The retail customer journey has been changed forever. No longer is going to a physical store and browsing the aisles the only method of shopping. More browsing than ever is taking place online, more sales than ever are occurring in digital spaces and more pressure on retailers is driving change – and new challenges – that continue to alter the shopping experience.

Understanding these changes are key to creating successful customer journeys. More importantly, though, is understanding what the modern consumer seeks. A series of recent reports provide some insights into the consumer of 2021 and what they say is important to them, giving retailers and brands a road map to fulfilling consumer needs.

The face of the online consumer

In Jungle Scout’s Q1 2021 Consumer Trends Report, consumers reported that free shipping was the top reason to shop online. That jumped up from the fourth spot in the Q4 report, suggesting shipping cost was less of a factor during the busy holiday season. Lower prices, which was sixth in the Q4 report, jumped up to No. 2 in Q1. Convenience was third in Q1 after topping the survey in Q4.

The report, which surveyed 1,005 U.S. consumers Jan. 26-29, 2021, found that 46% of consumers leave items in their online cart and forget about them, suggesting brands have some work to do to convert these customers.

When it comes to which online retailers are most popular, it’s no surprise that Amazon (NASDAQ: AMZN) topped the list, with 73% of respondents saying they shopped at Amazon.com at least once in the past three months. Amazon was followed by Walmart (NYSE: WMT) at 40%; eBay (NASDAQ: EBAY) and Target (NYSE: TGT), 18% each; and Kohl’s (NYSE: KSS) and Apple (NASDAQ: AAPL), 10% each.

When it comes to returns, 31% of respondents said they would return a product bought from an online store. That number increased slightly, to 32% for Amazon shoppers, but both numbers remained below the 37% who said they were likely to return an item at a physical store.

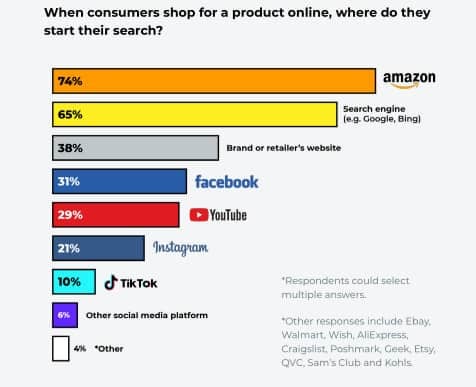

Consumers looking for items often start with Amazon, with 74% of them saying that is their first online stop. Search engines were popular as well, with 65% saying that’s where they start researching items. A brand or retailer’s website was cited by 38% followed by social networks Facebook, 31%; YouTube, 29%; Instagram, 21%; and TikTok, 10%. (Note: Respondents could select multiple answers.)

When it comes to getting a product in a timely manner, though, the clear choice is Amazon, with 64% saying they turn to Jeff Bezo’s platform.

Nearly three-quarters of consumers – 73% – believe the majority of shopping will happen online in the future and 43% said they would be fine if they never shopped in a physical store again. A full 58% of consumers shop online at least once a week if not more.

When it comes to price and shipping considerations, 68% of all consumers said they are looking online for the item with the lowest price, but 48% said they would pay more for that item if it came with faster shipping. Interestingly, of Amazon shoppers, 55% said they would pay more for faster shipping even though the company already offers free shipping for most items for Prime members.

Shipping trends

A SOTI Bricks to Clicks report found that last-mile delivery remains the most inefficient part of the entire e-commerce supply chain for 59% of U.S. transportation and logistics companies. Yet for the consumer, that piece remains a critical part of the online buying experience.

In a survey of 6,000 consumers conducted by Arlington Research for mobile technology platform SOTI during Q4 2020, 67% of consumers said they wanted real-time visibility into the location of their Christmas gifts from the moment the online order was processed. Delays in delivery exceeding two days turned off 38% of consumers, who said they would look elsewhere for the product in those cases, and 57% said they were frustrated with the returns process for online orders.

Delivery experience management company Convey conducted its own survey on Amazon, building the results into a recent webinar, “Amazon’s Momentum and Retailer’s Moment of Opportunity.” The company’s survey found 6 in 10 consumers were more likely to complete a purchase if the estimated delivery date was visible in the product card prior to checkout.

Related:

Read: AI breaking down silos and improving e-commerce experiences

Read: Millennials powering B2B e-commerce landscape

Read: Taking the measure of returns: 5 questions for FedEx’s Ryan Kelly

“It’s very much an Amazon takeaway experience,” Carson Krieg, co-founder and head of strategic partnerships at Convey, said during the webinar.

Almost half of consumers (47%) said they would like the ability to pick up an online order at a physical store on the same day if the retailer had a store location nearby. That theme came through in the SOTI report as well.

“When they are under pressure, whether online or in-store, customers want a high-quality and tailored experience,” the SOTI report said. “But they also want maximum simplicity and convenience. We can expect these trends to spill over from the holiday experience into the rest of the year.”

The Convey survey was conducted in December 2020 at the height of the holiday shopping season and asked 1,200 consumers 15 questions. The results showed that consumers have mixed feelings about Amazon – even as the e-tail giant continues to drive supply chain innovation and alter consumer demands. While 19.9% had a “very negative” view of Amazon’s impact on retail and another 28.6% held a negative view, 49% of shoppers said they preferred to shop with Amazon because they trusted their package would be delivered on time.

Despite the negative views of Amazon, 28% of respondents reported making at least half their purchases on Amazon.com.

Krieg said this indicates the importance of a strong fulfillment program for all brands, not just Amazon.

“2020 was a test for all retailers including Amazon,” he said during the Convey webinar. “Amazon had similar capacity constraints and restrictions as brick and mortar did … but what did they do is they hired workers … and they made the tough decision to turn off their FBA (Fulfilled by Amazon) program.”

Throughout the Convey survey, the theme of cost and shipping continued to appear. Respondents said they would choose Amazon over a smaller retailer due to cost of items, with 33.7% saying items were more expensive at the other retailers. Additionally, 23.3% said shipping was either more expensive or wasn’t free at the smaller businesses, while 22.1% said shipping was going to take longer.

“Some consumers were willing to wait longer for shipping … if it’s free,” Krieg noted.

Amazon Prime members were also more likely to be wealthier shoppers. According to Convey’s data, of those with household incomes above $75,000 per year, 41% bought half of their goods from Amazon, and the shipping experience was “very important” for 64% of them. Even though 33% of these shoppers shopped exclusively at Amazon for the holidays, 24% said Amazon was having a negative impact on retailers.

Krieg said the lessons learned from the Convey surveys are clear: Brands not selling on Amazon need to step up their delivery games.

Amazon is now fulfilling more than 50% of its package deliveries, Krieg said, and while “a lot of retailers are not going to have the scale to do that,” the benefits Amazon has gained from it are clear – and they are pushing others to match it.

“Two-thirds of the country (68%) is saying that if you screw up the first [delivery], we’re not going to give you another shot,” Krieg said.

What can retailers do?

Krieg advised retailers to offer in-store and curbside pickup where possible and be proactive with communications to customers.

“You can be brand forward and capitalize on the opportunity by sending more alerts around certain shipments,” Krieg said, noting that packages delayed by weather or traffic can be alerts. The more touch points with the customer, the better, he added.

Bringing all communications and data streams – from distribution centers to delivery networks to stores – into a single silo helps this process.

Krieg also said to be vocal about sustainability efforts. He noted that 30% of consumers under the age of 30 believe Amazon is harmful for the environment, and sales of sustainably marketed products grow at 5.6 times the rate of conventional products, according to the Boston Consulting Group.

Show how you are reducing waste by being more efficient through shorter supply chains that reduce emissions or result in less food waste; spotlight how slower – and cheaper – shipping methods can be a sustainable choice, he said.

“The consumer base will pay more for these goods,” Krieg said.

“Two-thirds of the country is saying that if you screw up the first [delivery], we’re not going to give you another shot.”

– Carson Krieg, co-founder and head of strategic partnerships at Convey

Shash Anand, vice president of product strategy for SOTI, said that technology offers retailers a pathway to both better shipping experiences and increased trust surrounding the entire purchase.

“Almost half of consumers abandoned online purchase because they didn’t trust the site [would secure their data],” Anand said, noting that 57% were more trusting of well-known brands.

SOTI provides technology that helps protect data privacy as well as improves the shipping process, including returns.

“Delivery [and returns] is not only an option but a must,” Anand said. “Sixty-three percent of consumers would like the returns process to be easier if not automated [entirely]. This is an opportunity for retailers to perfect their game.”

Anand said retailers should evaluate technologies and look to use cases that will show how the technology works in real-world applications. This can include mobile devices, RFID, scanners, wearables and drones.

“There are many companies that have gotten this right and they are doing extremely well and thriving in this economy,” he said.

Technology deployment should take into consideration customer privacy and speed of delivery – and shipment tracking is a must-have that customers have come to expect. Anand said retailers need to become technology companies since the customer journey now includes the shopping experience, the payment experience and the delivery experience. Falling down in any one area can drive a customer away forever.

Click for more Modern Shipper articles by Brian Straight.

You may also like:

Social Auto Transport raises $1.5M in seed funding to expand gig economy auto-moving business

Bringg’s collaboration with Uber opens new doors for e-commerce