Hot Takes

September is the new December.

In terms of holiday shopping, consumers are being urged to buy things when they see them instead of holding out for massive sales as we come into a rather unique holiday season. Retailers that are able to get their products on the shelves and in time for the holiday shopping season are counting their blessings as delays are reaching an all-time high.

This month showed us a record 70-plus ships off the ports of Los Angeles and Long Beach waiting to come in and unload. With consumer spending continuing to increase as we go into the holiday season, there is a greater risk of hot items being out of stock — if they are able to stock them at all.

Some of the major retailers have chartered their own container ships and cargo planes to ensure they have enough stock for the holiday season.

This is the year to get creative to ensure you have product on the shelf.

Some shippers are relying on the expedited freight market, but those prices are climbing more and more every day and can’t be relied on as we continue into the fall.

With the lack of inventory and people willing to spend more money, retailers are straying away. Anything that can be pushed to next year can and will be in order to allow more time to get enough of the products to market.

The ultimate balancing act has begun. If companies start to raise prices on items and raise them too high, then consumers will be less likely to buy. But if they keep them at current prices, then they lose money. Freight costs are ultimately going to hit a company’s bottom line and be a factor of price increases.

It’s going to be one of the most impressive balancing acts.

Long story short, it’s time to start that holiday shopping now and maybe hit up some of those local shops. They’re suffering as much as the big guys, but they don’t have as much of a cushion.

Quick Hits

The Buying Boom — Anyone who has tried to buy a house in the last year will tell you it was an absolutely ridiculous process. You would hear stories of a house being on the market for 24 hours, then there would be a bidding war ending with $25,000 over list price, if not more.

While the housing market has calmed down a little bit, it looks like the market for buying 3PLs and brokers has become our new housing market.

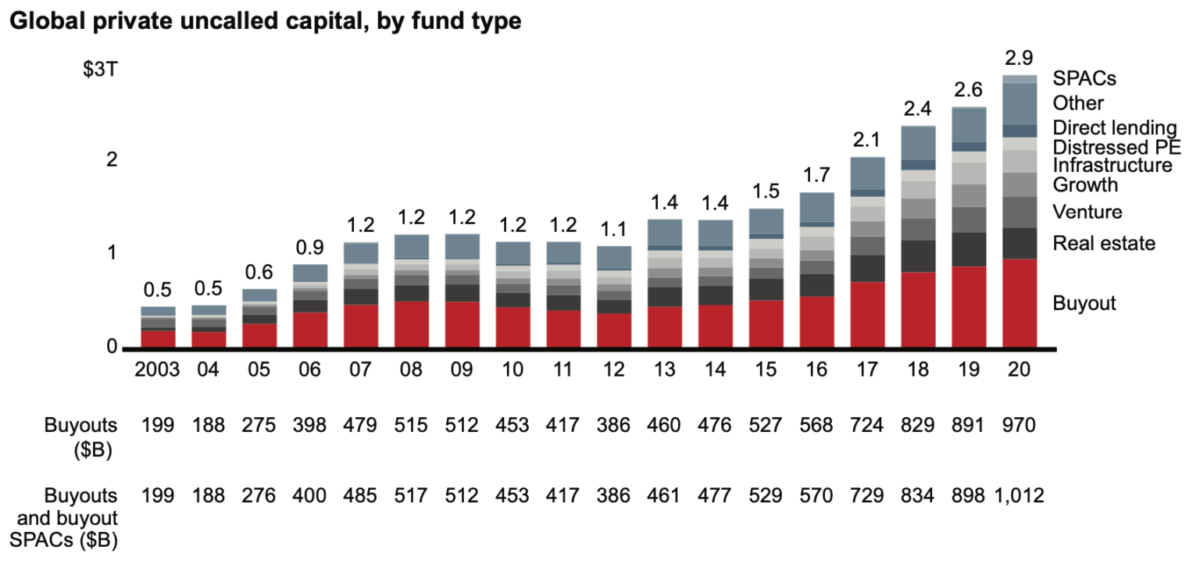

Throughout the last year, private equity firms did not stop raising money for investments.

Due to difficulties from COVID last year, it was hard to spend the money like they would in previous years, meaning all the capital gained needs to be invested quickly within the next year or two to ensure returns on their investors’ money.

The higher rates in the spot market are presenting higher revenue per load, thus making brokerages and 3PLs more attractive to investors. The announcements made in the past few weeks are only the beginning of many to come.

Now is the time for smaller and mid sized freight companies to get the capital they need to build the foundation for their companies’ future.

Bring it on Home — Struggling with final-mile deliveries? Not for much longer.

Meet the Front Door Collective (FDC), a company of industry veterans changing the final-mile game.

It’s no secret that we are living in a gig economy, and while certain companies have been able to capitalize on that, such as Instacart and DoorDash, FDC aims to do something a little different.

FDC is partnering with Canoo, an electric vehicle manufacturer, to help businesses manage growing demand for last-mile resources.

It is focusing on building careers for its final-mile drivers opposed to just a job or a gig to make some cash. Instead of checking multiple apps for the best rate of the week, drivers now have the power to be at the center.

FDC is emphasizing drivers as people and maintaining the human element that sometimes gets lost in big corporations.

Seeing as how final-mile service is something that has historically been a struggle, from service failures, inconsistent rates and availability, FDC could be an actual industry changer if it sticks to this model.

Market Check

It’s wine o’clock! If wine is your drink of choice, you might want to brace yourself for higher-than-usual prices and potential shortages of your favorites the next time you are at the store.

The wildfires affecting northern California and that state’s supply chain issues have led to wine prices increasing. While the demand on wine from the restaurant industry has only started to bounce back from the previous year, the current market is proving to get a little tight as consumers are drinking more wine at home and the disruptions to the supply chain continue.

The upside is that California is shipping a majority of its grape crop from August to November, which is one of the primary reasons the USDA truckload spot market rates from California to the rest of the country are astronomically high. To see nothing that is under $10,000 is something I don’t think I’ve seen in a HOT minute.

The rates this year are almost double that of last year. While harvest season is following the typical trends of previous years, be prepared to pay double than the past.

The Port of Long Beach is trialing extended operating hours (overnight and weekends). That ability for drivers to pick up in the middle of the night would be ideal, especially given the atrocious traffic that the entire area faces regularly. But warehouses aren’t 24/7. While it could be a nice experiment, it needs a little more buy-in from all parties if it’s going to provide actual relief for the ports.

I would expect to see rates in California continue to climb and not really ease up for the next month.

Who’s With Who

PLS Logistics has acquired D&L Transport. D&L Transport will remain a subsidiary of PLS and continue to operate under its own authority with all current employees staying post-acquisition. This proves to be a lucrative deal for both parties, seeing as how PLS will have an annual revenue run rate of $950 million and is expected to clear $1 billion in 2022. Read more here

Project 44 acquired last-mile tech company Convey for $255 million. With this most recent acquisition, project 44 has a fully transparent end-to-end supply chain. This could change the technology game. Project 44 now can build out analytical tools to provide predictive ETAs, both before and after purchases are made, optimize workflows between supply chain companies and overall provide a better e-commerce experience for its B2B customers. Read more here

The More You Know

Don’t wait till Black Friday to shop

Record shattered: 73 container ships stuck waiting off California

Bankers have never seen a stronger market for 3PLs

Wildfire crews battling blazes – and supply chain kinks

FRONTDoor Collective raises $7.5 Million for sustainable, last mile delivery standards

Want to see this in your inbox? Subscribe here.