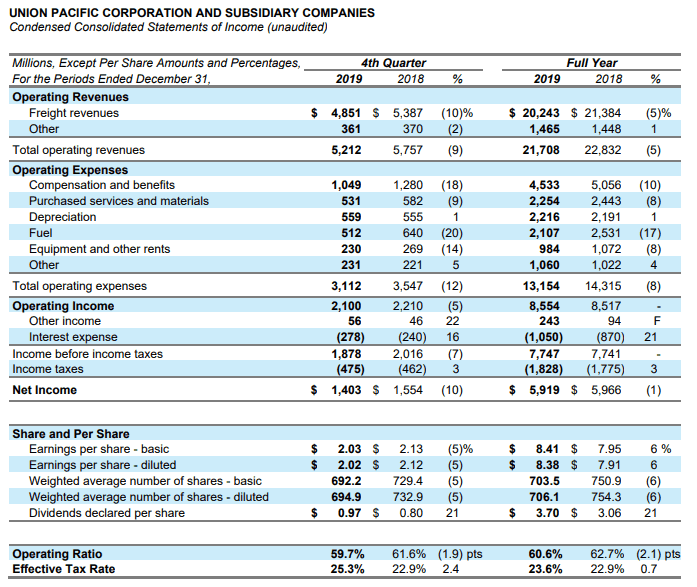

Union Pacific (NYSE: UNP)’s fourth-quarter net profit dipped 10% amid a drop in operating revenue.

Net income for the fourth quarter of 2019 totaled $1.44 billion, or $2.02/diluted share, compared with $1.55 billion, or $2.12/diluted share. Operating revenue in the fourth quarter was $5.2 billion, a 9% drop from the same period in 2018.

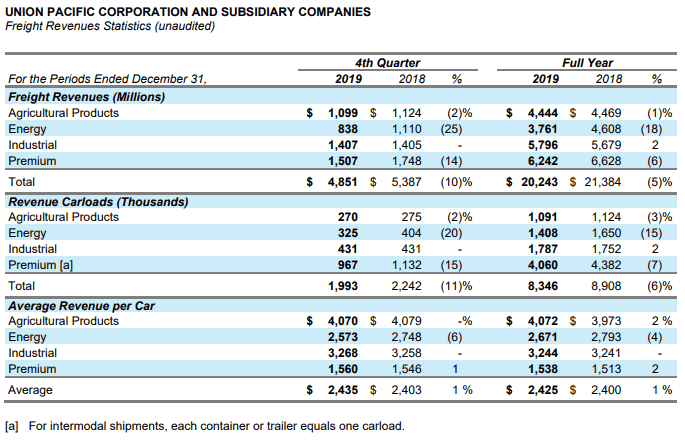

Fourth-quarter operating revenue slipped amid fewer shipments of agricultural, premium (including intermodal) and energy products, although industrial volumes were flat, Union Pacific (UP) said Thursday. Freight revenue dipped 10% to $4.89 billion amid lower volumes and a decreased fuel surcharge revenue.

Although revenue was down, operating expenses also fell in the fourth quarter. Operating expenses totaled $3.11 billion, a 12% decline from the fourth quarter of 2018.

The dip in operating expenses contributed to UP reaching an operating ratio of less than 60% in the third consecutive quarter. Fourth-quarter operating ratio was 59.7%, compared with 61.6% in the fourth quarter of 2018. Operating ratio — a measure of a company’s financial health — can be calculated by dividing operating expenses by revenue.

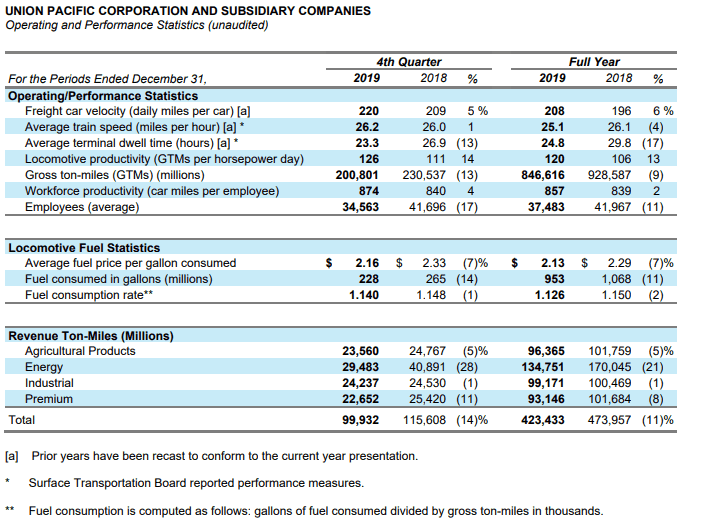

Service metrics also improved in the fourth quarter, with freight car velocity up 5% to 220 daily miles/car, train speed up 1% to 26.2 miles per hour and terminal dwell down 13% to 23.3 hours. Terminal dwell is the amount of time a train stays at a terminal.

| Rail | 2019 Value | 2018 Value | Y/Y Gross Change | Y/Y % Change |

| Freight revenue (in millions) | $4,851.0 | $5,387.0 | ($536.0) | -9.9% |

| Carloads (000s) | 1,993 | 2,242 | -249 | -11.1% |

| Revenue per carload | $2,435 | $2,403 | $32 | 1.3% |

| Gross ton miles (in millions) | 200,801.0 | 230,537.0 | -29,736 | -12.9% |

| Revenue per ton mile (in millions) | $99,932 | $115,608 | -$15,676 | -13.6% |

| Employee counts | 34563 | 41696 | -7,133 | -17.1% |

| Train velocity (mph) | 26.2 | 26 | 0 | 0.8% |

| Dwell time (hours) | 23.3 | 26.9 | -4 | -13.4% |

| OR% | 59.7% | 61.6% | -1.9% | -3.1% |

| EPS | $2.02 | $2.12 | -$0.10 | -4.7% |