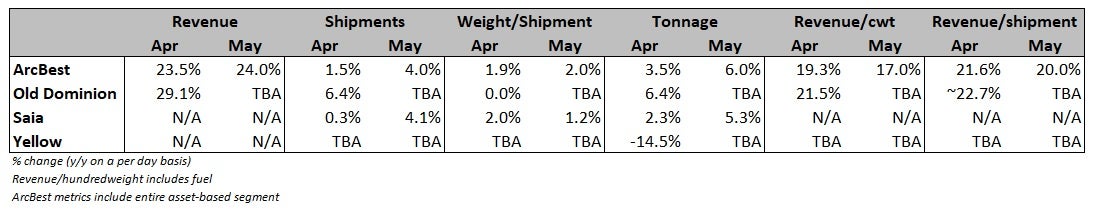

Less-than-truckload carriers continued to see positive growth trends in the second quarter, according to intraquarter updates from ArcBest and Saia on Thursday.

Transportation and logistics provider ArcBest (NASDAQ: ARCB) reported that total billed revenue per day increased 38% year-over-year in May. The company’s asset-based division, which includes LTL, reported a 24% increase in daily revenue as tonnage increased 6% and revenue per hundredweight, or yield, jumped 17%. The company previously disclosed a similar increase in asset-based revenue in April.

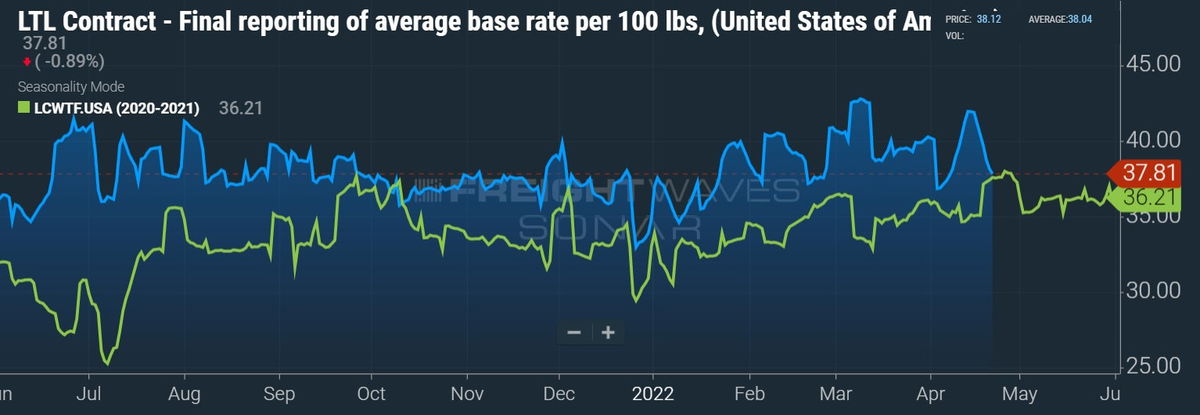

While yield metrics have been inflated by higher fuel surcharge revenues, the industry has used a favorable demand backdrop to push contractual rates higher. Most publicly traded carriers reported contractual rate increases in the 10% range during the first quarter.

On-highway diesel prices are up nearly 70% year-over-year on average so far in the second quarter. The retail per-gallon price was $5.54 for the latest week reported, according to a May 30 update from the U.S. Energy Information Administration.

The year-over-year tonnage growth rates were up against tough comps from 2021. That period was compared to the early days of the pandemic when large swaths of manufacturing and the economy were shut down. Stacking the year-over-year growth rates for the past two years shows ArcBest’s tonnage was up 32.4% in April and 27.3% May.

Saia (NASDAQ: SAIA) also reported Thursday that tonnage was up 5.3% year-over-year in May, following a 2.3% increase in April. On a two-year stacked comparison, the carrier’s tonnage was up 32.8% in April and 27.8% in May.

Saia does not provide revenue metrics in its intraquarter updates.

The industrial sector is the key driver of tonnage in most LTL networks. Released Wednesday, Manufacturing Purchasing Managers’ Index logged a reading of 56.1% in the month, a 70-basis-point increase from April. A reading above 50% indicates growth in the U.S. manufacturing sector.

The update was the second-lowest reading since September 2020. However, the index has been in expansion territory for two full years now. The new orders subindex increased 160 bps to 55.1% with order backlogs increasing 270 bps to 58.7%

ArcBest also provided an update on its asset-light segment.

Daily revenue grew 82% year-over-year in May, excluding results from its maintenance and repair unit. The increase followed a 122.2% top-line jump in April. The large growth rates include the November acquisition of TL broker MoLo. The company noted “some general softening in the spot market,” which impacted the May growth rate.

Purchased transportation costs as a percentage of revenue in the division were 82% in May versus 81.3% in April. Third-party capacity costs have eased as the spot market has cooled. By comparison, the asset-light segment’s PT costs as a percentage of sales were above 85% in the past two quarters.

Shares of ARCB (+5.3%) and SAIA (+4.2%) were outpacing the broader market — S&P 500 was up 0.4% as of 11:25 a.m. Thursday.

More FreightWaves articles by Todd Maiden

- Landstar loses another CFO after short tenure

- Lineage Logistics and Bay Grove acquire visibility platform Turvo

- ShipX closes e-commerce transportation loop through acquisition