic change’: Maersk commits to long-term relationships with shippers

- Shippers fear ‘catastrophic’ fallout from ‘crazy’ California port fees

- How high can container shipping profits go? Will 2022 top 2021?

- Container shipping’s ‘hockey stick’: Liner profits just keep on climbing