Volkswagen’s (U.S. OTC: VLKAF) long-awaited truck initial public offering (IPO) has been realized as shares of its now public heavy-truck and bus unit TRATON SE are trading on the Frankfurt Stock Exchange and Nasdaq Stockholm under the ticker 8TRA.

The on-again, off-again share offering paves the way for future consolidation in the commercial truck original equipment manufacturing (OEM) space as Volkswagen challenges Volvo Group and Daimler in North America and China as it is “striving to become a Global Champion of the truck and transport services industry.”

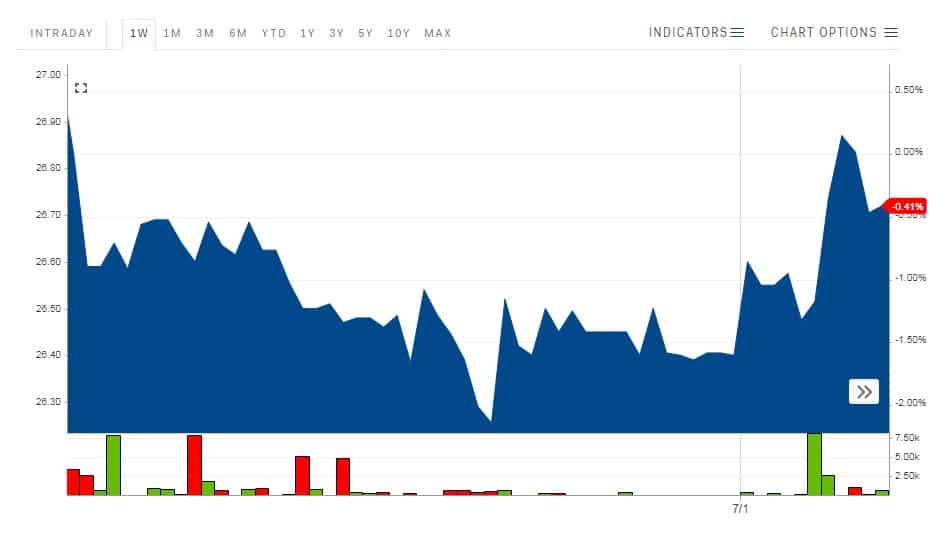

Shares of TRATON began trading on June 28, 2019, opening at 27 euros per share, the low-end of the 27 to 33 euro range anticipated before the deal roadshow. The stock currently sits below the 27 euro opening price.

The stock price values TRATON at roughly 13.5 billion euros, which is well below the high-end of the expected range, which topped out at 16.5 billion euros. However, it provides Volkswagen with 1.55 billion euros in capital to pursue “champion” status.

Focus now likely on potential Navistar deal

Carving out a stand-alone TRATON was a major part of Volkswagen’s restructuring, which seeks to increase shareholder value. Management believes that shares of Volkswagen are undervalued and seeks to gain a higher earnings multiple on its stock.

Volkswagen trades at less than 6 times forward earnings compared to heavy-truck manufacturers like PACCAR (NASDAQ: PCAR) and specialty-truck maker Oshkosh Corporation (NYSE: OSK), which both trade around 11 times forward earnings. Navistar (NYSE: NAV) currently trades at a 9x price-to-forward earnings multiple.

The spinoff of TRATON will, in theory, allow Volkswagen to see earnings multiple expansion and increased valuation on at least a portion of its business.

Volkswagen has long been rumored to have interest in acquiring medium- and heavy-duty truck manufacturer Navistar in which it already holds a 16.8 percent interest (16.6 million shares). The two currently have a “strategic alliance” that provides joint collaboration on engine technology, the sale of engines and contract manufacturing.

Volkswagen’s management has brushed back Navistar acquisition talk in recent weeks, but in 2018 TRATON Chief Executive Officer Andreas Renschler said that an acquisition of Navistar would be a “good idea.”

TRATON reported revenue of 25.9 billion euros in 2018 with truck sales of 233,000 units and is viewed as the market leader in its core markets of Europe and South America. Navistar generated $10.3 billion in revenue during its 2018 fiscal year ending October 2018, representing roughly 14 percent of the U.S. market share. There is very little overlap in geographies currently as North America accounts for only 1.5 percent of TRATON’s vehicle deliveries. Additionally, Navistar’s $3.3 billion market cap is roughly one-quarter of TRATON’s value.

An acquisition of Navistar would provide TRATON with a meaningful North American commercial truck platform as it attempts to grow its commercial truck market share.

Volkswagen’s restructuring

In addition to restructuring assets like the TRATON spinoff, Volkswagen is pursuing other avenues to increase shareholder value.

The company is looking to divest non-core assets like MAN Energy Solutions, a manufacturer of large-bore diesel engines for marine and stationary applications, and Renk AG, a transmissions and gear manufacturing company.

Volkswagen wants to generate new capital because it has made significant investments in other areas like electric vehicles and connected cars. Volkswagen has a goal to achieve three million electronic vehicle sales by 2025.

TRATON deal closes

The share offering for TRATON was expected to be as high as 25 percent with a total company valuation of approximately 25 billion euros. But management shelved the deal due to market uncertainty, although some have speculated that there wasn’t that much interest in TRATON as a stand-alone or for a commercial truck deal of that size in European markets.

Before the official offer period, TRATON procured a cornerstone investor in Swedish pension fund AMF, which agreed to purchase a 200 million euro stake in the newly public entity.

Formerly Volkswagen Truck & Bus AG, TRATON includes the MAN, Scania and Volkswagen truck brands. The group of brands was consolidated in 2015 to form TRATON with the mission of creating a “global champion.” TRATON has roughly 81,000 employees and 29 production and assembly facilities in 17 countries.

Chairman of the Supervisory Boards of Volkswagen and TRATON Hans Dieter Pötsch said, “The successful IPO demonstrates the investors’ trust in TRATON’s future. It confirms that TRATON and Volkswagen are on the right track and that they are pursuing the right strategies. The IPO will provide a basis for both companies to create additional value for all their stakeholders going forward.”